Bad spending habits: Learn how companies hook you and how to FINALLY break free.

You have really been trying, haven’t you?

You’re trying to improve your spending, but it has been a real challenge.

You’re certainly not alone. Plenty of people struggle with their spending.

Companies are making it easier than ever to set up bad spending habits.

They have been studying human behavior and habit formation, adding new persuasive techniques into their marketing campaigns.

Plus, it’s easier than ever to buy things you don’t need and spend more money than you have. Frictionless payments, targeted promotions via email, social media ads & envy, Buy Now Pay Later.

But once you understand how habit formation works, and the methods being used to get you to overspend, you can break bad spending habits and start to play defense.

This is critical because your spending habits can make or break your entire financial situation.

*If this is something you struggle with and need some extra help, get my free guide: 5 Steps to Cut Spending without a Restrictive Budget

Table of Contents

Why are spending habits important?

The number one predictor of your future wealth is how much money you have left over after what you earn and what you spend.

People who live paycheck-to-paycheck will struggle to build wealth whether they earn six-figures or make so little that they can’t even pay for the necessities.

Conversely, a person who earns five figures and can save money will become wealthier than someone who has a six-figure income but is living paycheck-to-paycheck. I’ve seen it many times.

Good spending habits can propel you to financial independence, because you spend thoughtfully and have extra money each month to put toward your financial goals.

Bad spending habits get in the way of building wealth and reaching financial independence, because they cause you to live above your means, run out of money by the end of the month, rack up debt and spend right through your assets.

In health, they say you can’t outrun your fork. Meaning it’s much easier to eat 500 calories than it is to burn them.

Well, in personal finance, I say you can’t out-earn bad spending habits.

The good news is that you can get rid of bad habits and build good spending habits to grow your wealth.

Even if you’re starting from a zero or negative net worth, you can build wealth from nothing.

Starting…

Right…

NOW!

How are spending habits formed?

Don’t skim through this part!

When you know how habits are formed, it will open your eyes to the frameworks that companies are using to make you set up bad spending habits.

Then you can recognize how to eliminate and avoid bad spending habits altogether.

I’ve been reading a lot of books on habit formation lately in a quest for self-improvement and to help my clients understand their financial habits.

This year, I have read Hooked by Nir Eyal, Tiny Habits by BJ Fogg, Atomic Habits by James Clear, and The Power of Habit by Charles Duhigg

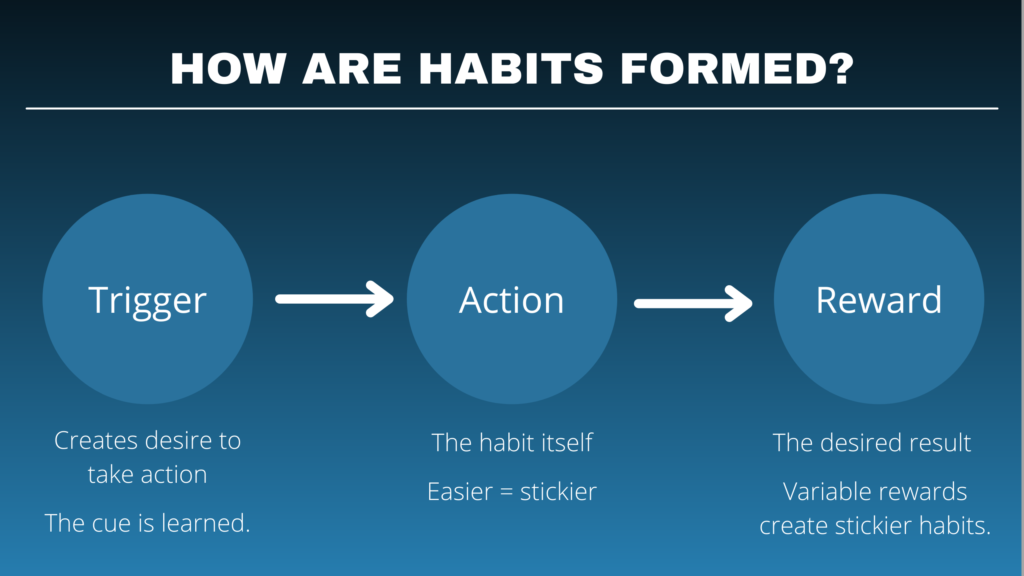

If I were to summarize how habits are formed, it starts with an event (a cue, trigger, or prompt) that makes us take an action in search of a reward.

The Trigger

Let’s talk first about the trigger, cue, or prompt. It’s the event that creates the desire to take a certain action for a particular reward.

The best example is the notification on your phone or watch. What do we do after hearing the “ding” (or your sound effect of your choice)?

We look at it…immediately.

Why?

We want to see what it could be…right now!

Social media and advertising can use this method but also a different technique.

They are amazing at alerting us to problems we didn’t know we had.

Remember infomercials? It’s a perfect example.

I mean, seriously, what will you do if someone accidentally squirts you with a ketchup bottle? How will you get that stain out?!?

Then, after making us think we have an urgent problem, they show us the action to take that will solve the problem…Buy their product.

The Action

Now that we’ve been alerted to something, the ACTION has to be super easy and worth the reward.

For example, if you had to drive 10 miles in a snowstorm and talk to your worst enemy in order to see what Amazon Prime Deal of The Day is, you’d probably say, “Nah. Not worth it!”

But all you have to do is look at your phone and tap on it. Super easy.

Companies have made it easier than ever to take action to buy something.

Back in the day, you would have had to pay cash. Whatever you had with you is what you could buy. Then you’d have to take the time to count it out at the register. Need change back, the person working at the store would then count out your change.

Then came checks. Ever have someone pull out their checkbook to pay for groceries back in the day?

They had to pull out their checkbook, grab a pen, fill out the check, update their ledger, then put it back. Then, the person working would ask for their drivers license to verify their identity.

These methods slowed down the buying process aka friction to payment.

Credit cards were a big evolution.

You didn’t have to have the money with you, or even in your bank account, But you still had to go through the labor intensive process of pulling it out of your wallet, swiping it, and waiting seconds for approval 🙂

Now we can pay with our phones, our watches, tap our cards, and pay in one click with saved payment information. It’s virtually “frictionless”. There is little effort to take action.

We can even place in order in advance and pick it up!

The evolution of collecting payments has made things super convenient and saved us a ton of time. That’s the positive spin on it.

The problem is that we end up overspending and not even having to think about money before buying something.

The Reward

The REWARD piece is where companies have really evolved.

They have learned that predictable rewards don’t really lead to sticky long term habits.

For example, I know that everytime Bed Bath & Beyond sends us something in the mail, it’s going to have a 20% off coupon that comes with it.

I just toss it most of the time without even looking. We have plenty at this point.

The new science supports that variable and sometimes random rewards work much better to create habits that stick.

When we’re not sure what to expect, it inspires our curiosity and excitement. WE HAVE TO KNOW WHAT IT IS!

(Nir Eyal does a masterful job explaining variable rewards and how they hook the user.)

So when you get a phone notification, what is it about?

Is it a comment or like on a post we made? Is it an exciting news story? Is it a work email? Which friend is texting me or sending me a DM? Is Lululemon offering a one day sale?

Social media is masterful at this.

We keep scrolling, because of the variable reward.

What’s next? An important milestone for a friend? A controversial political post? A cute pet? We don’t know what’s next so we spend hours just scrolling.

It’s kind of like a slot machine. We keep pulling the lever wondering if the next spin is going to be the big payout!

Rather than companies offering 20% off on anything in the store, they now discount certain product lines instead.

When you get an email, it’s not just a blanket offer. It’s a specific one that is different every time. The variable reward makes you take the action to open it up and click the link.

Another reward could be random bonuses or a limited time offer (which really feeds into our FOMO).

Again, infomercials knew this decades ago. The reward is that you can solve your problem…but wait, there’s more! They have bonus offers if you order in the next 10 minutes!

When you’re in the moment, it’s hard to see this in action. It’s easy to get sucked in.

But when you take a step back, you start to see the formula and how they are persuading you to spend more money and set up bad spending habits.

What are examples of bad spending habits?

A bad spending habit is one that causes you to buy things you don’t need or can’t afford. This overspending is a waste of money that could otherwise go toward building your wealth.

Here are examples of bad spending habits:

- Impulse buying

- Signing up for free trials without a plan to cancel.

- Not paying your bills on time and racking up late fees and interest.

- Spending until your checking account hits $0 each month.

- The habit of juggling bills and timing payments based upon when you get paid.

- Treating your friends and family when you’re broke.

- Putting items on payments when you can’t afford the total cost.

- Being numb to carrying a balance on your credit card.

- Turning a blind eye to your budget.

Breaking bad spending habits isn’t about how to stop spending money or go on a no spend challenge, nothing extreme like that.

It’is all about replacing them with better habits in baby steps.

Here’s how to do it.

How to break bad spending habits

The best way to break bad spending habits is to follow this process:

- Identify bad spending habits and what they stop us from achieving.

- Understand the trigger or cue that initiates the action and defend against it.

- Make the action/habit harder to make.

- Comprehend the reward we’re trying to achieve, and look at positive alternatives to achieve that reward.

- Start by implementing the very smallest step to turn things from bad to good.

Next, I’ll guide you through how you can improve your spending habits.

How can I improve my spending habits?

Alright! It’s time to improve your money habits!

We can improve our spending habits by breaking up the different components that cause us to start a new habit in the first place.

First, think of something you think is a bad habit. Maybe it’s impulse spending or one of the other examples of bad spending habits listed above.

Now, let’s get started.

Awareness

Yes it’s true. The best way to fix anything is to first be aware of it.

We need to become aware of the habit itself AND we also need to know the trigger and reward we’re looking for.

What causes us to initiate the habit?

Is it a promotional email? Is it stress or exhaustion? Is it hearing that your friend bought something you’ve been wanting for a while?

What’s the reward we’re looking to get out of it?

Does it reduce your stress? Does it numb your feelings? Is it to prove something to a friend or family member? Are you looking to solve a problem?

Finally, what is this bad habit keeping you from achieving in your life?

Are you trying to pay off credit card debt? Save for a down payment on a house? Pay off your student loans? Build up an emergency fund so you can stop juggling bills?

Once you know these things and what you’re trading them for, you’re more likely to improve your habits.

Action step: List your bad habits, what the trigger is that creates the action, what you’re looking to gain through the action, and what will happen if this bad money habit continues for the next 5-10 years?

Remove triggers

Now that you’ve identified what makes you initiate the habit, get rid of it!

Good examples would be unsubscribing from promotional email lists, turning off notifications, or deleting the app.

If your bad money habits come from something out of your control like a stressful day at work or dealing with the kids, then you might not be able to remove the trigger. We have to focus on changing the action.

Action step: Think about your habit. What is the trigger that puts the habit in motion? How can you lower the likelihood of it happening or eliminate it altogether?

Make the action harder

If you’re craving Oreos and they’re in your pantry, it’s really easy to indulge that craving.

But if you don’t have them in the first place, you have to get dressed, go to the store, and pick them up. That’s much harder.

My son recently made a tape maze that I had to crawl under to get to the next room.

(Picture)

Put something like that (metaphorically speaking) in front of the action you normally take.

Sometimes adding just a little friction or an obstacle that gets in the way of taking action on your bad habit will stop you from doing it.

Action step: Think about your habit. What could you do that makes the action inconvenient or harder to take?

Find the reward elsewhere

Let’s be honest, it’s really easy to lose your temper with kids when they’re driving you crazy. I certainly do.

The reward we’re looking for is to have the behavior stop, get them to hurry up when you have to be somewhere, or just have some peace and quiet.

Really, we’re trying to calm ourselves in these situations. Well, just taking a deep breath or leaving the room can calm us down more than yelling at our kids.

If you find yourself shopping out of stress or distraction, maybe calling a close friend and connecting with them will be more helpful.

This step will take some introspection, so don’t stop once you come up with the initial reason. It could be a step or two deeper than that.

Action step: Think about your habit and the reward you’re looking for. Where could you find it elsewhere?

Small changes

This is really important.

Drastic changes rarely take place unless there’s a drastic event.

Habit change is all about baby steps to get there.

We can’t just go in and tear everything up or create a budget if we’ve never done it before.

Habits that are engrained will require small incremental changes so that the bad habits are eliminated and the new habits stick.

For example, the best way to make a family budget that sticks starts with evaluating your values and priorities, then tracking your spending. It’s not to follow a rigid and strict budget. The wheels will fall off.

If you’re trying to set up good habits, create an automatic trigger and make the action as easy as possible to take.

For example, when I was trying to eat better, the first small habit I set up was to stop eating by 8:30pm.

Because let’s face it. Nothing healthy gets eaten after that time. Plus, putting a few hours between eating and bedtime leads to better sleep.

My trigger was setting up an alarm on my phone to go off everyday at 8:20pm to say “Finish eating.”

My reward? Weight loss, better sleep, and more energy.

This wasn’t the first thing I tried though, so think of this as an experiment instead of trying to set up the perfect system.

Make yourself the head of your own personal research project. Use trial and error to figure out what works best for you.

Action step: Figure out a positive action to take that is so small, you say, “I can easily do that!”

Need help breaking bad spending habits?

You’re not the only one with bad spending habits. Trust me. I’ve been there, and so have many of my clients.

If you wonder why you aren’t further ahead despite earning a six-figure income or if you feel like money is getting in the way of an otherwise thriving relationship, there’s a solution to your problem.

Sometimes you can go it alone, and other times you need a partner to hold you accountable.

I’d be thrilled to help you here.

The first step is to set up a free 30 minute consult to see the help you need and what the process looks like to improve your spending habits and get on the same page.

Here’s the link to book:

If you want help, but you’re not ready to talk, here’s a link to my 5 steps to cut spending.