What is Buy Now, Pay Later? The new popular way to get into debt.

How do you feel about monthly payments?

You probably fit into one of four camps:

- Nothing should ever be put on payments. If you don’t have the cash today, you shouldn’t buy it!

- I don’t think it’s a good idea, but sometimes major things come up and there’s not enough in my bank account.

- I like monthly payments if I can get a low interest rate, because I can make a better investment return with that money elsewhere.

- It doesn’t seem like there’s a big difference between paying in full and taking on monthly payments. It’s no big deal.

It used to be that houses and cars were the only things people went into debt for and made monthly payments.

Then other large purchases like furniture or appliances could be financed and paid over time.

Then cell phone companies started offering to put your new iPhone or Galaxy on payments.

Recently, there has been the rise of “buy now, pay later” apps where you can put almost anything on a payment plan.

Heck, I went to buy a $40 pair of shorts and they offered 4 payments of $10…for shorts!

Wherever you fall in the spectrum of feelings about paying in installments rather than up front, there are pros and cons of this approach and the growth of “Buy Now Pay Later” purchases.

We’ll go through these as well as the dangerous game that I call “Payment Stacking”.

Table of Contents

What is Buy Now Pay Later?

Buy now pay later (or BNPL) is the option to pay for something over time rather than in full up front.

You make one payment at checkout then pay the rest of the installments in weekly or monthly intervals.

These payments are usually billed directly to your credit card or debit card until the purchase is paid in full.

Most BNPL programs are 4 installments but some can go as long as 36 months.

Some programs have late fees and charge interest. But as more BNPL companies enter the marketplace, those fees and charges are coming down (and even non-existent in some cases).

Buy Now Pay Later is just a fancy way to say that you are financing your purchase.

The difference is that pretty much any purchase can be put on payments no matter how small (like the $40 shorts I was telling you about).

How does Buy Now Pay Later work?

Many online retailers and major brick & mortar stores are offering Buy Now Pay Later at checkout.

If the store offers BNPL (online or in store), the option will be presented to you at checkout to either pay the full balance or to pay in installments over time.

When choosing BNPL, there’s a brief application, followed by a soft credit check (which won’t ding your credit score). Then you’ll be approved or denied quickly.

It’s similar but shorter than applying for a store credit card and it doesn’t affect your credit score to apply.

Each one may have different terms and conditions.

Most will have a set number of payments but some will give you the option for your repayment term.

Why is Buy Now Pay Later so popular?

BNPL is popular because it aligns the wants of consumers, businesses and BNPL providers:

- Businesses want customers to buy more stuff.

- Consumers want to buy more stuff but paying up front may stop them from doing so.

- BNPL providers collect fees and can earn a profit by breaking up the full purchase amount into smaller payment amounts.

Right now, BNPL is relatively small accounting for less than 3% of purchases, but it’s growing fast.

Chances are that you’ve come across companies like Affirm (probably on Amazon or Peloton), Klarna, AfterPay, Sezzle, or Splitit.

BNPL is becoming more popular because it is very consumer friendly compared to traditional financing:

- It takes the credit bureaus out of the equation since there’s no credit report or credit score check. You’re not building credit on these plans.

- The payment plans either have low interest rates or are interest free.

- The application process is super fast.

Forbes has a great article on the endgame that BNPL companies are looking for.

Eventually, these companies want consumers to shop directly from their websites rather than the end online store.

This is bad for credit card companies and payment processors because BNPL bypasses their fees.

BNPL firms charge retailers a 4%+ transaction fee, which is higher than the 2-3% charged by credit card companies. But retailers are willing to pay the higher fee because customers end up spending more money if they can break it down into installments.

Banks and payment processors are going on defense. Some recent developments include:

- Credit cards are offering greater perks like points and rewards programs.

- Square is acquiring BNPL provider AfterPay

- Apple Pay coming up with its own BNPL program.

- PayPal is going to stop charging late fees on BNPL payments to become more competitive.

There’s no question that BNPL offerings will continue to grow because consumers want it. That growth will lead to more companies entering the market. Banks and businesses are going to have to compete by creating it in house or acquiring BNPL providers.

Is Buy Now Pay Later a good idea or bad idea?

For most consumers, it’s bad.

Need proof?

4 in 10 BNPL users have made late payments.

What was supposed to be a low or zero internet plan results in pricey late fees and potential overdraft fees.

If the BNPL was put on a credit card that gets maxed out or not paid in full, spending limits could be decreased and the purchase is subject to super high credit card interest rates.

Beyond that, Buy Now Pay Later makes it easy to overspend and desensitizes people to regular monthly payments.

For example, cell phone companies (and the phone manufacturers) want you to pay for your phone in installments.

This makes it so much easier to upgrade because, hey, you’re already making a payment. Nothing will change.

But if you pay for your phone in full when you buy it, making the decision to upgrade becomes less likely because you will have more money leaving your bank account.

The same thing is true with auto leases. A monthly payment for 36 months turns into having payments for eternity because of constantly getting a new car.

But if you buy a car in cash or pay off the auto loan, you’re less likely to take on a new payment.

Plus, monthly payments make things seem affordable and trick our brains into spending more.

What’s the difference between spending $3,000 vs $83 a month for 36 months?

The payments seem affordable so it must be cheaper.

Nope. They’re both $3,000. But you’re more likely to spend $3,000 if it’s spun to you as $83 per month.

The most dangerous thing of all is that monthly payments (BNPL or financing), lead to what I call “Payment Stacking”.

What is Payment Stacking?

Have you ever been at a party that serves “mini” desserts?

One small cupcake on its own is no big deal.

But then you go back and grab another one…and another one…and another one.

Soon you leave the party feeling lethargic and guilty from all the calories – at least, that’s what happens to me 🙂

Payment stacking is similar to that.

One payment (mini-cupcake) might be ok. It’s affordable right?

But then we do it again and again and again.

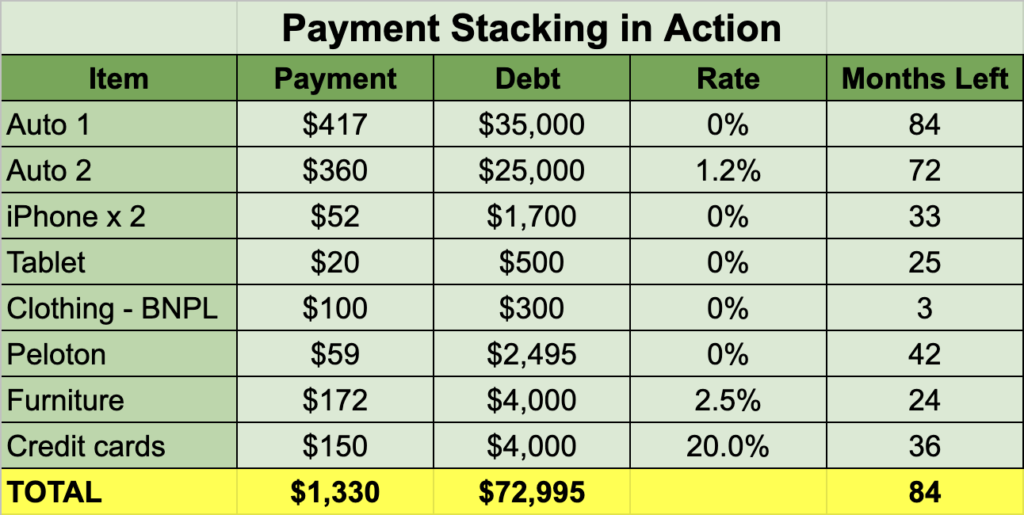

Next thing we know, we have $1,000 going just to payments and have racked up $70,000 of debt (aka things we’ve bought but haven’t paid for yet).

Now we’re making payments on auto loans, iPhones, electronics, furniture, appliances, and now Amazon purchases and clothing too.

These payments stop from reaching our short term financial goals like building up an emergency fund, paying off debt, or getting the employer match on our retirement plan.

Just when you think something is affordable, it ends up destroying your ability to build wealth and reach your financial goals because there’s no money left over at the end of the month and you’re living paycheck to paycheck despite earning a decent income.

How do debt payments destroy your wealth?

Any money you spend is gone for good and can’t advance your financial future.

As one of my clients put it, “So when I spend money, I’m transferring my wealth to someone else?”

Correct!

That’s totally fine as long as your spending is in alignment with your values and priorities and that you’re not overspending.

Monthly payments cause us to spend more than we need to, parting with more hard-earned cash than the benefit we get in return. It’s the opposite of living below your means.

The other thing is that these monthly payments eat into our ability to invest and grow our wealth for the future.

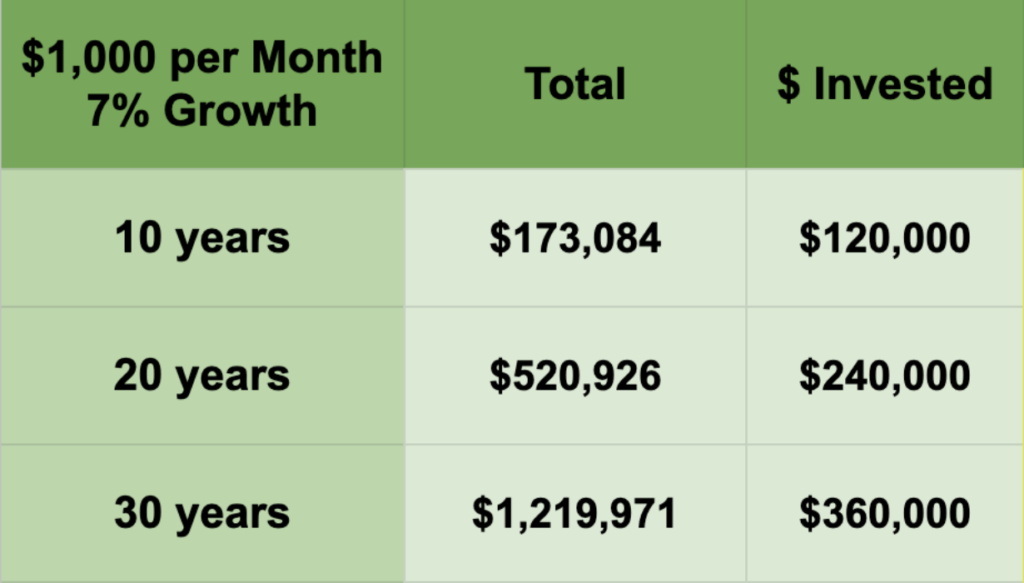

Remember my example above where $1,000 per month is going to payments?

Well, if those payments didn’t exist and that person ended up investing $1,000 a month at 7% instead, they’d have an extra $500,000 in 20 years and $1.2 million in 30 years!

Those payments take that future away from you. Instead of having over $1,000,000, you end up spending that money and have nothing to show for it.

Finally, paying in full (or at least thinking about it) causes you to spend less money.

The first time I considered paying cash for a car, I ended up spending 36% less than I was originally planning to.

Boy did that car dealership want me to walk out with a more expensive car and finance it too!

Would you rather have an extra $10,000 in your pocket or gIve it to the auto dealership because of the “fantastic” 0% interest rate on an auto loan?

How to avoid Buy Now Pay Later and Payment Stacking

The best way to avoid taking on too many monthly payments is simply asking yourself this one question:

“If I had to pay for this in full, would I still buy it?”

Companies use monthly payments to trick our brains into thinking we can afford it.

Cars are always a perfect example, because they’ve gotten really expensive over time.

So what have the auto manufacturers and dealerships done?

They’ve extended the financing terms from 60 month financing to 72 and even 84 months!

Spreading out the payments over a longer period of time means that you can spend more money for the same monthly payment.

Can you afford a $400 a month car payment?

$400 per month at 0% will buy you a $24,000 car over 60 months but it would buy you a $33,600 car over 84 months. Monthly payments normalize spending 40% more for a car!

See how the monthly payments get you to spend more?

Your best defense against Buy Now Pay Later and payment stacking are to ask yourself the following questions when looking at the TOTAL COST (not the payments).

You don’t have to use all of them. Just pick your favorite one or two:

- How much in total will I pay for this? (take the payment x the number of installments)

- Is there anything else that I would rather do with this money rather than spend it here?

- How long do I have to work to pay for this? Compare the total purchase cost with your hourly earnings – if salaries, take your salary / 50 weeks / 40-50 hours / week

- How many things do you have on payments right now? Add up everything you owe, your monthly payment amount on each, and when each will be paid off. Yes that includes cell phone payments. You can use my personal balance sheet template.

- Do you already have credit card debt or a tiny amount in your checking account?

- Be honest here: Are you someone who makes payments on time or not?

Just ask yourself one or two of these before making a purchase. It will help you realize whether you should do it or not.

Need help freeing up money to pay off debt?

The number one predictor of financial success isn’t how much you make, it’s how much you have left over at the end of the month (aka your savings rate).

This is the cornerstone of personal finance.

It can be hard to go it alone here. Or if you’re financially attached to someone, it can be a challenge to get on the same page.

The Family Budget Expert is here to help!

Schedule a free 30 minute consult with me. We’ll talk through how to fix the problem and help you transition from paycheck to paycheck living to finally having money left over to pay off debt, invest and build your savings.

Looking for help but don’t want to talk?