Weekly Budget: Give it a try with these 5 simple steps.

You might be thinking, family budgeting is tough to manage on a monthly basis, why on earth would I want to do this weekly!

It’s more complex and takes a lot more work! Sign me up!

In reality, weekly budgeting can be more effective and take less time than a monthly budget.

Setting up a weekly budget may be just the thing that helps you gain control over your spending once and for all (even if you feel like you can’t save money)!

Table of Contents

Is it better to budget weekly or monthly?

Just like everything else, there are pros and cons to making both a weekly budget and monthly budget.

Let’s start with the more common budgeting technique.

Pros and cons of a monthly budget

The first pro is that…you’re setting a budget! Congratulations!

But budgeting monthly is really hard to keep up with and really easy to lose track of.

What happens when you go over? It all falls apart and you feel like you have to wait until the first of next month for any changes to matter.

It’s kind of like trying to eat healthy, then having just one cookie during the day. “Oh well, might as well finish the entire batch!” That’s the mindset.

Pros & Cons of the Weekly Budget

Weekly budgets make your daily spending habits matter and keep your goals front of mind. Also, you keep track of your spending better because of the weekly check ins.

If you have a dining-out budget of $800 for the month, what difference does an extra $10 make? But if you set a $200 per week limit, that $10 really matters.

Each week is a fresh starting point that allows you to course correct and end up where you wanted to even if one week doesn’t work out.

Create a weekly budget

The bottom line is that you’re more likely to end up where you want with a weekly budgeting program.

Weekly budgets beat monthly budgets.

If you read other posts about weekly budgeting out there, it would lead you to believe it’s super complicated, but that’s not necessarily the case.

Budgeting weekly doesn’t have to take a ton of time to implement.

What should my weekly budget include?

Your weekly budget should include both your discretionary and non-discretionary expenses for that week only. Each week will be different based on when your monthly bills come out.

Usually, week one is going to be the highest of the month. It typically includes the more expensive recurring bills like loan payments, utility bills and rent or mortgage payments.

Groceries, discretionary expenses, and other variable expenses like dining out can be spread evenly through the other weeks of the month.

Where do you put monthly income in your weekly budget?

Income is important to have in your budget because it’s the upper limit of what your total spending could be.

It should be at the top of your budget.

Does your pay frequency affect the budget?

Take your salary and break it down into a weekly income.

If you get paid weekly, easy peasy!

If you get paid bi-weekly or twice a month, simply divide your paycheck by two to get the weekly amount.

What if I get a bonus?

Bonuses can be tricky because it’s a lot of extra money all at once. Be very careful here. The bigger the amount, the more strategic you have to be.

Many people use bonus money to boost their savings, catch up on debt payments, up their personal spending for that month, or take on a home improvement project.

Rather than doing one or the other, pick a healthy balance between accelarating towards your financial goals while also enjoying some of the money.

What if I work off commissions?

Studies show that the more frequently people get paid compared to others making a similar salary, the less likely they are to save money, and the more likely they are to spend money.

If you get paid daily or weekly, make the necessary adjustments mentally to think longer term. Don’t make a weekly budget based on the ebbs and flows of each day.

Zoom out when creating a weekly budget so you have more money left over.

How do I budget for a week? Here’s the five-step process.

The goal in creating a weekly budget is to get better results but with equal or less effort. Even though it sounds like more work, that won’t end up being the case.

Not everything with your personal finances has to be super complicated. Anything can be simplified :-).

This will be a simple process that includes tracking your overall expenses and monitoring only a few key budget categories that you want to improve.

Here’s how to put together your weekly budget.

Step 1: Figure out how much you want to spend monthly

There are two parts to this step.

First, let’s take a look at your take-home pay. How much do you get paid monthly?

This is the number after accounting for taxes, health insurance and other deductions.

Now some might jump right in and create a weekly budget, but this is a mistake.

Don’t just guess or pull numbers out of the air. Those who do are in danger of having their budget fail.

Spending money is not just a bunch of financial decisions, it is a series of habits ingrained in you that could be hard to break. If you go with a random number, you could be setting yourself up for major lifestyle changes without expecting to do that.

Start by tracking your spending to see how much cash flow is actually going out each month.

Once you figure out how much you spend, back it off by no more than 10% to start. If you try to go bigger than that, you’re setting unrealistic expectations. You’re better off setting realistic goals.

Start with something you can achieve, then you can cut deeper over time if you want.

Step 1a: Build in your savings goals.

If you want a rock solid financial future, you have to start putting money away maybe even on a weekly basis.

Make sure that your monthly spending accounts for money going towards your financial goals like saving for retirement, eliminating the balance on your credit card statements, building up your bank account balance.

Step 2: List out the timing and amount of your big bills

Start with your big fixed expenses that are more than $300 and don’t happen weekly including:

- Mortgage payment or rent

- Child care

- Car payment

- Cell phone bill

- Cable/Internet

- Student loan payment

- Insurance payments

- Personal loans

- Monthly dues

- Amazon subscribe & save items, and so on.

Don’t worry about the specific date, just try to place it in that week.

There’s no need to time every single purchase you make. For example, you needn’t time your smaller streaming services like Disney+ and Netflix.

Also, leave out any automated investing or transfers to a savings account. Those aren’t expenses, those funds are just transferred to other accounts.

Don’t overcomplicate it. Scan through your last one to three months of expenses and see what those $300+ items are and when they come out.

Step 3a: Figure out what your overall weekly spending on everything else.

OK, so now you know about what you have spent over the last few months, and you know when your major bills come out.

Subtract big bills from your overall spending target for the month.

Divide the remaining number by four to come up with the weekly amounts.

For example

- You want to spend $10,000 per month

- Major expenses total $4,000 from step 2

- That leaves you with $6,000 on everything else

- Flexible expenses will be $1,500 per week ($6,000 divided by 4)

This is the total spending number you want to track.

Here’s another little hack: Track your number of transactions each week. In other words, how many times are you making a purchase each week?

Step 3b: Calculate your total weekly expenses

Keeping the example above, let’s say that your housing cost is $3,000 which comes out in week 1, and your auto payments total $1,000 which comes out in week 3.

You want your average weekly expenses on everything else to be $1,500.

So I’m going to spread $1,500 per week throughout the month, then add in the fixed expenses.

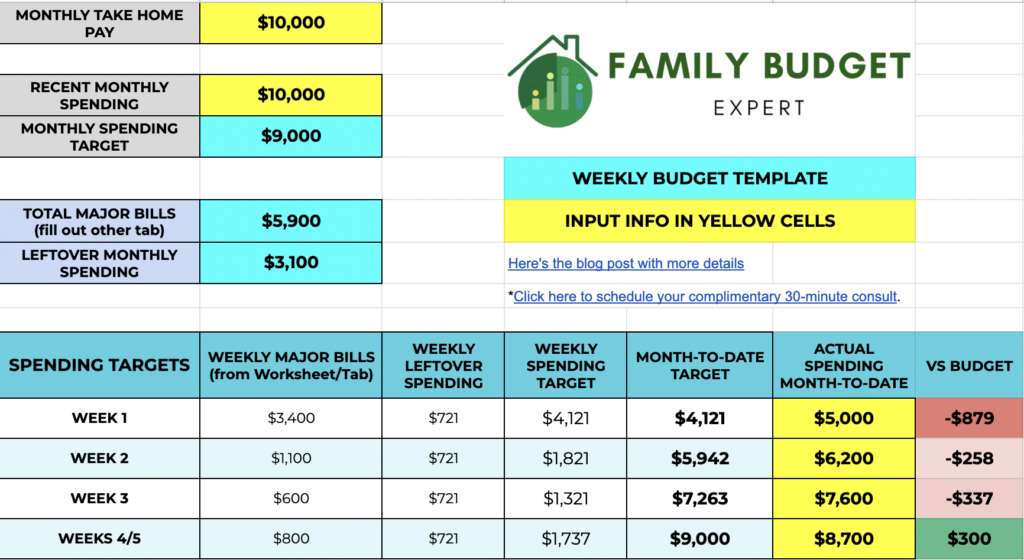

Here’s what your weekly spending targets could look like. These will be total spending month-to-date:

- Week 1: $4,500 = Mortgage $3,000 + $1,500 on discretionary expenses

- Week 2: $6,000 = prior weekly spending + $1,500

- Week 3: $8,500 = prior spending + auto loan $1,000 + $1,500

- Week 4: $10,000 = prior expenses + $1,500

Step 4: Make a weekly budget for one to three categories you want to improve.

You don’t need to make a separate budget for things that are small and you can’t control, and you certainly don’t need to get super complex like the envelope system.

But you should create a budget for those categories you feel you could help you cut spending and start saving.

Many people pick spending on food, Amazon & Target, clothing purchases, and kids discretionary spending as places they want to reduce their spending.

Whatever it is, create your budget in those areas of improvement based on what you have been spending in those areas. Look at your total spending in those categories and then reduce that by 20%.

Divide that number by four to come up with your weekly budget.

Track those categories ONLY. You can use a budgeting app to aggregate the transactions.

Step 5: Remember your irregular expenses

Each month will have a different event that happens once a year or so.

Such things as birthdays, holidays, anniversaries, kids’ activities, annual dues, and other annual committed expenses are easy to lose track of. Be sure to include these in your weekly budget.

What about unexpected expenses?

Home & car repairs, unexpected medical bills, and even good things like being invited to a wedding pop up.

Yes, an emergency fund will help you navigate it, but you also need to build a buffer in your weekly spending. If you don’t have enough money or wiggle room in your budget, lower your spending target to accomodate for the unknown.

Bonus step: Treat it like an experiment

You’re going to be over or under budget for the first few months until you settle in.

Expect it to happen, because it will.

Stick with it and improve. Give it eight to twelve weeks until you feel you have it figured out.

The first part of learning something new is frustrating and feels like it will never work. But if you keep a curious and learning mindset, you’ll make it happen!

Frequency = consistency = confidence

Need a weekly budget template?

Budgeting works best when it’s a simple system that you can maintain over time, one that works for you and your life. This is critical if you want to reach your financial goals and financial security.

What matters most is finding a budget framework you think will work, trying it on, experimenting and making it suit your life.

Weekly budgeting can help you get there.

Here’s an extra resource for you. Try my simple weekly budget planner.

If you’d like more help, set up a complimentary 30-minute consult to dive in together!

For informational and educational purposes only. Information was previously posted by Rob Bertman, Family Budget Services, formally Family Budget Expert, prior to Mr. Bertman joining Focus Partners. The opinions expressed may not accurately reflect those of Focus Partners.