Chances are that you didn’t get together with your carbon copy.

Yes, for some reason we enter relationships with people who operate differently than we do. Often it’s those differences we blame for the conflict and stress in our relationships.

Money arguments can be at the heart of that relationship stress.

But why would we choose each other if we know that we don’t see eye to eye on certain things? Why is that?

More importantly, how do we get on the same page with money when we don’t see eye to eye?

Table of Contents

Why are we not on the same page with money?

They say that opposites attract, and a part of that is true.

I believe that we are drawn to qualities that we ourselves would like a little more of in our lives.

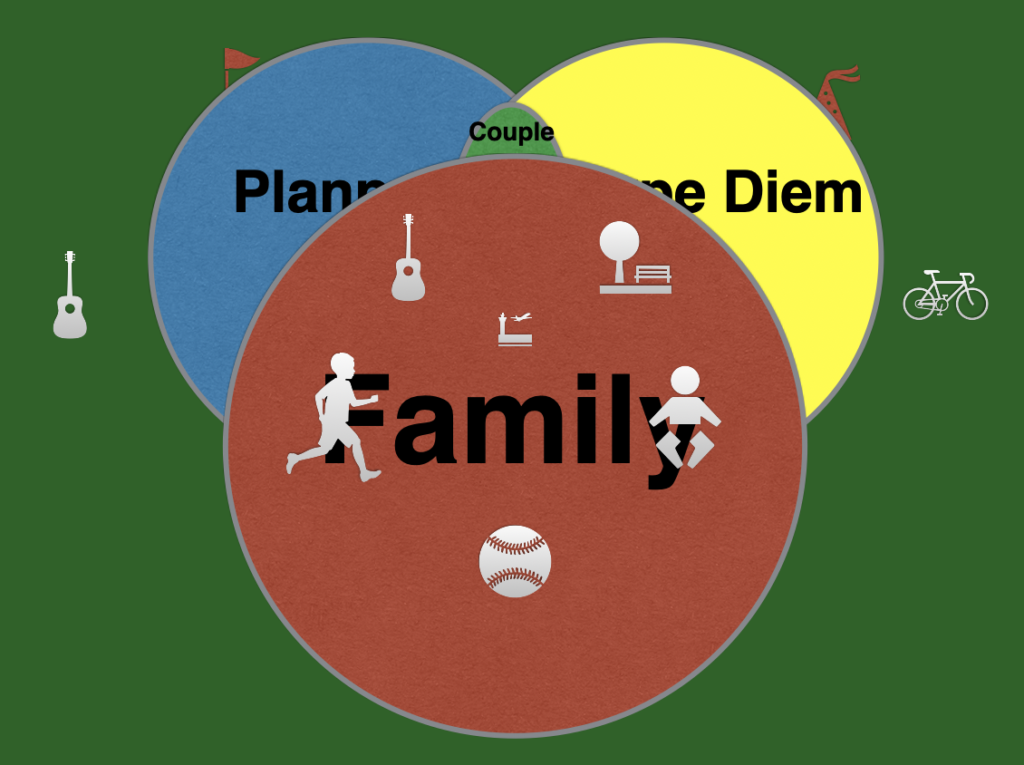

A disciplined person wants to be able to let loose a little bit. A spontaneous person wants to be a little more of a planner at times.

A spender sees the value in saving. A saver sees the value in living for today a little more.

When we get together, we find the things we enjoy doing together and think the differences are funny.

But then over time, those differences may get on our nerves.

And often, we keep our finances separate so we can do the things we want without being judged by the other for how much we spend.

Our financial goals and financial life remain separate too because we’re not really talking about money at that point.

Yes, money and relationships can be challenging at times…

Then kids come along.

Money and time shrink.

We now need to start working together more than ever and coordinate our finances, because the expense of having kids takes over our personal finances. If we’re not prepared, it can lead to money problems.

That financial stress is paired with the fact that we have less time and less money to work on ourselves and our relationships.

Yes, money and marriage can be tough. Especially when you’re not on the same page as your spouse.

But it can also yield tremendous benefits and synergies if you approach it the right way.

You can go from money RIVALS to money TEAMMATES.

How do you get on the same page financially?

There are 3 main things you have to do if you want to get on the same page and stay on the same page with your spouse about money, going from money RIVALS to money TEAMMATES.

Carve out time and money to spend on yourselves as individual and as a couple

Chances are there’s something that your spouse/partner spends money on that drives you crazy.

But it’s also likely that you spend money on something that drives them crazy too.

The bottom line is that we all have our things that are important to us as individuals that our significant other doesn’t really understand.

It’s important that you continue to do the things you enjoy and that makes you fulfilled as an individual.

As long as it’s not wrecking your finances or detrimental to your relationship, give each other encouragement and support (rather than judgement and aggravation) to do the things each of you enjoy.

Also remember that you have to keep your relationship strong.

Remember to reserve time and money for things you enjoy doing together to keep your connection strong and your relationship strong.

You’re not opposites. You complement each other.

The words we use are important.

When we say, “We’re financial opposites,” it sets us up to focus on our differences without seeing the complementary perspective.

Remember why you were first drawn to each other?

It wasn’t only the things you had in common. It was the other person’s traits that you wanted to add more to your life.

You balance each other out.

It’s like when you fill up the bathtub. You don’t just use the knob for hot or the knob for cold (unless you’re doing an ice bath). You use both because that balance gets you to a nice relaxing experience.

Think of your personalities as balancing each other, and that is essential for healthy communication when you talk to your spouse.

What are the strengths of your perspective and what are the strengths of your spouse or partner’s perspective?

Give that some thought and join forces so you can work on your long term goals starting with your short term financial goals.

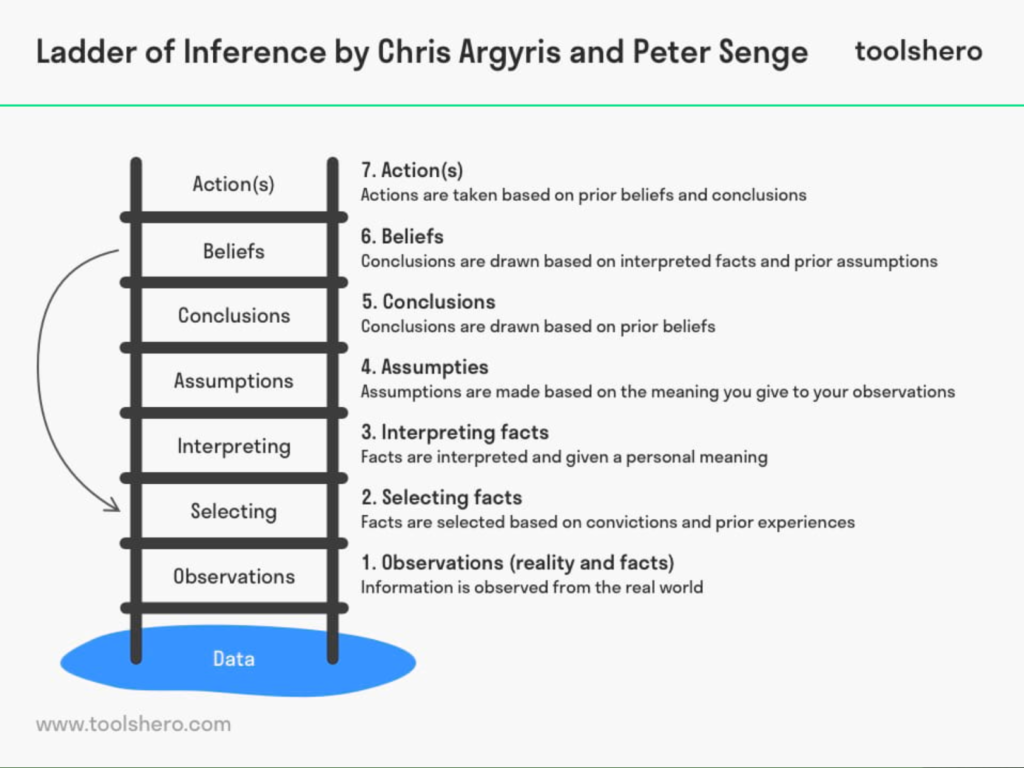

The Ladder of Inference

This is a concept I recently learned that was extremely helpful.

Simply put, the ladder of inference is how we go from facts, data and reality to making assumptions, and developing judgements.

Or, how we make the facts fit our own belief system. We draw our own conclusions.

“Someone who gets coffee everyday obviously doesn’t care about financial security.”

“I need to make more money so I can pay off this debt.”

“I can’t enjoy our vacation because we should be paying off our credit cards instead.”

“My spouse doesn’t want to be involved with money so I just do it all for us.”

All sorts of money arguments in relationships come from making assumptions. Then we get in that cycle where you say,

“Whenever we talk about money, we end up arguing so we just avoid the subject altogether.

If you want to start talking about money again and get on the same page, it starts with leaving the past in the past, then objectively looking at the facts.

Leave the past judgements and assumptions about each other to the side.

Work on the facts of where you are and come up with a unified approach to get out of it.

Find consensus and be open and honest.

For example, if one of you wants to get out of debt and the other wants to invest, figure out a way to make progress or both. It doesn’t have to be one or the other.

Or if you’re having trouble creating a family budget that sticks because you don’t see eye to eye, think about making sure that you get what you want in three categories:

- You as INDIVIDUALS

- You as a COUPLE

- You as a FAMILY

No matter where you’re starting and if you feel behind, it is possible to get on the same page and build wealth from nothing.

Need help getting on the same page financially?

Sometimes it takes a 3rd party to be involved to help find the common ground so you can get on the same page with money.

My goal is to help couples and families find the extra money at the end of the month to put towards saving, paying off debt and investing and get rid of the financial stress that gets in the way of an otherwise thriving relationship.

Financial advisors and financial planners don’t typically focus on this which is why I started Family Budget Expert.

Set up a complimentary 30 minute session with me so we can talk through it.