Why do budgets fail? How to overcome your budgeting challenges

It’s not you…really, it’s not.

Traditional budgeting fails most people because it doesn’t normally fit in with how we operate in our daily lives. Plus, budgeting is not a one-size fits all approach, even though some would like you to believe that.

However, there are universal principles that make it easy to stick to a budget for anyone.

The question is why do budgets fail and what can you do to create a budget that actually works for you.

Oh…first one quick detour…Why is budgeting so important?

Well, you can’t reach your financial goals and life goals without having money left over at the end of the month.

How do you get there? By creating a budgeting process for your family that will actually work.

Ok…Now, let’s talk about why budgeting is so difficult.

Table of Contents

8 reasons why budgeting is so hard?

Budgeting is hard for 8 reasons:

- It’s rigid and restrictive.

- It’s too time consuming to maintain.

- The focus is on numbers rather than process and spending habits.

- It’s all about sacrifice and setting limitations.

- We set arbitrary and unrealistic budget limits.

- Most couples aren’t on the same page with budgeting.

- There is pressure to stick to it.

- We track too much information.

- We feel guilty when we fail.

Does that seem like a list of things that set you up for success? Heck no!

Yet, despite all that, this is the most common budgeting approach and we feel horrible when our budgets don’t work.

As you can see, there are major problems with this process.

However, focusing on cash flow is the most important thing you can do in personal finance, so we need to figure out how to overcome these problems with budgeting.

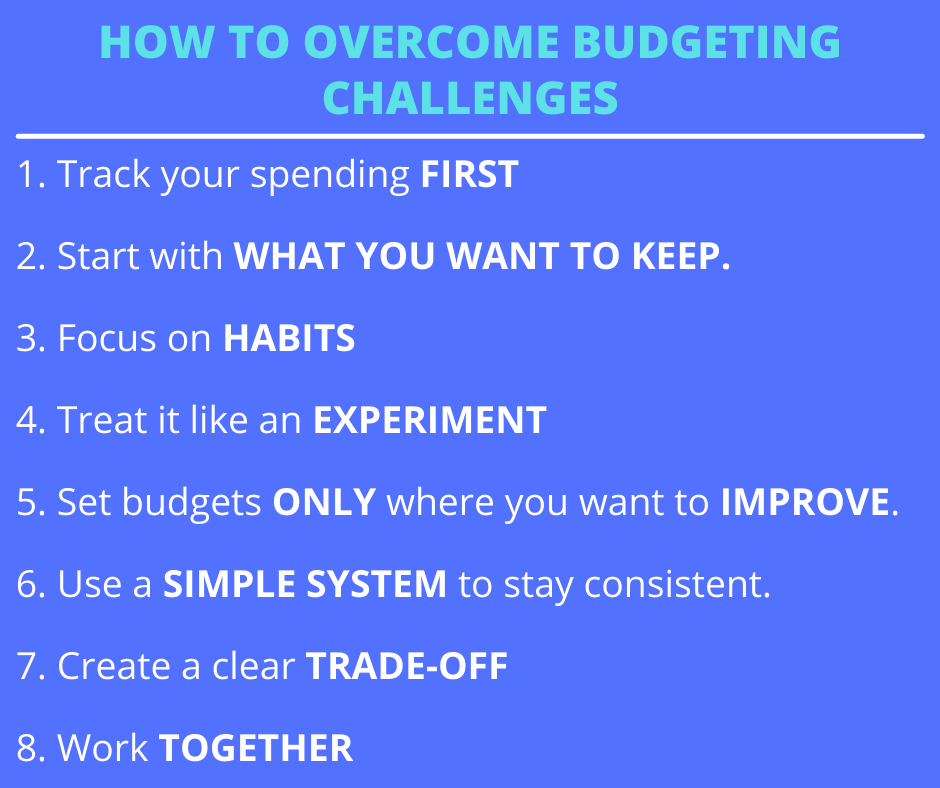

How to overcome budgeting challenges

Yes, it is possible to create a monthly budget that will help you avoid budget failures.

Here’s how to overcome these challenges and go from “budgeting is hard” to “budgeting is easy!”

Tip #1: Track your spending FIRST

If you only do one thing after reading through this, DO THIS STEP!

Track your spending, and do it before you set up your budget.

Most people will just pull random numbers out of the air-based upon what they THINK they’re spending, and these unrealistic budgets lead to going way over budget.

Plus, budgeting isn’t just about the numbers. It’s about changing your spending habits.

Tracking your spending will give you your baseline to measure your improvement.

There’s no need to cut things drastically at first. Take it slow and focus on the progress.

But first…track your spending to know how much you’re spending and where your money is going.

Tip #2: Start with what you want to keep rather than what you will give up

Budgeting doesn’t have to be restrictive and limiting. It can be empowering, and allow you to spend…get this…AND feel good about it.

Rather than first focusing on what you want to cut (a negative motivation), start with what you want to keep spending money on.

Your money should be spent on things that are aligned with your values and priorities. Keep spending money on the stuff you care about.

Making room in your budget for these things. Not only will it help you spend less money, but you will finally be able to spend money without feeling guilty.

Tip #3: Focus on the process and habits more than the numbers

We’re learning more and more that habits lead to our outcomes in life, good and bad.

The Power of Habit by Charles Duhigg teaches us that the right habits can lead us to success.

Our spending habits will dictate whether we will be saving money or going into debt.

So when you figure out what you want to cut back on, forget about trying to fit it into a number at first.

Take a look at the habits, triggers and tricks you can change and implement to make it happen.

This will help you stop spending money on things you don’t care about so you can have more money left over for the things you do.

Tip #4 Treat it like an experiment – Learn from “failure”

How long did it take your kid to learn how to ride a bike? How many times did they fall down?

What is a skill you developed or are working on? Where were you when you started vs where you are today?

You made progress right? You learned from your mistakes and experience.

The same thing applies to budgeting. We feel like we should be good at it and are so incredibly hard on ourselves if we go over budget, build up a little credit card debt, and can’t seem to build up an emergency fund.

Stop it!

Think of yourself as a researcher who is trying to figure out the best system that will work for you.

John Maxwell’s Failing Forward shows us that even though we will all have failures, it’s how you respond to it will dictate whether you succeed or not.

Same thing with budgeting. You will fail, and will take some time to be the right fit for you.

Tip #5: Set a budget only where you want to improve

Some people focus so much on tracking a gazillion budget categories, but that becomes really cumbersome and unnecessary.

Spending money is something we do all the time, most families will have 100+ transactions per month.

But the largest and most predictable is your housing payment, and it’s only one transaction.

So why have a budget for it? Tracking that information is unnecessary and just gunks up the process.

On the other extreme, the smaller transactions are easy to shrug off.

But the little things add up and are harder to see the overall context without a budget.

Set budgets ONLY for the areas you want to improve and create them starting with what your current spending is.

Only use 1-3 – Most people create ones for dining out and Amazon / Target, and possibly one more.

Tip #6: Have a simple system for keeping the wheels on

Again, there’s no need to track each individual transaction and micro category.

Track only what matters.

The most important thing that matters is your total inflow and your total outflow.

Secondly, it’s the 1 to 3 categories where you can and want to reduce spending.

(It’s a lot easier if you have budgeting software or a budgeting app.)

Finally, rather than waiting until the end of the month when the numbers are already set, commit to a Weekly Spending Review so you can adjust and end on target.

This should only take 5 minutes.

- Review your transactions to gain awareness of where your money went.

- Look at the 1-3 budget categories you want to improve.

- Review your total spending for the month and your total inflows for the month.

This simple system will keep the wheels on and help you keep this up over the long term.

Tip #7: Create a clear trade-off

One of the problems with sticking to a budget is when we don’t have a trade-off. What will I do with that extra $10 I didn’t end up spending?

It’s really important to have inspiring long-term financial goals, but what really brings it home is by setting short-term financial goals that are the first steps to reach those long term goals.

Be very specific here.

Instead of, I want to pay off my debt, think, I want to pay off this specific credit card balance.

That clarity will help you make different choices in the moment.

Tip #8: Work together

A budget where one spouse / partner / significant other creates it without input from the other is destined to fail.

Even if one of you is used to doing the finance thing in your relationship, both of you need to come together here.

This will ensure you make room for what’s important to you as individuals, you as a couple, and you as a family.

Another positive side effect is that the person who isn’t familiar with the numbers is usually a little stressed or feeling guilty about the spending they do. Working together decreases the stress and anxiety from the person who hasn’t been involved.

Both of you should be involved in the process including the weekly spending review.

I’m not saying you have to combine your finances here by the way, just get on the same page with your overall spending and your goals.

This has been a transformational change for the families I work with. Not only with their family finances, but also with their relationship.

What else can you do if your budgeting fails?

I’m here to help!

Let’s set up a complimentary 30 minute call to talk through your challenges, problems and failures.

By the time we’re done, you’ll have some easy to implement solutions you can take with you that will make noticeable positive changes.

or