Finish the year strong with your money: 12 tips to roll into the new year ready to achieve your goals

How often have you relied on the turn of the calendar to be your motivation to start an ambitious goal?

How long were you able to work towards that goal? If you’re like the masses, probably not very long.

We think that all it takes is to turn the switch, to have a catalyst like the new year to get us moving.

But in reality, it’s darn hard to just jump into something, to go all in without setting ourselves up for success.

Rather than thinking of flipping the switch, it would be more effective if we could take baby steps that would lay a solid foundation BEFORE we actually start working towards our goal.

For example, it would be great to do some bodyweight exercises or low intensity cardio before we commit to hitting the gym hard on January 1st.

When it comes to starting off the new year right, we first have to get ourselves into position for success to gain some of our friend Mo(mentum).

It doesn’t have to be anything major, just a small step in the right direction to start off right.

I know we’re going into the holiday season, which can be one of the most expensive and gluttonous times of the year.

But even though that’s the case, we can still make some progress so we can end the year on a high note.

Table of Contents

How to finish strong: 12 Helpful Tips

Take a look through these 12 tips to finish the year strong. Your key to success will be narrowing this list down to the ones that will have the biggest impact on your life.

If you want to go right down the list, great! But if you only get to one, that’s also great!

Just make progress no matter how small.

Give yourself some grace

Look, chances are that you wished you were further ahead than you are today.

I’m very hard on myself and get really mad at myself when I look at what my plans were for the year and where I came up short.

Self-talk can be brutal sometimes. We would never talk to a friend the way we talk to ourselves.

So be a your own friend. Forgive yourself so you can move on.

Look at things going forward as an experiment and view your actions through the eyes of a supportive friend rather than perhaps your critical self.

Review what went well

Now let’s begin on a high note.

Let’s think about the good stuff that happened this year.

Pretend you’re a 3rd party observer rather than yourself.

What went well last year? What were the circumstances that led to things going in that area? What was your approach?

Maybe you had support. Maybe you had deadlines to hit. Maybe you just cared more about it. Or maybe it was just consistent action and focus.

List what went well for you so you can look back and feel good about those things. But also see if there were any patterns that could cause you to have success going forward in other areas.

Where can you improve?

Now it’s time to take a look at the things that could have gone better for you.

What are the things that didn’t make it to the finish line?

What interactions with your work, your relationships, or yourself didn’t go that well?

Now take the time to not only list these things, but also reflect on why things didn’t go according to plan. What circumstances made it that way?

Remember, go easy on yourself here.

Pick just one thing you could improve that would have the greatest impact on your life going forward.

Take one step toward something you’ve been procrastinating on

We all have that one thing we’ve been avoiding.

Over time, I’ve learned that the thing I’ve been dreading ends up being not as big of a deal as I built it up to be.

Plus, once I complete it (finally), there is just a huge release of stress and I feel amazing.

The stress and anxiety we hold by avoiding is much worse than pushing through and getting it done.

Is it fun to face it? No. But not facing it is worse.

Pick one thing that you just haven’t gotten yourself to get done, list the next tiny action to make progress, and do that one action.

You’ll feel so much better!

Clean up and declutter

Ever walk into a room and notice all of the things that have to get done? It can feel deflating.

Think of the unmade bed with a load of clean laundry to fold on top of it.

Now imagine walking into a room with a bed made and the laundry is folded and put away. Feels better right?

The same thing is true for any area of your life.

Clean up the little odds and ends that have been zapping your energy. There are some great ways to simplify your finances too.

Make a list of all the things floating around in your mind that keeps you from feeling at peace and focused.

Now pick the first one you’re planning to do, pick when you’re going to do it. Then do it!

Focus on process, not outcome

The bottom line is that you might not be able to achieve your goals for the year at this point…but that’s ok.

Rather than focusing on reaching your financial goals, focus on the process it would take to get there.

Did you want to save an extra $10,000 this year compared to last year or pay off one of your credit cards but haven’t done it yet?

Well, what process would you need to start setting up to make progress? Can you set up an automatic monthly payment or transfer to make progress? Can you up the percentage of your income going to your retirement accounts?

Focus on the process it will take to reach your short-term financial goals rather than trying to reach the outcome by the end of the year.

Forget trying to find the perfect process. Think of it like an experiment.

Just start something, commit to it for a period of time, and adjust if necessary.

Start tracking your spending

If there’s one process you need to put in place, start tracking your expenses.

This is the keystone habit in personal finance.

When you track your spending, you can see where your money is going and be armed with the information to make adjustments and end up where you’d like to be.

It doesn’t matter where you’re starting your journey, as long as you know what your starting point is.

Awareness is the first part of making any changes.

Commit to a weekly spending review

The number one predictor of your future financial success is how much money you have left over at the end of the month.

But it’s really hard to make the small adjustments if you are only reviewing your spending monthly or less often than that.

Most people wait until they get their credit card bill or bank statement and wonder how they spent so much…

Then it happens again the next month and the month after that.

When you review your spending weekly, it should take only 5 minutes. It’s not overwhelming or intimidating, and you only have to make small tweaks to end up on target.

If there’s one thing you take away from this post, do a 5 minute weekly spending review!

Take inventory of what you own and what you owe

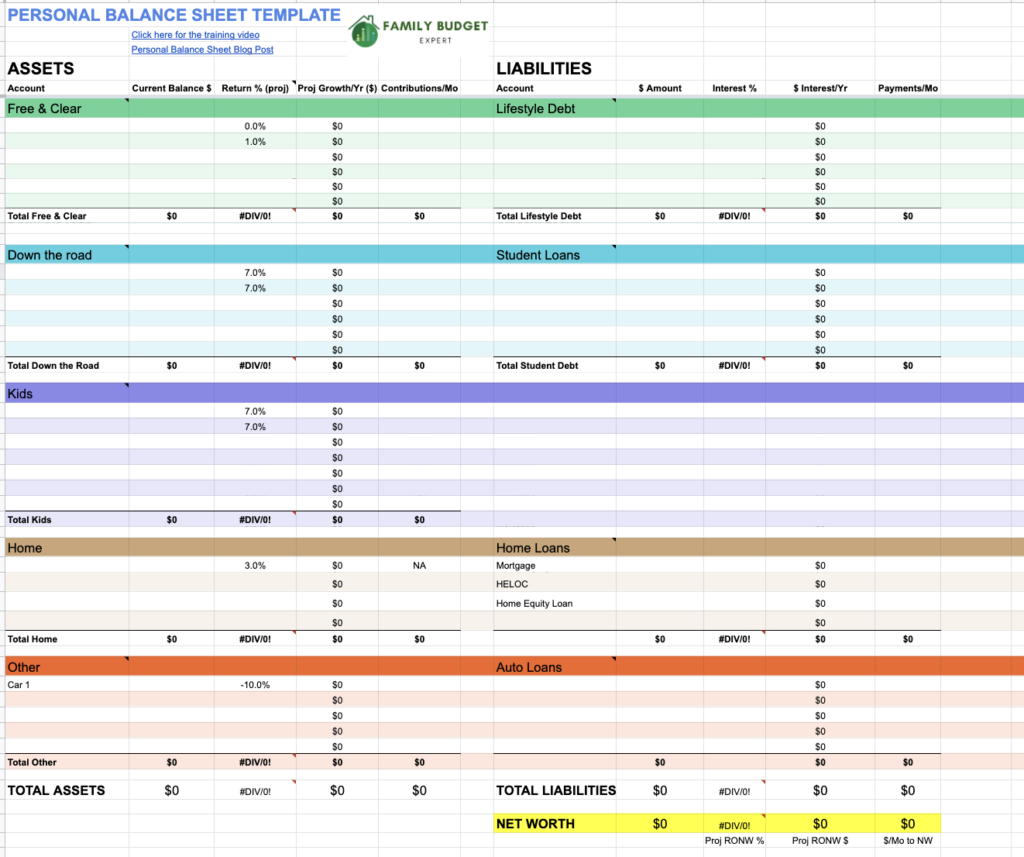

One of the best things you can do to get organized financially is to list out your assets and liabilities.

You’ll see what buckets need to be filled and which ones are doing fine. You’ll also be able to pinpoint where your financial stress is coming from.

If you’d like help here, read about how to put together your personal balance sheet.

Or

Figure out your goals

Based upon what we’ve gone through so far, what would be your top goals to complete.

Most people like outcome goals, but I have transitioned to process goals lately and have found it much more effective. I mentioned this earlier.

For example, rather than saying I want to lose 10 pounds (the outcome), my goal would be to related to the most important process to get there.

In my case, it’s not eating after 8:30. (Because nothing healthy gets eaten after 8:30).

So think about a process goal you’d like to commit to.

Narrow down the most important goal

I’ve also learned that becoming a serial goal achiever is all about narrowing things down and staying focused.

I used to set a gajillion goals and never accomplish any of them because I was spreading myself too thin.

So, think about what you want to accomplish and pick the top goal that will have the greatest impact on your life.

This isn’t to say that you won’t improve in other areas naturally, but pick the goal that will have the greatest impact.

For example, I’ve noticed that my best results happen when I’m eating for energy rather than cravings.

I have more energy which helps me stay more focused. My brain is clearer, I’m less crabby, and that energy helps me perform better in work, health, family, relationships, and pretty much everything else.

Do some thinking and find the one goal that will help everything else fall into place.

Determine the next 5 moves to get there and do 1 by the end of the year.

Got your goal? Great!

Now it’s time to figure out your next actions to take.

Start by making a list of everything you need to do to make that goal happen.

If it’s healthy eating, then I need to make a list of food to have in the house that will help me make better decisions. That would be my first move.

If you want to get a handle on your financial situation or live below your means, start tracking your spending, maybe your first move is selecting the right budgeting app for you.

Whatever your moves are, look at the first one and get that first one done by the end of the year.

Finish the year strong by planning ahead

Now that we’ve gone through my 12 tips on how to finish strong, it’s your turn.

No matter how many days are left in the year, you can still go through this process to get things going for you.

As it relates to budgeting, I’m here to support you as best I can.

So if you’re wondering what your goals should be, the next moves, and how to make it happen, I’m here to help.

Schedule a free 30 minute consult with me here:

If you want help but don’t want to talk yet, get my free guide