Non-monthly expenses: Why your budget should be different each month

It seems like something comes up each month that breaks your budget. This can make you feel like a complete failure, like you’re horrible at budgeting.

But that’s actually not the case.

The thing is, something comes up every month that throws our budget off.

Often we think it’s the unexpected stuff. Something needs to be fixed in our house or car.

Sometimes we think it’s our lack of self-control that derails us. Why can’t we stick to those limits we set in our tidy budget categories!?

But really, most of what makes us go over budget for the month are completely predictable non-monthly expenses.

If we take just a little bit of time to remember what those annual expenses are, we can not only save our budget, we can also change our mindset from feeling like we’re horrible with budgeting to confidence that we can actually stick to a budget.

Table of Contents

What are examples of non-monthly expenses

You might refer to these as irregular expenses too. These are the things that happen every year, just not every single month.

These do not include your predictable monthly bills like your mortgage payment / rent, cell phone, home wi-fi, monthly streaming services, health insurance, monthly childcare, debt payments.

These are predictable yet non-recurring expenses.

Here are some non-monthly family expenses examples or events:

- Birthdays (for each family member)

- Anniversary

- Holidays (seems like there’s one each month right?)

- Travel (Summer trips, spring break, winter break)

- Annual doctor visits / Dentist visits

- Veterinarian check ups

- Annual membership / Dues

- Home maintenance

- Auto maintenance

- Kids activities (summer camp)

- Tuition for kids’ school

- Charity / annual giving

- Auto insurance

- Home insurance premiums

- Property taxes

- Income taxes

As you can see, it seems like there’s always some “new” expense that doesn’t show up each month.

These expenses not only can derail our confidence in budgeting, but it also shows us that every month will be different.

Your budget doesn’t have to be the same each month. You can spend more money in some months and spend less money in others.

We can get into trouble with budgeting if we feel like we have to spend the same each month even when we spend thousands on a family vacation in July.

That being said, there is a way to smooth things out and build a buffer to weather the expensive months and stock away some surplus from the less expensive ones.

How to budget for non-monthly expenses

The goal of budgeting for non-monthly expenses is to anticipate which months will be more expensive and which months will be less expensive. Most of these non-monthly expenses are entirely predictable with just a little bit of planning.

When we have that clarity and know what to expect, we’re more likely to stick to our budget.

Here’s how to go about budgeting for those non-monthly expenses:

Step 1: Make a list

Doesn’t everything start with making a list 🙂

Seriously though, go through and make a list of everything that comes up throughout the year.

Pull out your favorite spreadsheet, notebook, or app and list out each month (January, February, March…)

Underneath each month, list out everything you can think of off the top of your head. The easy things to recall are birthdays, holidays, vacations, etc.

Next, pull up the activity on your credit cards and checking account.

Just skim through all of that and note the things you may have missed such as when you take your pets to the vet or when you pay for kids’ summer camps.

Remember that annual Amazon Prime membership too 🙂

Don’t worry about being exact. We just want to have things close enough.

Step 2: Estimate how much you spend on these annual expenses

Estimate how much you spend in each of these areas.

Unless you really want to take the time to sift through past transactions, just take your best guess.

We’re not looking for perfection here. Close enough is good enough. Just don’t forget the major ones.

The most important thing is that you’re aware and planning in some way for them.

Step 3: Add everything up

Now that you have a list of all of your non-monthly expenses and an estimate of how much you spend there, add up all of those into one annual number.

It will be larger than you think, probably in the 5-figure range, $10,000+.

Step 4: Divide by 12 to smooth these expenses out into your monthly budget

Now that you know the total amount, let’s figure out what that works out to on a monthly basis.

For example, if your non-monthly expenses are $12,000, then that would be $1,000 per month in addition to your normal monthly expenses.

That’s your average monthly…non-monthly spending.

Step 5: Create a dedicated savings account for these expenses

You’ll want to set up a bank account separate from your emergency fund. This savings account will become your buffer for the more expensive months you have.

I’m all about simplifying your finances, so just set up one account for this, not a different one for every single non-monthly expense (yes, I’ve seen it done before).

Some months you’ll add to this account. Other months, you’ll draw from it.

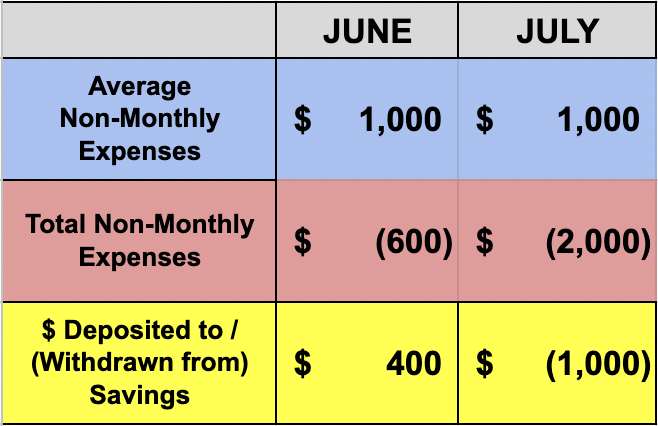

For simplicity, let’s go with the $12,000 per year example ($1,000 per month).

$1,000 is the baseline. If your non-monthly expenses are less than that, you add to the account. If they’re more, you take money out of that account.

Let’s say that March is “only” $600 of extra annual expenses. That means you’d add $400 to that additional savings account.

When you take that family vacation and spend $2,000 on it in July. You would pull $1,000 from that account.

Step 6: Be ok with your monthly spending being different each month

It’s just the reality that each month will be different. Your monthly budget should not be the same.

If you think all of your monthly expenses will fit neatly into the same parameters each month, that will get you into trouble financially and psychologically.

It seems like we can do that when we set our budget for the holidays, but we have trouble in other months of the year.

Get used to the fact that each month will be different. The difference here is that now you have planned and are prepared for it.

Need help figuring out how to budget with your non-monthly expenses?

Creating a budget can be challenging, but it doesn’t have to be that way.

I believe that the key to personal finance is getting good at managing your cash flow, how much comes in and how much goes out. That’s the top predictor of your future financial success.

That’s why it’s the only thing I focus on.

If you’re looking for help here, set up a complimentary 30 minute session with me so we can talk through it.

Looking for help but not ready to talk?