The stress-free guide to celebrating the holidays without overspending and accumulating piles of gifts your kids will forget about in a week.

The holiday season is meant to be joyful and fun. We want the season to feel special. We want to provide a meaningful experience for our kids either because that’s what we remember or that’s the experience we weren’t fortunate enough to have.

But that joy often reverses into financial stress as soon as January rolls around.

Many end up being shocked when they get their credit card bill, asking themselves, “How did we spend that much?”

In fact, my busiest time of year is in January & February after people realize that they spent too much over the holidays.

Holiday planning can help create those meaningful experiences, but it doesn’t have to lead to overspending or sacrificing your financial well-being.

Let’s build a holiday budget that:

- Makes it meaningful without going overboard and creating regret in retrospect.

- Is flexible enough to take advantage of early bargains and last-minute shopping.

- Puts the gift-receiver at the center of the decisions without breaking the bank.

- Helps you avoid holiday debt.

- Encourages you to start saving to support your holiday finances.

Table of Contents

Quick Summary: How Do You Create a Realistic Holiday Budget?

· Create a holiday shopping gift list with the first column being the people you want to buy gifts for.

· Brainstorm ideas and research prices.

· Set your budget after reviewing the total.

· Add a buffer for last-minute deals.

· Then start buying, avoiding impulse deals that aren’t related to gifts on the list.

· Use gift cards and credit card rewards to reduce out-of-pocket spending.

· Track your holiday spending as you go with a budgeting app to see how you’re doing compared to your budgeted amount.

· If you go over, make a list of the gifts that are a MUST to keep and return the rest BEFORE the holidays start.

How Much Should a Family Spend on Holiday Gifts?

A realistic holiday budget isn’t about spending less—it’s about prioritizing what matters to you.

Rules of thumb like the “spend 1% of your income” rule can be a good baseline, but it doesn’t consider your financial situation, your long-term goals, or your priorities and values.

No one should tell you how much to spend. It’s your call. If you value your home, spend more on your home. If you value travel, spend more on travel. If the holidays are a big deal, go for it!

It’s all about making choices. If you’re going to spend on the things that matter, don’t waste it on things you don’t care about.

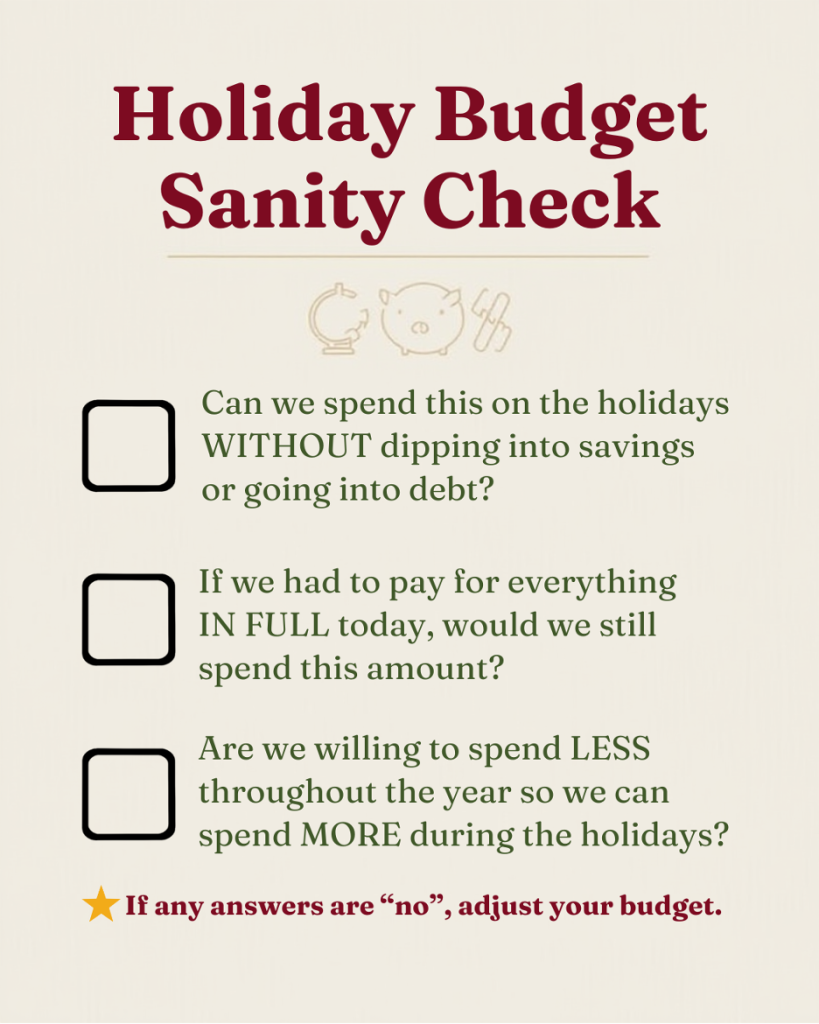

Use this Holiday Spending Sanity Check instead of using the 1% rule. Ask yourself:

- Can we spend this amount on the holidays without dipping into savings or taking on debt?

- If we had to pay for everything in full today (no Buy Now Pay Later, credit card debt, or payment plans), would we still be able to buy these items?

- Are we willing to spend less money throughout the year so that we can spend more during the holidays?

If you answer “no” to any question, your holiday budget needs adjusting downward.

Remember the times when your income wasn’t as high as it is today. You still made it a meaningful holiday season, right?

Bonus Tip: Before setting this year’s budget, review last year’s spending over the holidays. Check your credit card statements to track what your holiday expenses were. Make adjustments for this year based upon how you’d like this year’s budget to be different.

Step-by-Step: How to Create a Realistic Holiday Budget

Now it’s time to dive into how to make this year’s holiday season meaningful, meet you where you are, and also not make January filled with “woulda”, “coulda”, “shouldas”.

Step 1: Make a Complete Holiday Spending List

Start by listing the people you want to buy gifts for.

Here’s a list to get you started:

- Spouse / Partner / Significant other

- Kids

- Siblings / Nieces / Nephews

- Parents / Grandparents

- Teachers / Caregivers

- Service providers (mail carrier, hair stylist, cleaners, trash & recycling workers, etc.)

- Co-workers, Assistants, Employees

- Gift exchanges & Secret Santa

- Charitable giving

- Stocking stuffers (small, budget-friendly gifts to include in stockings)

When brainstorming gift ideas, remember that you can provide an experienced-based present instead of a physical gift. Both can be meaningful and fit different budgets.

Remember to account for these other holiday expenses:

- Holiday cards + postage

- Wrapping supplies

- Holiday travel costs (including hotels, flights, gas, and related expenses)

- Special meals & groceries

- Party hosting & potluck dishes

- Outfits for events

- Holiday decor (new decorations—consider storage needs, too)

- Shipping costs

If it’s something extra for the holidays, put it on the list.

Step 2: Research Gift Costs Before You Buy Anything…Except for Sales

For each person, list:

- Gift ideas

- Links to purchase (prioritize local when you can)

- Estimated cost

- Is it currently on sale?

Many retailers now extend their Black Friday and Cyber Monday sales over several days or even weeks, giving you more opportunities to shop early and find the best deals. Shopping early can help you avoid last-minute stress and secure discounts before items sell out.

If you see something on sale that you don’t want to miss out on, go ahead and buy it IF it’s returnable and doesn’t put you in a bad financial situation. You can always return it later.

Take advantage of major sales events but make sure to research and compare prices. A sale doesn’t always mean you’re getting a good deal.

Step 3: Add It Up and THEN Choose Your Budget

Once you know what everything will cost, now you can figure out if that’s what you want to spend this holiday season.

(If you’re able to plan ahead, consider setting up a sinking fund to save gradually for your holiday costs. A sinking fund is basically making regular deposits into a dedicated savings account in the months before you will spend the money. It helps you plan ahead and accumulate the funds you need over time.)

If you want to spend less than this list, here are your options:

- Look for cheaper alternatives.

- Choose fewer gifts.

- See if you can do a shared gift with a friend or family member.

- Replace items with less expensive experience gifts.

- Look for used items on Facebook Marketplace or eBay (great for electronics and games).

Instead of “How cheap can we go?” ask:

“How do we spend thoughtfully and provide for our family while providing a meaningful holiday experience?”

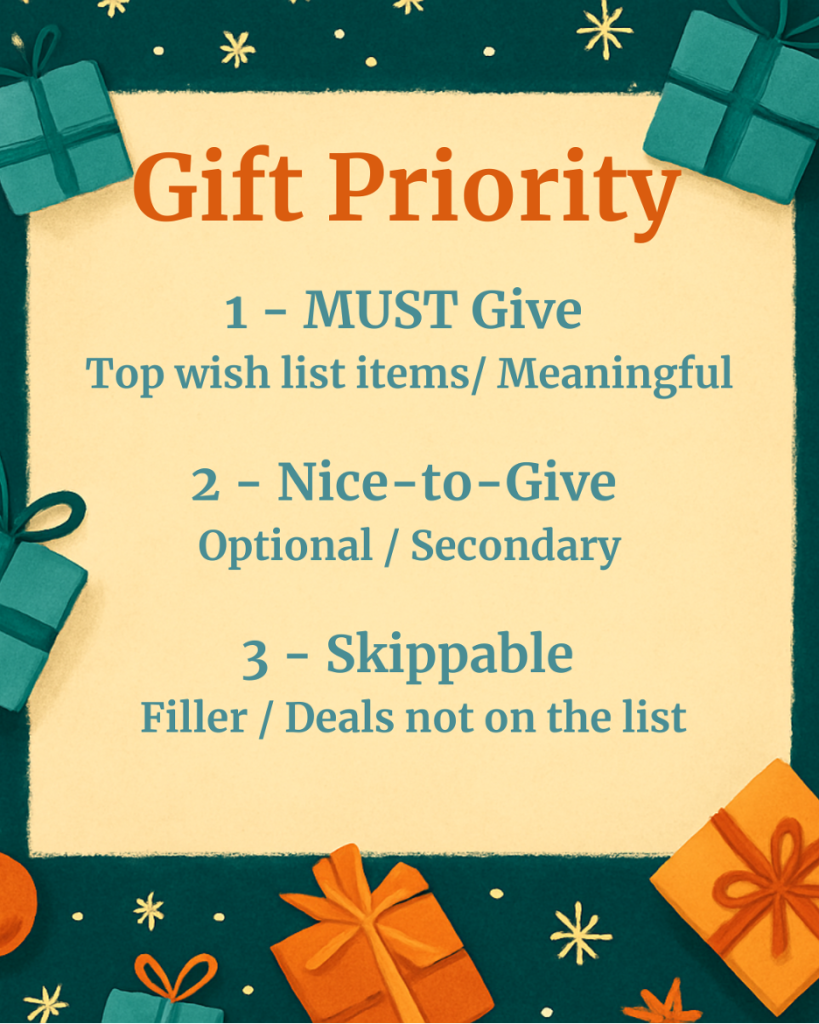

Step 4: Prioritize Using the 1-2-3 Rule

Make a column for “Priority” when you build your list. This will come in handy while you’re doing your holiday shopping and after you’re all done (if there is such a thing).

Think about this in terms of who you’re gifting to as well. Gifts for close friends and family may be higher priority for you.

| Priority | Meaning | Example |

| 1 | Must-give / meaningful | Your child’s top wish item or a MUST BUY according to you, or gifts for close friends and family |

| 2 | Nice-to-give / optional | Nice to have, small extras, add-ons |

| 3 | Replaceable / can skip | Random filler gifts, buying a deal just to get a deal |

Reduce 2s + 3s until your estimated holiday spending fits your budget.

Step 5: Unlock hidden ways to pay without “spending your money”

You don’t need to clip coupons to save money. Use up some of these resources instead of laying out cash:

- Unused gift cards hidden around the house or in email.

- Credit card rewards + cash-back points.

- Store credits from returns.

- Dedicated holiday savings that you have built up throughout the year.

Avoid:

- Buy Now Pay Later (BNPL) traps like Klarna, Afterpay, Affirm. You’ll regret it when you’re still paying in the spring.

- Running a balance on credit cards that you won’t pay off when the statement closes.

- Dipping into emergency savings.

Step 6: Track Actual Spending as You Shop

After each purchase, replace the ESTIMATED cost with the ACTUAL cost. This should be easy, especially if you just click on the links you have from Step 2.

Include EVERYTHING, even those unplanned items and things that you think “don’t count.”

Use a budgeting app and create a custom “Holidays” category if you want to make it easier.

The best way to fight overspending is to track along the way and check in on where you stand. You don’t want to end up surprised and regretting how much you spent after the holidays are over.

Step 7: Make Returns BEFORE The Holidays Start

Now that you have bought everything, review your gifts and look at how much you spent using your spreadsheet or budgeting app.

If you’re overbudget, look back to Step 4 with the 1-2-3 prioritization rule. Then, follow these steps:

1. KEEP the gifts that are in the “must give” category. These are the highly requested ones or the ones you are most excited to give.

2. Next, sort the gifts remaining from MOST expensive to least expensive. Return any gifts towards the top of the list first. This will mean fewer returns.

3. Even after you get to your goal, keep going! Go down the entire list. There’s no need to spend money if it won’t be meaningful to you or the gift receivers.

These steps will give you a better chance of not only being UNDER your holiday budget, but they will also help make sure that you’re spending only on things that will enhance the holidays.

Giving Back: How to Include Charitable Donations in Your Holiday Budget

The holiday season is about more than just gifts and gatherings—it’s also a time to give back and make a difference in your community.

Including donations in your holiday spending plan is a great way to share the holiday spirit with others, while staying true to your family’s values and financial goals.

Plus, it brings the kids into the fold and help them appreciate the season even more.

Here’s how you can make charitable giving a meaningful (and budget-friendly) part of your holiday budgeting:

- Plan ahead and set a goal: Decide how much you’d like to dedicate to charitable donations. Consider opening a separate savings account or “holiday savings” fund early in the year so you’re ready to give when the season arrives.

- Do your research: Take time to look into charities and causes that matter most to your family. Check their mission, values, and financial transparency—websites like Charity Navigator or GuideStar can help you find reputable organizations. This ensures your holiday spending goes towards the actual cause you’re trying to support.

- Explore creative ways to give: If money is tight, remember that giving back isn’t just about giving money. Volunteering your time, donating used items, or participating in local fundraising events are all valuable ways to give back during the holiday season.

- Make it a family tradition: Involve your loved ones in choosing which causes to support. Discuss your family’s giving goals, research charities together, or volunteer as a group. This not only teaches kids about generosity but also helps you pass along this value of giving back.

- Clean out old toys, books, and other household items to donate: Have your kids participate in a pre-holiday clean up and donation. Let them choose the toys to give away. We used to frame it this way with our kids: “Other families and kids might not be able to get the toys they want for the holidays. Which of your toys do you think they would enjoy more than you are right now?” This will help your kids realize that others might not have what they have. Plus, it will get rid of a lot of clutter. Research other non-profits outside of the big ones where the items might be put to better use (daycares, hospitals, etc.).

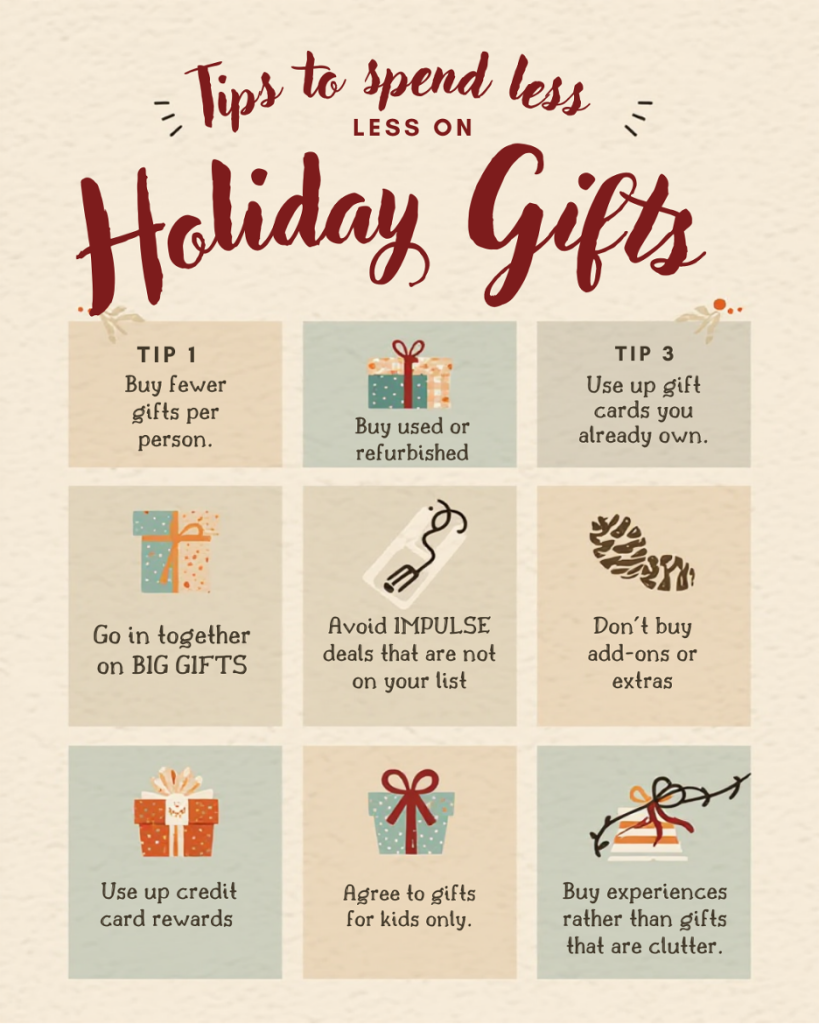

10 Ways to Spend Less Without Cutting the Holiday Cheer

Here are my top 10 tips to reduce your expenses while keeping the fun this time of year:

1) Buy fewer but more meaningful gifts

Let’s be honest: many gifts don’t get used after a week. Try to avoid those. Less is more.

2) Replace some gifts with shared experiences

Movie nights, weekend excursions, family cooking classes, and game nights can sometimes be the best gifts. Spending time with loved ones often creates more lasting memories than exchanging material gifts.

3) Go in together on big gifts

If you’re looking at more expensive gifts, go in with others. This will spread out the cost and lower everyone’s spending.

4) Use up credit card rewards

Redeem points for:

- Gift cards

- Online store credit

- Statement credits to offset spending

5) Use gift cards you already own

Start out by using the ones from stores where you don’t personally shop but you can use to get something for someone else.

6) Buy refurbished or open-box electronics

Apple, Best Buy, Amazon, eBay, and major brands sell certified refurbished items, often with warranties. The savings can be massive, especially for electronics.

7) Agree to “kids-only” gifts with extended family

We do this with our family, and it is a game-changer!

8) Avoid impulse “deals” on things that aren’t on the list

There are no savings on a deal if you wouldn’t have bought it in the first place.

9) Don’t buy matching add-ons

Watch out for the extras that are offered in the cart like accessories and warranties. These quietly drain the budget.

10) After buying everything, make some returns.

Go back to your list and pick some things to send back, especially if your spent more than your holiday budget.

Need help creating a holiday budget for your family?

We have covered a lot of ground here. Do you need help creating your budget or implementing it?

Book a free call with me!

We can talk through your family budget for the holidays to make sure you’re spending enough to have a meaningful holiday season, but not so much that you regret it after New Year’s.

FAQ (Common Holiday Budget Questions)

How much should a family spend on holiday gifts?

Spend what fits your values and financial goals. Be sure the amount won’t eat into your emergency savings or make you take on debt.

How do you avoid overspending during holiday shopping?

Make your list first, research prices before buying, and only purchase items already on the list. Make returns after your shopping is complete. Most importantly, set a clear holiday budget to avoid accumulating holiday debt, which can result from spending beyond your means during the season.

How can you budget for gift giving during the holidays?

Start by setting a total spending limit for gift giving. Allocate specific amounts for each recipient and include all gift-related expenses in your holiday budget. Planning ahead helps ensure your gift giving is meaningful without risking your financial well-being.

Are experience gifts better for kids?

Yes, especially when you can provide a memorable activity rather than accumulating junk that they’ll forget in a week.

When should you use credit card points for gifts?

Use credit card points when you can get 1.5x the point value, if you want to spend more than your budget allows, or for special deals on things you’d purchase anyway.

Should families do gifts only for kids?

Kids-only gifting is a simple way to reduce your holiday budget.

Is it ok to buy impulse gifts?

Absolutely! Just check the return policy in case you change your mind after completing your shopping.

Should you spend 1% of our income on holiday shopping?

No. Your budget should be based upon your priorities, your financial situation, and how much you want to spend this time of year. You can spend more or less than 1% depending on these factors.

Does holiday travel and hosting friends and family count towards your holiday budget?

Yes. Anything that will spike your spending in December should be considered when making your holiday budget.

How much of your year-end bonus should you spend on the holidays?

I like to abide by the 50/50 rule for typical bonuses. Take AT LEAST half of it to put towards your financial goals (pay down debt, add to your investments, build up your savings account, etc.). Take NO MORE THAN the other half and spend it during the holidays on gifts, travel, and charity. If your bonus is a major part of your annual income, put a much higher percentage towards your financial goals and spend a lot less of it.

The information provided is educational and general in nature and is not intended to be, nor should it be construed as, specific investment, tax, or legal advice. Individuals should seek advice from their wealth advisor or other advisors before undertaking actions in response to the matters discussed. No client or prospective should assume the above information serves as the receipt of, or substitute for, personalized individual advice.