Budgeting for Beginners: The Family Budget Expert Method

We’re getting back to basics here. This is Budget 101: Budgeting for Beginners – The quintessential skill of personal finance.

Table of Contents

Why is budgeting important?

Do you feel like you’re behind financially and can’t seem to figure out where your money is going?

Do you wish you had more money to pay off debt or invest to build your nest egg for the future?

Well, paycheck to paycheck living won’t get you there. You can have the best financial plan in the world, have all the knowledge to invest successfully, and even figure out which debt to pay off first.

But what good is it if you don’t have the money to fund these financial goals?

The #1 predictor of financial success is your savings rate. That’s the amount of money you have left over after you do all of your spending.

Income matters, but it’s not nearly as important. I’ve worked with couples earning $300,000+ who have a negative net worth (more in debt than in savings) as well as couples making $80,000 that have stashed away $400,000+.

Having money left over at the end of the month is the key to financial independence, so it should be the #1 thing families focus on. That’s why budgeting for beginners is so important.

How do you reduce expenses and free up extra money at the end of the month, budgeting is the important tool to get there.

What are the basics of budgeting?

Budgeting can be fairly straightforward.

Just sit down, take a look at how much you make and fill out how much you want to spend. Then you’re good to go, right?

Wrong!

Budgeting for beginners is relatively simple, but the goal is to make sure it sticks and that you make room to reach your financial goals, so there are other steps involved in the process

The basics of budgeting are:

- Identify your goals.

- Track your spending (including irregular expenses).

- Calculate your net income.

- Find ways to reduce spending.

- Create your budget.

- Review your budget on a regular basis.

I’ll walk you through the steps one at a time. Ready? Let’s go!

Step 1: What are your short-term and long-term financial goals?

Budgeting can be hard to stick to unless you know why you’re doing it.

Before diving into the numbers, it’s important to establish the reasons why you’re putting together your household budget in the first place,

These don’t have to be traditional financial goals. They can also be relationship goals too. The most important thing is that you uncover your motivation for going through the budgeting process in the first place.

Financial goal examples

- Save for a house

- Get out of credit card debt

- Build up an emergency fund

- Pay off student loans

- Save up for a vacation

- Improve your credit score

- Donate to charity

- Start a business

- Retire at 60

Relationship goals

- Stop arguing about money

- Happier marriage

- Provide for your children

- Make sure spending is aligned with your values and priorities

- Take control of your money

- Set a strong example for your kids

Take some time to figure out what’s important to you as an individual, as a couple, and as a family. Maybe it’s getting out of debt, maybe you have a savings goal, maybe you want a stronger relationship, or maybe you want to break the family cycle of bad financial habits.

It’s important to know this before actually diving into the numbers. That way, you’ll have your motivation to keep things going, so don’t jump ahead until completing this.

Step 2: Track spending

Most people jump right into creating a budget, but that’s not the way to make sure the budget sticks.

The first step is to first know where your money is going and how much you’re spending. Otherwise, you’re just pulling numbers out of thin air.

Most people don’t know how much they spend on a monthly basis. When I work with clients on their family budget, they often significantly underestimate their monthly spending. I’ve had some who are about $500 per month off and others who were $4,000 per month off.

There’s no reason to guess your monthly expenses. Get the concrete numbers by tracking your spending first.

It’s never been easier to do this. There are so many great budgeting tools out there.

You can try a budgeting app like Mint, YNAB, EveryDollar or Tiller. Maybe you like spreadsheets and can use Microsoft Excel or Google Sheets. Maybe you’re the kind of person who loves the Bullet Journal and want to write it down manually by going through bank statements and credit card statements.

Use whatever budgeting tool works best for you. The goal is to look through the last 3 months of spending at the very least.

This will give you a good indication of how to set up your budget.

Step 3: List irregular expenses

I haven’t yet met anyone whose spending is consistent month to month.

Unless you are able to go back and track a full year of spending, there’s certainly plenty of major irregular expenses that need to be budgeted for.

- Summer camp

- Holidays

- Kids’ birthdays (gifts and parties)

- Annual vacations

- Property taxes

- Annual insurance premiums

- Once-a-year doctors visits

- School tuition

- Annual donations / charitable giving

- Pet check-ups at the vet

Think about your particular family and the seasonality to your spending. Make a list. You can even create a spreadsheet calendar like I did for those non-recurring expenses.

The most important takeaway is to don’t forget about your seasonal spending so these expenses don’t sneak up on you.

Step 4: Create Simple Budget Categories

A common question I get is, “Where can we cut our spending?” It can be hard to see where to cut using traditional budgeting.

So we’re going to talk about simple budget categories that will help you figure out what levers you can pull to cut your spending. It’s also going to help us diagnose why it’s so hard to get ahead.

Let’s not go overboard and create 50 budget categories and sub-categories.

Let’s keep it simple. We want to make sure it’s good enough to be effective but not too complicated that it’s intimidating to keep up with.

When starting a budget, we need to know which expenses can’t be changed without uprooting our life (fixed expenses) and which ones do I have some control over (flexible spending/discretionary spending).

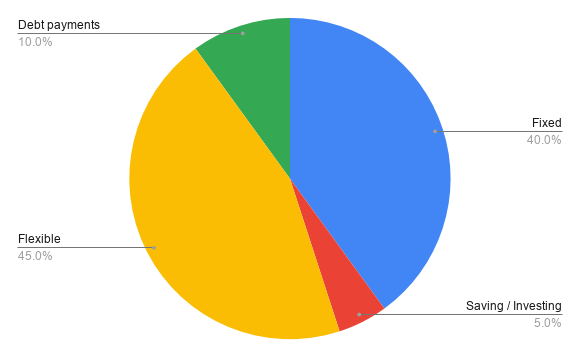

It’s also important to track how much monthly cash flow is going toward paying down debt or investing. Both of these improve your net worth over time, so we want to track your progress there.

Here are the 4 simple budget categories you need.

Fixed expenses

- Mortgage/rent

- Utilities, home repairs

- Car payment / auto maintenance

- Daycare tuition / Childcare expenses

- Grocery spending

- Cell phone bill / Home internet – Wifi

- Health / medical expenses

- Other kid necessities

- Home supplies / staples

- Pet / veterinary bills

Flexible expenses

- Dining out

- Clothing

- Travel / Entertainment

- Streaming services

- Discretionary Amazon / Target / Walmart expenses

- Gifts

- Personal care / discretionary fitness

- Household maintenance & improvement

Debt payments – excluding home & auto

- Credit card payments

- Student loans

- Personal loans

- Consolidation loans

- Home equity loan or HELOC

Savings & Investing

- Employer retirement plan contributions – 401(k), 403(b), 457, 401(a), SEP IRA

- Personal retirement accounts – Roth IRA, Traditional IRA, Rollover IRA

- Brokerage account

- Transfers to savings account

It could look something like this:

Now you know how much spending you have control over and what you don’t. You also know how much is going towards debt repayment.

You’ll also see why you feel like you can’t break the paycheck to paycheck cycle. Are your fixed expenses too high? Are you swamped by debt payments?

This helps us really understand what levers we can pull to save more money.

Step 5: List every source of income

Aha!

You noticed we’ve only been talking about expenses so far. That’s where the focus should be.

That being said, we do need to know how much is coming in so that we know if we are cash flow positive or negative.

Income can come from different sources. Some regular, some irregular. Remember to include income from anywhere and anytime you’re getting it.

You might have household income from many of these categories, but it’s possible it comes from only one.

- Paycheck, salary – (W-2 income)

- 1099 income from side hustles

- End of year or quarterly bonuses

- Rental income

- Regular investment income

- Family cash gifts for birthdays, holidays or other

The income that matters is what makes it into your bank account, so we want to focus on your take home pay, not your gross income.

If you are self-employed, exclude the taxes you’re withholding for quarterly estimated payments or for when you file your taxes.

If you have money taken out of your paycheck for retirement, a flexible spending account (FSA) or health savings account (HSA), add that into the savings & investing portion from Step 4.

Your monthly amounts may not be predictable and that’s ok. Even if you have variable income, use the historical information here unless you have a significant change up or down that you are fairly certain of.

Step 6: Calculate your net income

Ok, so now we know how much money is coming in and how much is going out.

Look at your total income and subtract your total expenses for the last 3 months. (If you’ve been tracking your spending for longer, go back up to 12 months).

Take that number and add back the amounts you’re putting toward savings, investments, and debt repayment.

How does it look?

Remember that this is the key indicator of your future financial success. If you’re saving a healthy amount, that’s great! If you’re not, it doesn’t mean you’re doomed.

No matter what your situation has been, it doesn’t have to impact what it can be.

Either way, this is good information to know. Our past decisions can’t be changed, but this information equips you to make sound financial decisions going forward.

Here’s what I know, we can all do better. Now let’s figure out where you can cut your expenses and how to launch yourself to a more optimistic future.

Step 7: Identify spending you want to Keep, Cut Back, and Eliminate

If you’re trying to find ways to save more money and break the paycheck to paycheck cycle, this is it.

The Keep, Cut Back, Eliminate Method I created is the best method you can use. The average client I work with sustainably cuts their spending by 18% and actually starts getting along!

That money is now freed up to go towards paying off debt, saving, or investing.

Aside from spending less money, every dollar that goes out will be aligned with your values and priorities as an individual, a couple, and a family.

I’ve also seen couples transform their relationship through this process. They stop fighting about money and get on the same page.

This budgeting for beginners step should be done every 3-6 months.

Here’s how it works.

Take a look at your transactions and classify them as one of these three buckets:

Keep

This is money you’ve spent that you can look back on and smile. Not only does it bring up a sense of fulfillment, but the amount of money is just the right amount. In fact, you’d do it all over again at the same price.

Don’t just think about your family though. There are 3 types of “Keeps”:

- For you as individuals – Personal interests and hobbies

- For you as a couple – Keep your relationship strong.

- For you as a family – What do you enjoy doing together and what family values do you want to support as your children learn and grow?

This is important because we want to preserve your individual hobbies and interests. We also want to make sure that you are spending money on things that keep your relationship strong. Then, we want to make sure you’re providing your family with the experiences that line up with your values.

There is no veto power here. If one of you thinks it’s a Keep, it’s a Keep (unless it is completely wrecking your finances).

Your fixed expenses may all fall in here, but there might be some that you can move down to the next categories if it’s not too disruptive to your lifestyle.

Cut Back

This is spending that you enjoyed, but you probably could have done it for less money and gotten the same experience. The goal here is to reduce spending by 20-25%, and it’s easier than you think.

For example. If you go out to lunch 5 days a week, see if you can cut it back to 4 days. That’s a 20% reduction in food spending.

Or when you travel (when we can all do that again), it’s booking a hotel that is 20% less expensive per night or using a travel website to get a good deal.

How about at Amazon or Target? See if you can cut your bill by 20% when you shop there. Instead of spending $100, spend $80.

These small cuts make a huge difference over time. If you have $2,000 per month of spending that you could cut back on, that’s an extra $500/month. $500 per month invested over 30 years can turn into $500,000. That’s no chump change!

Both of you in the relationship must agree that it’s a Cut Back. If you don’t agree, chances are it belongs in the Keep category.

Eliminate

These are 100% ramp downs in spending. It could be a subscription you forgot you were paying for, a streaming service you don’t really watch, a bad habit you’re trying to kick.

Be warned though. Some people want to slash and burn and cut to the bone. Hold off on that. Don’t throw everything into Eliminate right off the bat.

Start by making it a Cut Back for a few months. If after giving that a go, you’re ready to get rid of it completely, go for it.

I just want to make sure you’re not crash dieting..or crash budgeting.

Step 8: How to make a monthly budget

Now you have your goals (aka your reasons for budgeting), you’re tracking your spending, you know your monthly income, and you’ve figured out what you want to Keep, Cut Back, & Eliminate, you can now create your budget.

Start by keeping it simple. All we’re trying to do is track your income and expenses and see how much you have left over. That should be in the main goal, not dissecting how your toothpaste spending has changed over the last 3 months.

Here are some budget systems you can use:

- Keep, Cut Back, Eliminate – my personal fav 🙂

- Fixed, Flexible, Debt payments – per above

- Zero based budget

- The envelope system (Dave Ramsey)

- Traditional budget categories (housing, food, kids, travel, etc).

- 50/30/20 Budget

Think of this like an experiment or like shopping for clothes. Try a few things on and see what fits best and which one makes you feel great. Understand that the first 1 to 3 months aren’t indicative of what it will feel like once you get in the swing of things.

Your first goal is to create a budget that sticks. Optimization comes later.

Forget perfection! The most important thing is to take action and get started by creating a simple budget plan that resonates with you.

So there you have it. Your budgeting for beginners guide.

Oh wait, there’s one more thing.

Bonus Step: The 5 Minute Weekly Spending Review

Have you ever gotten your credit card statement in the mail and thought, “Why is it so high? What did we spend our money on? Where did our money go?”

But it’s not just a once in a while thing is it? No, it happens every month, and every month, we’re shocked.

It doesn’t have to be that way.

Enter the 5 Minute Weekly Spending Review: Your solution to keep the wheels on the bus.

Chances are one of you will be the person who is more intimately involved with your budget than the other. Either way, once a week, both of you need to sit down and cover these three items:

- Review your transactions – See where your money went over the last 7 days.

- Check your income and expenses to date – Where is your spending compared to the money that has come in so far?

- Pick only one or two traditional budget categories that you identified as Cut Back. – There’s no need to review every one of your budget categories. Only review the ones that you are trying to make changes to.

This is critical for a sustainable budget because you can adjust your spending on a weekly basis rather than waiting for the monthly reset.

It’s kind of like weighing yourself once a week. If you’ve put on a couple pounds, you can adjust your diet & exercise routine before you look back and wonder how you put on the “Quarantine 15”.

Budgeting for Beginners: Need help getting started?

Budgeting for beginners can be simple, but sometimes you need that jump start. Maybe you need some accountability or a 3rd party to get you two on the same page.

Remember: Your savings rate is the most important thing you can focus on if you want financial freedom. That’s why it’s the sole focus of Family Budget Expert.

If you want budget help to not only figure out where you can cut spending without feeling like it’s a major sacrifice, then understand the best use of that extra money to improve your financial situation. I’m here to help.

If you’re not ready to talk but want to learn more:

2 Comments

Leave a Reply

You must be logged in to post a comment.

Rob:

Very good article. This information needs to be taught in school. Not just college, I mean from elementary on up. To quote Simon & Garfunkle, “When I look back on all the crap I learned in High School, it’s a wonder I can think at all”. We need to get more practical with what we teach our children, especially about how to handle money. Keep up the good work!

Thanks Dan! Nice S&G quote from Kodachrome 🙂