What Is a Sinking Fund and Why Is It Important in Budgeting?

It’s kind of a weird term, right? What exactly is a sinking fund?

Simply put, a sinking fund is when you set aside money each month to save up for a large purchase in the future.

Think of it like a savings plan for major expenses you plan to make.

The idea is to have enough money to make a big purchase without going into debt to make it happen.

The most common way people use sinking funds are to save up for the holidays, a vacation, and a down payment on a house.

Let’s dive in deeper to learn about the benefits, how they work, and how to set them up.

Table of Contents

What are the benefits of sinking funds?

Sinking funds will help you get out from behind the 8-ball. Plus, there are other great reasons to set up sinking funds including the following:

Having money when you need it

There’s no greater feeling (financially speaking) than having the money on hand to pay for a big expense.

Building a sinking fund will help you save up for your financial goal.

Avoiding high interest debt

Many families do this concept of sinking funds in reverse, and it ends up being very costly.

They don’t set aside money in advance of a major purchase. Instead, they put it on a credit card the pay off the high interest debt over time.

Sinking funds get you in front of the expense instead of behind the eight ball. It’s a a pre-payment plan for a major expense.

Not only will you avoid accruing credit card debt, but you can also earn money as you build it up if it is in a high yield savings account.

Smoothing out your monthly budget

I often hear, “We do fine with budgeting and then something always seems to come up that puts us over.”

The concept of sinking funds will minimize this from happening.

Every month is going to be different. Some months you’ll have extra money left over, others you may spend more than you earn.

If you take a look at your regular monthly expenses and plot out your non-monthly recurring expenses for the year, you will smooth out your monthly budget.

Essentially, you’ll be taking your total expenses for the year and dividing them by 12 months rather than having the roller coaster of higher spending months and lower spending months.

The cherry on top is that you’ll be able to cover those non-monthly expenses and other one-time purchases.

Planning ahead

It’s tough to reach your financial goals without planning ahead.

Even though it seems like this process might take some work, the clarity and peace of mind by having a plan goes a long way to reducing stress.

Plus, you’ll be able to measure whether you’re on track or not.

Looking forward to fun things

Yes, taking a vacation is fun, but you know what else is? The anticipation of the vacation!

Imagine being able to go on your trip guilt-free because you have enough money in your savings account to make it happen. That’s the most fun option!

What is a sinking fund used for?

You can set up sinking funds for any big purchase you have coming up in the future. Here are some sinking fund examples:

Vacation

Holidays

Birthday presents or parties

Back-to-school shopping

New car

Home improvement projects

Scheduled car maintenance

Annual medical expenses (doctor, dentist, optometrist)

Pet expenses or veterinary bills

Save up in a sinking fund for any expense you wouldn’t be able to pay for without planning in advance.

How do sinking funds work?

Sinking funds work by taking those irregular expenses and one-time purchases and smoothing it out to a specific dollar amount you’ll save each month.

This breaks down your predictable larger expenses throughout the year into bite-sized monthly savings amounts.

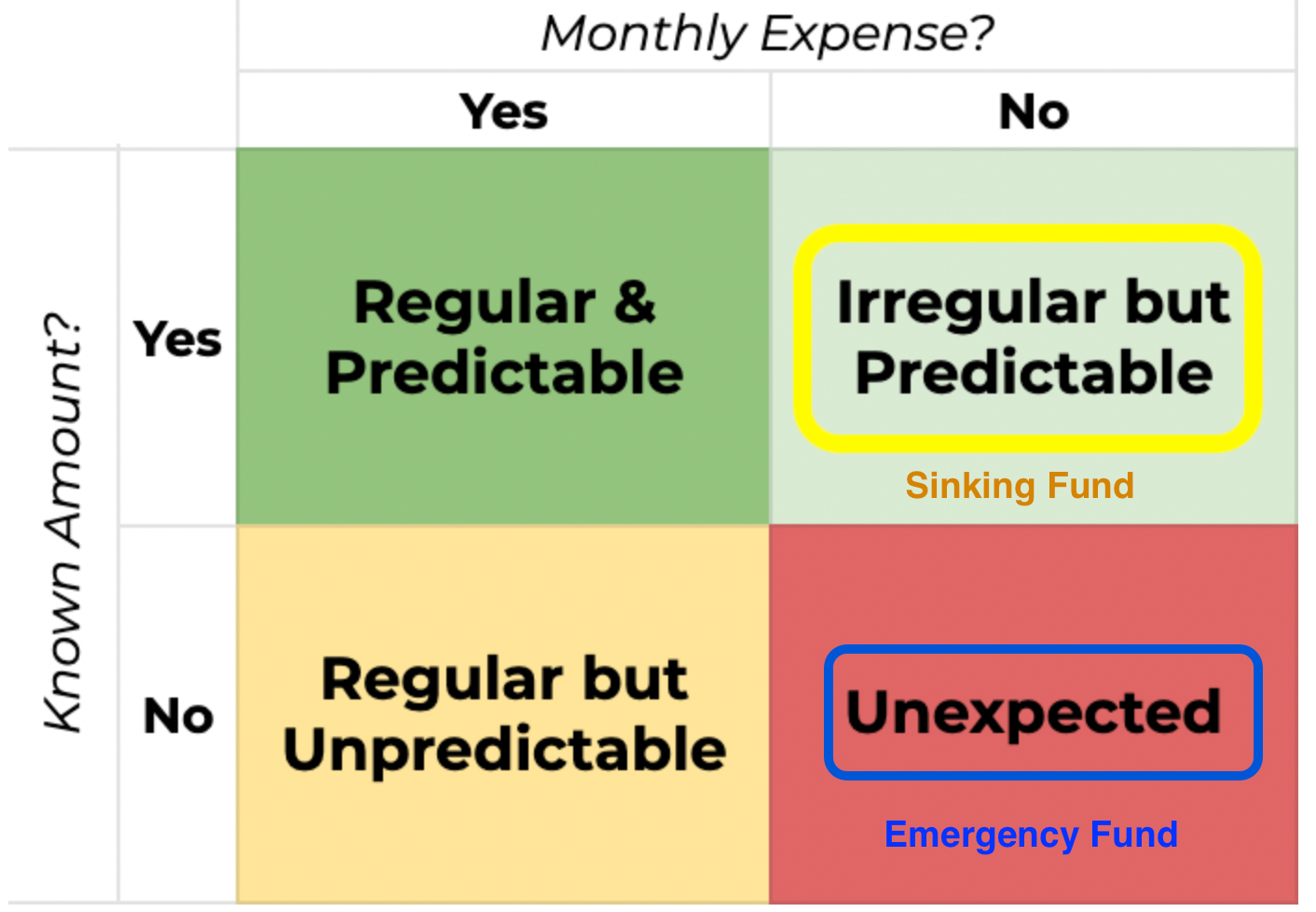

Sinking fund vs emergency fund

An emergency fund is for unexpected expenses like home repairs, medical emergencies and car repairs.

A sinking fund is for a larger, known expense, things you can create savings goals around.

Simply put, a sinking fund is predictable while an emergency fund is unpredictable.

Sinking fund vs savings account

A savings account is a where you put the money for your sinking funds.

High yield savings accounts are the best place to put transfer your sinking funds into vs general savings account at a bank. They will typically pay more interest than your standard savings account and definitely more than your checking account.

You’ll want to keep your sinking fund at a reputable financial institution with a high annual percentage yield (APY) on the account.

How much should I put in a sinking fund?

The calculation of how much to save in a sinking fund is pretty straight forward.

First, decide what you want to purchase in the future. Then, figure out how much it will cost.

Finally, determine when you want to make the purchase.

Simply divide the amount of money you’re going to spend by the months until you want reach your goal.

For example, if you want to save $500 in two months, then you need to save $250 per month for the next two months.

How to create a sinking fund

Ok, we’ve been through a lot to this point. Now let’s dive into the practical way to create your sinking fund.

What are you saving up for?

Start by making a list of what you need to save for or what you want to save for.

What do you put on this list? Anything you feel like you need to save up for.

Think through your year and list out the predictable stuff (birthdays, holidays, travel, summer camp, etc).

Next, are there any other one-time purchases or projects you are planning? This could include a home improvement project, a new car, real estate, or even new tires on your car.

How much will it cost?

Come up with the specific amount you’ll need to spend on this purchase.

Do a little bit of research. If it’s a new car, take a look at what the price range would be. If it’s a home improvement project, get some quotes.

It’s ok to estimate but spend at least a little time here.

When will you need the money by?

When will you make the purchase? Do you have a hard deadline or is it flexible?

Get as specific as possible but understand that the timeline might change.

Figure out how much to set aside each month.

Take how much you need to save divided by how many months you have to get there.

If you want to save up $24,000 over the next 2 years, then that would mean setting aside $1,000 per month.

Do you have any cash on hand right now that you could put towards it? That could jumpstart your sinking fund and shorten the timeline.

Make sure this isn’t earmarked for anything else like an emergency fund or other plans to invest or debts to pay off.

Reevaluate your goal

Now that you know how much it will take each month, can you do it? Are there any changes you need to make?

Not only is it important to know if you CAN do it but are you WILLING to do it too. Will you do what it takes to get there?

It’s better to slow play it a little bit as long as you get there in the end.

Select account do you want to save money in?

Put the sinking fund in a separate account. If you already have one opened up, use it. If not, look for a reputable financial institution that pays a good interest rate and doesn’t have any fees on the account

Create an automatic transfer

Set up a regular occurring transfer from your checking account into your sinking fund account.

It’s best to automate this rather than doing it manually each month.

Voila! You’re on your way to your financial goal!

What if I have multiple sinking funds?

You probably have multiple goals that come to mind as you were reading through this.

Some might say to open up a different account for each sinking fund, but I disagree. Keep it simple!

Keep all of your sinking funds in one place and use a spreadsheet on the side instead of how much is earmarked for each goal.

Plus, let’s be honest. Plans will change. You’ll want to move some goals around. It’s easier to do that on a spreadsheet than it is to have transfers all over the place.

Sinking funds are an important part of budgeting

Being prepared for your big expenses is critical to achieve your financial goals.

It’s hard to focus on your long-term investments and your other future plans if you have to use debt for those larger purchases.

All it takes is putting a certain amount of time create your sinking funds so you can avoid being behind the 8-ball and be proactive in reaching your goals and dreams.

If you need help setting up a sinking fund or finding the extra money at the end of the month to put into them, we’re here to help!

Let’s start with a discovery call to talk through how to get you started!

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based on third party data and may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this information.