Family Budget: How to create one that FINALLY sticks

Ever tried to create a family budget? How long did it stick?

Not very long huh? Don’t worry. You’re not the only one.

Many families struggle to create a household budget that sticks, and even me, the so-called Family Budget Expert couldn’t keep the wheels on.

But through trial and error, and working directly with clients, I was able to figure out how to (not only) start a family budget, but keep it going sustainably.

Even with raising 3 kids, owning a house, and bringing in next to nothing the first couple years of my business, I found a process that works.

Table of Contents

Why is family budgeting important?

What financial goals do you want to achieve?

Do you want to get rid of credit card debt, build an emergency fund, pay off student loans, save for retirement?

These are great goals! Now…ready, set, go get them done!

Oh wait…we never seem to have any extra money left over at the end of the month to put towards these goals.

Without that extra money, our financial situation is stuck in the mud.

Ok, so how will you find that extra money?

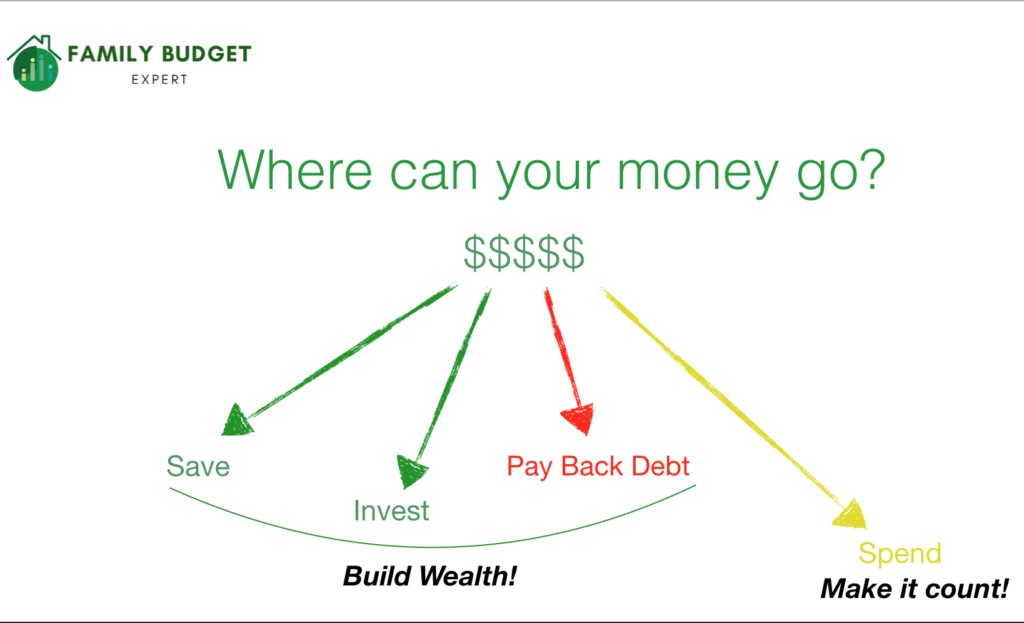

Let’s start with the concept that every $1 you spend does not go to building your wealth. We need a system to make sure that every $1 spent matters to you so the rest can go toward building your wealth rather than to wasteful spending.

Family budgeting is the key to get there.

Why is budgeting so hard to stick to?

If we know we should set a monthly budget, how come we just can’t seem to make it work?

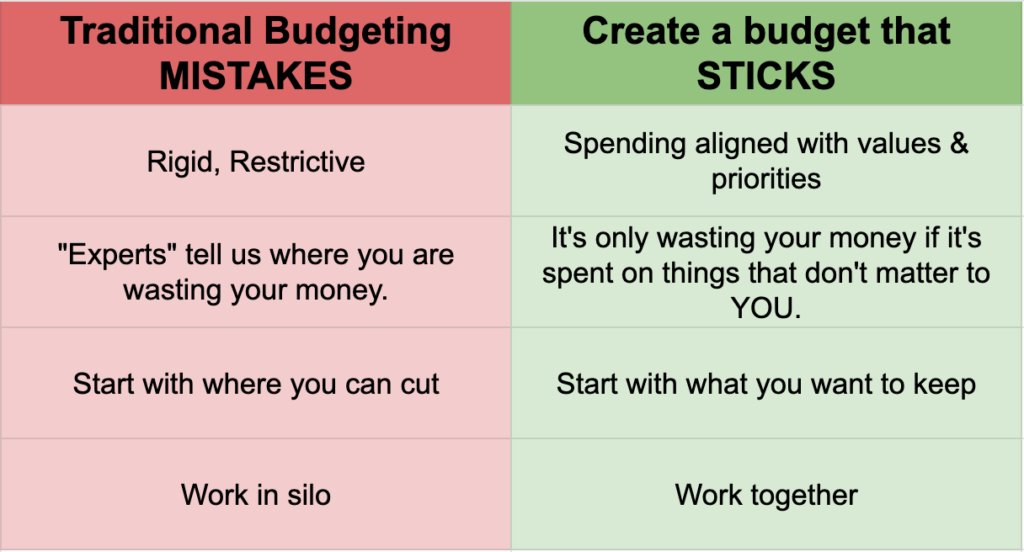

It’s because traditional budgeting techniques fail many couples because it is flawed from the get-go.

We either:

- Put a budget together without being fully committed.

- Pull numbers out of the air based upon what we “ought” to be spending

- Create a monthly budget based upon our income rather than our values and priorities

- The budget is done in a silo. Only one spouse does the work.

However the biggest family budget mistake is putting it together as step one.

Don’t get me wrong. A critical step in personal finance is to create a budget. It’s just not the first one to take.

How to start a family budget

Budgets that work are ones where:

- Both spouses/partners work together.

- It doesn’t feel restrictive.

- There is a simple review process that you can commit to doing together.

We want each $1 you have is put to the best use possible to help you live your best life. The leftover money is deployed efficiently to build a solid financial future.

In order to do that, your budget should empower you to spend guilt-free on the things that matter to you and cut out the things you don’t really care too much about.

Cutting your spending means you can save more money and have an even better chance of reaching financial independence faster.

This might surprise you…but starting your family budget does NOT begin with creating it, or even looking at numbers for that matter.

Creating a family budget that sticks starts with thinking about how to align your spending with your values and priorities as an individual, as a couple, and as a family.

Traditional budgeting gets this backwards. It usually starts with rigid restrictions on the things we’re told we’re wasting money on which sets it up for failure.

If you love your morning coffee, are you more likely to follow a budget where:

A: You have to change your routine to cut back on your spending, or;

B: You keep your morning coffee routine as-is and decide to cut back on something you don’t care so much about instead?

“B” is the obvious answer for those who want to sustainably keep a budget.

Rather than starting with the things we want to restrict, the budget is much more likely to stick if we start by looking at the things that are important to us that we want to keep.

Step 1: Identify your values & priorities as an individual, as a couple, and as a family

What do you want out of life? What are your values and priorities? Money can be a tool to get there.

Ask yourself this, “If we had a clean slate and could start over building your budget from scratch, what would we make sure you had the money to spend on?”

Maybe it’s focusing more on health and wellness. Maybe it’s education for your kids. Maybe it’s taking vacations. Maybe it’s giving back to your community or supporting your favorite causes.

Whatever it is, we want to build your budget to preserve spending in the areas that are important to YOU.

When you’re thinking about values & priorities, it’s important to think about what’s important to you in 3 separate categories:

- You as individuals

- You, the couple

- You, the family

Oftentimes, the first things that come to mind are very family focused. That’s all well and good, but we often neglect to prioritize ourselves as individuals and our relationship with our spouse.

What’s important to you as an individual or as a couple can take a backseat to the family which can lead to arguments in the relationship.

However, the best plans and happiest budgets make sure you’re doing what you love by yourself or with friends, making room to keep your relationship strong as a couple, and helping your kids develop in alignment with your family values.

Think about those areas for you in those three categories. That’s step 1.

Step 2: Track your spending

This is the key step before creating a family budget. Most people who don’t track their spending beforehand and are just pulling random numbers out of thin air.

It’s kind of like saying, “I’d like to lose 10 pounds to get to my goal weight,” before stepping on the scale. That number is just pulled out of thin air.

Where did we come up with that number? What if it should be 20 pounds? What if it should be 5?

Tracking your spending is like stepping on the scale before deciding how much weight you want to lose.

Honestly, I’ve had clients say that they dread this part of the process more than any other part. It’s kind of like…stepping on the scale.

In fact, I’ve found that people who feel behind where they want to be financially are much more comfortable looking at their credit card debt or their savings account balance than they are looking at their spending.

BUT, after they see where they’re money has gone, there is a sense of relief because it’s often not as bad as they think. And even if it is, now they know. It’s out in the open and they now feel even more empowered and motivated to make the changes they need to make.

Think about it this way: Past spending is a reflection of past choices that can’t be changed. Tracking spending helps you learn from those past choices so you can make better decisions now and in the future.

When reviewing your past spending, ask yourself these questions:

- How are my spending habits in line or out of line with the values and priorities you set in the last step?

- How much have you spent in total each month?

- How many transactions do you have on a monthly basis (# of times you spent money)?

Forget about the traditional budget categories of food, housing, kids, etc for the moment. We just want to understand if your spending matches your priorities and gain awareness around the numerical facts..

Next, let’s find ways to spend on what matters while reducing your spending overall.

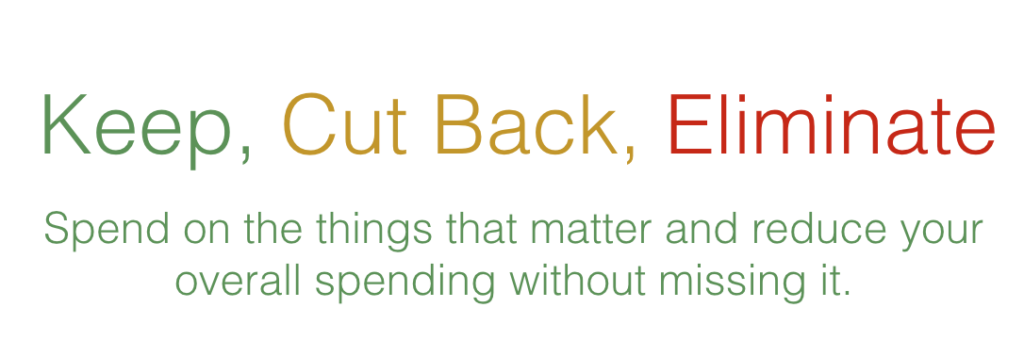

Step 3: Keep, Cut Back, Eliminate

This is the 3 category budgeting system that will get your spending aligned with your values and priorities AND cut your spending at the same time.

Believe it or not, you can have your cake and eat it too. Keep, Cut Back, Eliminate not only lets you enjoy life, but it also helps you cut your spending.

The average result from my clients using this technique is an 18% sustainable cut in spending. That newly freed up money can go toward other financial goals like growing your bank account, paying off debt, and saving for retirement.

This technique is different from other methods you’ve heard of. We’re not going to talk about your food budget or your travel budget. In fact, we’re not going to talk about any of the traditional budget categories. Let’s start by understanding what’s important to you.

Now that you are tracking and reviewing your past spending, we can figure out what looks good and what doesn’t on YOUR terms. Let’s take a look at your spending whether it’s a budgeting app or something else.

Keep

The first step to creating a budget that sticks is not by starting with what you need to cut. The first step is deciding where you want to spend money that brings joy and fulfillment into your life.

More simply put, a “Keep” is something that you spent money on that brings a smile to your face. It could be a vacation, dining out at your favorite restaurant, or your kid’s sports league.

Not only is it aligned with your values, but the amount you spent is just the right amount according to you and not some “experts” or other family members.

“Keep” has 3 categories. You might remember them from above:

- Keep for you as an individual

- Keep for you as a couple

- Keep for you as a family.

The goal of starting here is not only to keep the fun stuff in your life, but it’s also to address and disarm your most frequent arguments.

You see, spouses typically have one thing they spend money on that drives their spouse crazy and vice versa. It usually ends up in the “keep as an individual” area.

What’s interesting about this is that the emotional response you get from “your thing” is the same as your spouses. It’s just that you don’t understand it.

It’s kind of like how my wife likes peppermint ice cream and I am not a fan.

When we go out for ice cream and I order my plain old chocolate, should I get upset with her for ordering peppermint and tell her that she’s wasting our money? Of course not. She loves her mint and I love my chocolate. We both say “Yum!” when we eat it.

It might be a silly example but it illustrates the point.

Most couples spend their time arguing about things that are important to the other, because they simply just don’t get it. But this stops them from making progress with their finances and can drive a wedge between their relationship.

Trust me. There’s no sense in getting into an argument about something that is important to your spouse even if you don’t get it. That’s why I created the “no veto power” rule in this category.

Your spouse cannot stop your spending here and you can’t for them either as long as you truly feel that it’s a keep item and it’s not absolutely wrecking your finances.

When working with my clients, this understanding dissolves the tension in their relationship around spending so that they are ready to work together. Now they’re in a better mindset to work together and agree on where to cut their spending.

Cut Back

These are the things you like to do, but there’s probably a way to spend less than you already are.

We’re not looking to slash and burn in these areas. We’re just looking to make some gradual changes by doing it less often or finding a less expensive option. In the end, it should be about a 20-25% reduction that you don’t really feel that much.

The best example I can think of is the person who goes out to lunch 5 days a week. We all need a break in the day, some social time with our friends, or something easy that we don’t have to think about.

Normal budgeting would say to pack a lunch everyday and reduce your spending by 100%. This all-or-none approach gets people in to trouble

So you budget and try to pack your lunch everyday. Monday you do great! Tuesday a friend asks you to grab a bite with them. Even though your lunch is in the fridge, you reluctantly accept. At that point, you feel like you’ve already broken your rule, so what the heck, you just go out the other 3 days too.

Instead of reducing spending sustainably, you feel like you tried and it didn’t work. “Well, I guess I failed that test.” This is a dangerous mentality and it doesn’t have to be that way.

What if you decided to just pack a lunch one day a week and go out the other four days. That would cut your lunch budget by 20% right there (1 out of 5 days). Do you think you could commit to that?

Rather than going for 100% and getting 0, you go for 20% and it sticks.

This is what it means to cut back. It shouldn’t feel like a sacrifice and you get to do the things you still want to do. But in the end, you are spending less.

Eliminate

These items are 100% reductions in spending. You are getting rid of these items for good!

They have no business getting your hard-earned money because they are not in alignment with your values and priorities. Some may actually be sabotaging where you want to be.

Beware though. Unless it is completely obvious to stop all spending on it, make it a “cut back” first. If it eventually becomes an “eliminate” that would be fine. It’s better to start slow rather than commit to an all or none approach. The goal is gradual progress or else it’s not sustainable.

For example, you’re trying to lose weight and you say, “I’m not spending any more money on dessert when I go out to eat!” Sounds good in theory, but in practice? Not so much.

The first time you order a dessert, you’ll feel like you failed and give up. If you just commit to skipping the dessert once a week, it will be much more sustainable.

(Plus, who wants to live a life without dessert?!?)

I really push back on clients in this category when I start working with them. Unless it’s something they can literally turn off like their local cable or an extra gym membership, it’s a cut back to start.

Now you’ve found a bunch of money in your budget that was being spent on things that don’t matter much to you. That extra money can now accelerate you toward being debt free, investing more in your retirement plans, or saving for a down payment on a house.

Step 4: 5 Minute Weekly Spending Review

Your spending is now in alignment with your values and priorities and it feels great! It’s time to add in a simple financial habit to make sure it sticks!

Enter the 5 Minute Weekly Spending Review. You did a bunch of work to track and review your spending habits. Now comes the easy part.

Once a week, the two of you will go into your budgeting app and:

- Review your transactions over the past 7 days.

- Take a look at your monthly net income to date (how much you have spent vs how much you have brought in)

- Count the number of transactions.

You must meet TOGETHER for 5 minutes per week to do the review. It’s totally fine if one of you in the relationship likes to do the budget stuff and wants to do more behind the scenes during the week, but this meeting is with both of you.

This process will bring BOTH of you the awareness of where your money is going and get into a regular rhythm of discussing your finances.

Plus, it will change your spending habits in the moment. By reviewing the last week, it will keep those past decisions and slip ups front of mind so that you’re less likely to do it again.

You can also see where you stand in terms of your monthly net income to see if you need to slow down your spending for the following week or if you have wiggle room instead of getting your credit card bill at the end of the month and wondering why it’s so high…again.

Step 5: Create a family budget

After one month of consistently doing your weekly spending review, it’s time to make your family budget.

Why wait this long to get here?

First of all, now BOTH of you know your numbers and understand the habit changes you want to make in order to cut your spending. You are no longer just pulling random numbers out of the air and trying desperately to hold on.

Secondly, you’ve shown that you are committed to making a change. How do we know this? Because you’ve taken the steps above to make progress and have stuck with it. Now you’re ready.

To make a household budget that sticks, it’s important to keep it simple and easy to maintain. We want to use Pareto’s Law (80/20 rule) and focus on the 20% of actions that will get us 80% of the results.

Pick one of the budgeting tools that works for you. It could be Mint, EveryDollar, YNAB, Tiller, or plain old Excel or Google Sheets. Make sure you’re drawing your monthly income and expenses from all sources.

Set up the unique budget categories of Keep, Cut Back, & Eliminate within the app, and also pick 1-2 of the traditional categories (like Dining Out or Amazon) that you decide as a category makes sense to limit your spending in these areas.

Do not under any circumstances make a 10 category budget. There’s no need to track your mortgage payment or your rent. Those and other fixed expenses will always be “on budget”. Track only categories that are discretionary expenses or flexible spending.

Create those budgets and review them during your 5 Minute Weekly Spending Review.

Now you’re reviewing your transactions over the past week, your monthly take home pay vs your monthly expenses, and the budget categories to see where you stand for the month.

This simple budget is set up and being monitored along the way.

There is no “perfect family budget” when you start.

Think of your budget as an ongoing experiment.

You’re trying to figure out what works best and that takes some trial and error to finally get something that will be predictable.

Perfection is the enemy of getting things done. So if a one-time expense or a spending spree blows up your budget, it’s ok. You can still make the next right choice when it comes to your spending.

If you can only do one thing, stick with the weekly review.

It’s honestly the most important part of this process. If the budget doesn’t work or if you have a lapse, the review will recenter you and keep you on track.

You now know how to start your family budget in 5 steps. Ready, set, go!

Need help with your family budget?

Maybe you feel like you should be further ahead financially and just can’t seem to see eye-to-eye with your spouse. It’s probably why you decided to check out this post.

Well, are you going to stay in that bleak path or are you charged up to make a change?

If you want to make positive changes to your finances (and your relationship), here are a few options I have for you:

- Ready to go? Learn about the Family Budget Transformation System

- Want to learn more? Schedule a complimentary 30 minute discovery session

- Just getting started? Download my free guide + worksheet: Cut Spending in 5 Steps

My goal is to help you make sure that every $1 is being put to optimal use to maximize your life.

Every $1 you spend should have a purpose in getting you what you want out of life.

Every extra $1 left over at the end of the month should go towards activities to build your net worth and help you feel great about your financial situation whether it’s paying off credit card debt, attacking your student loans, growing your savings, or investing for the future.

This is what we cover here at Family Budget Expert.

I’m here to help your family, your relationship, and your money thrive!

Want help, but not ready to talk?