Weekly Budget: Highly Effective Yet Super Complicated…Until Now

Wow, if you think monthly family budgeting is tough to manage, you should move to weekly budgeting.

It’s more complex and takes a lot more work! Perfect!

(Detecting any sarcasm?)

In all honesty though, weekly budgeting has its merits, and might be more effective than a monthly budget.

A weekly budget could be great for you but it doesn’t have to be complicated where you are beholden to every category and listing everything out.

This is not about perfection and notating every single detail. It’s about being more aware of your spending habits and being able to start saving more money.

It’s about reframing your spending so it has more context in your overall net worth over time.

My goal has always been to come up with effective yet simpler ways for you to make sure you’re spending on the things you care about and also free up as much extra money at the end of the month as possible.

Setting up a weekly budget may just be the thing that helps you gain control over your spending once and for all (even if you feel like you can’t save money)!

Table of Contents

Is it better to budget weekly or monthly?

But just like everything, there are pros and cons to making both a weekly budget and monthly budget.

Let’s start with the more common budgeting technique.

Pros and cons of a monthly budget

The first pro here is that…you’re setting a budget! That’s something to be excited about!

But they are really hard to keep up with and really easy to lose track of.

What happens when you go over? It’s really easy to fall off the wagon! If you spend more money than you anticipated, it all falls apart and you feel like you have to wait until the first of next month for any changes to matter.

It’s kind of like trying to eat healthy then having just one cookie during the day. “Oh well, might as well finish the entire batch!” That’s the mindset.

A third pro of the monthly budget is you can see the full picture of what your month looks like. It gives you great awareness around where all of your money is going including your fixed expenses and your overall personal spending.

Pros & Cons of the Weekly Budget

Weekly budgets make the tiny decisions matter and keep your goals front of mind.

If you have a dining out budget of $800 for the month, what difference does an extra $10 make? But if you set a $200 per week limit, that $10 has more context.

Weekly budgets are easier to follow because the spending decisions are condensed into 7 days instead of 30.

Each week is a fresh starting point which allows you to course correct and end up where you wanted to even if one week doesn’t work out.

Bottom line is that you’re more likely to end up where you want with a weekly budget.

A downside is that the budget is weekly which means it can take more time to create it.

But let’s flip that on its head.

If you read other posts about weekly budgeting out there, it would lead you to believe it’s super complicated, but that’s not necessarily the case.

Time to fix that!

What should my weekly budget include?

Your weekly budget should include everything that you expect to spend that week, and each week will be different.

There are certain expenses that come out once a month, and others that are consistent on a weekly basis.

Usually the weekly budget for week 1 is going to be the highest of the month. It typically includes loan payments, utility bills, rent or mortgage payments.

Weekly spending for weeks 2 through 4 are typically a little more consistent unless you have a car payment in week 3 or if you split your mortgage into biweekly payments.

Groceries and discretionary expenses like dining out can be spread evenly through the month unless you have a big dinner or fun celebration planned.

Where do you put monthly income in your weekly budget?

What do you do with your paycheck? Should you put it in when you get your paycheck or divide it into a weekly income?

Honestly, I would leave your income out of the weekly budget itself though it’s obviously a very important part of the equation.

You could take your salary and break it down into a weekly income, but your weekly budget won’t match up with what you spend especially in week one.

We will want to keep tabs on your running surplus for the month though.

In other words, your weekly spending should track both your budget but also draw against your income for the month.

How do I budget for a week? Here’s the 5-step process.

The goal in creating a weekly budget is to get better results but with equal or less effort. Even though it sounds like more work, that won’t end up being the case.

Not everything with your personal finances has to be super complicated. Anything can be simplified 🙂

This will be a simple process that includes tracking your overall expenses and monitoring only a few key budget categories that you want to improve.

Here’s how to put together your weekly budget.

Step 1: Figure out how much you want to spend monthly

There are two parts to this step.

First, let’s take a look at your take home pay. How much money do you have coming in each month?

This is the number after accounting for taxes, health insurance, and other deductions.

Now some might jump right in and create a weekly budget, but this is a mistake.

Don’t just guess or pull numbers out of the air. Those who do are in danger of having their budget fail.

Spending money is not just a bunch of financial decisions, they are habits ingrained in you that could be hard to break. If you go with a random number, you could be setting yourself up for major lifestyle changes without expecting to do that.

That budget won’t stick, and you’ll feel no-go at managing your family finances.

Start by tracking your spending to see how much cash flow is actually going out each month.

Once you figure out how much you spend, back it off by no more than 10% to start. If you try to go bigger than that, you’re setting unrealistic expectations.

Start with something you can achieve, then you can cut deeper over time if you want.

Step 2: List out the timing and amount of your big bills

Start with expenses that are more than $300 and don’t happen weekly.

This could be a mortgage payment or rent, child care, car payment, student loan payment, personal loans, monthly dues, Amazon Subscribe & Save items, etc.

Don’t worry about the specific date, just try to place it in that week.

There’s no need to time every single purchase you make. For example, your streaming services or other smaller entertainment transactions each month.

The Disney+ and Netflix fees are not worth getting so granular on. Same with smaller debt payments.

Also leave out any automated investing or transfers to a savings account. Those aren’t expenses, those funds are just being transferred to other accounts.

Don’t overcomplicate it. Scan through your last 1-3 months of expenses and see what those $300+ are and when they come out.

Step 3: Figure out what your overall weekly spending on everything else.

Ok, so you know about what you have spent over the last few months and you know when your major bills come out.

Subtract big bills from your overall spending target for the month

Divide the remaining number by 4 to come up with the weekly amount.

For example, if you want to spend $10,000 per month and your major expenses total $4,000 for the month, that leaves you with $6,000.

That means your weekly expenses will be $1,500 + the weekly major expenses that week.

This is the overall expense number you want to track.

Here’s another little hack: Track your number of transactions each week. In other words, how many times are you making a purchase each week.

Now that you have your monthly and weekly targets, it’s time to focus on the areas you want to improve.

Step 4: Make a weekly budget for 1-3 categories you want to improve.

You don’t need to make a separate budget for things that are small and you can’t control.

But you should be creating a budget for those categories you feel you could improve in your life.

Many people pick spending on food, Amazon, Target as places they want to reduce their spending.

Whatever it is, create your budget in those areas of improvement based upon what you have been spending in that area. Look at your total spending in that category then reduce it by 20%.

Take that number, divide it by 4 to come up with your weekly budget.

Track those categories ONLY. You can use a budgeting app to aggregate the transactions.

Step 5: Remember about your irregular expenses

Each month will have a different event that happens once a year or so.

Birthdays, holidays, anniversaries, kids activities, annual dues are easy to lose track of. Be sure to include these in your weekly budget.

Bonus step: Treat it like an experiment

This is not going to be perfect right out of the chute.

You’re going to be over or under budget for the first few months until you settle in.

Expect it to happen because it will.

Stick with it and improve. Give it 8-12 weeks until you feel like you have it figured out. If you’re not feeling it after that, then feel free to move on and try something else.

Just like anything, the first part of learning something new is frustrating and feels like it will never work. But if you keep a curious and learning mindset, you’ll make it happen!

Frequency = consistency = confidence

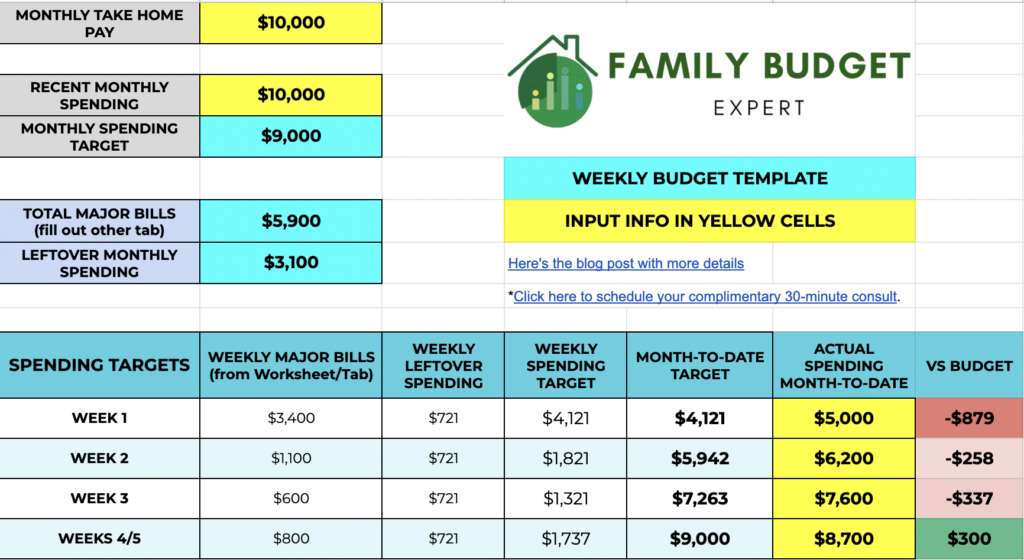

Need a weekly budget template?

Budgeting works best when it’s a simple system that you can maintain over time, one that works for you and your life. This is critical if you want to reach your financial goals and financial security.

Putting together a hodgepodge of budgeting tips, paying for everything in cash, credit card points hacking, tracking every purchase won’t really impact how you spend money or your overall cash flow.

What matters most is finding something that you think will work, trying it on, experimenting, and making it suit your life.

Weekly budgeting can help you get there.

Here’s an extra resource for you. Try my simple weekly budget planner.

If you’d like more help, set up a complimentary 30 minute consult to dive in together!