How to not overspend during the holidays

This is one of my favorite times of the year. It’s a time to celebrate the holidays, see family, friends, and get some time to relax.

This time of year is filled with excitement, hope, and happiness.

Or at least it can be if we don’t look back and feel guilty about spending too much money.

Real talk here: The holidays are a make or break moment for our annual family budget.

Good news though: You can have a meaningful and fulfilling holiday season AND spend less money at the same time.

Table of Contents

Holiday shopping tips to avoid overspending during the holidays

We have all experienced things that could lead to overspending during the holiday season.

“Oops! I forgot to add that person to the list!”

“They do so many nice things for us that we can’t go small with their gift.”

“Oh no! The gift on their wishlist is no longer available! I’ll have to make up for it.”

Or maybe we just want to spontaneously splurge on a big ticket item.

Or maybe you just underestimated how much you planned to spend.

There are ways to spend less money on gifts whether you like to start early or wait until the last minute.

Here’s how to not overspend during the holidays:

Start with a holiday shopping budget and plan

You might be thinking one of two things: “I’m not a budget person,” or “I’ve tried to set a spending limit for my holiday budget for the holidays but I just can’t stick to it.”

If that’s you or even if you’re great with budgeting, the first step actually isn’t coming up with the number.

How to budget for the holidays starts with making a list and tracking your spending as you go along. The budget can work its way into that.

The best thing you can do to prevent overspending during the holidays is to get a comprehensive list and make sure you’re thinking of all the spending you’ll be doing during the holidays.

This goes beyond gifts for family members and into the other holiday gifts and spending you might do like getting things for work friends, teachers, people who provide services to you, secret santa. Also spending money on holiday parties and travel.

THEN you can take a look at the estimated amount of spending and see what you can do to lower it if you want.

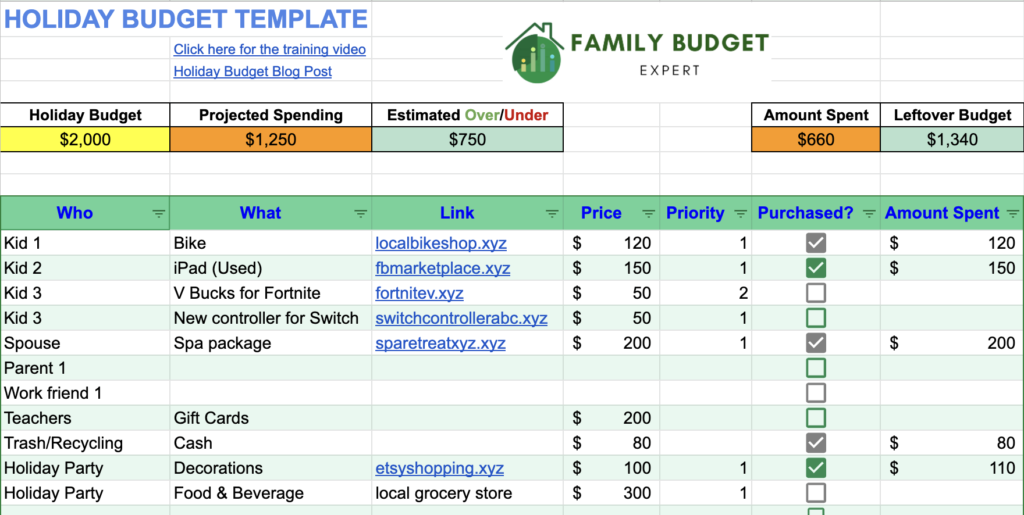

Start off by getting my free holiday budget template:

Then start making your list of holiday spending.

Not only will you be able to track how much you spend on gifts, but it’s also like your checklist or to-do list.

Plus, you’ll have some insight into what your total spending on the holidays will be.

*KEY TIP: Remember that all of your gifts don’t have to be things you buy. It could be something great but inexpensive like baking cookies, a cake, or another baked good you’re known for.

Go in with others on big ticket items

If you’re buying a big ticket item for someone, ask a family member or friend to go in with you.

For example, my son wants a gaming system this year. Rather than us or one of our parents going in on it alone, we decided to make it come from all of us.

Bargain shop / Buy used

It has never been easier to find a deal shopping online.

First it was eBay, then Craigslist, and now Facebook Marketplace. All three of those options are at your fingertips online. You can also go to a thrift store like Goodwill too.

There’s no reason to pay full price if there’s a way to get it used (and maybe even with an open box).

Avoid great deals unless it’s on your list

Black Friday has turned into a two month season. There are always deals going on.

Shopping for deals is great if it’s on gifts that you’re already planning to buy, because you’re getting a discount.

But when you start buying things not on your list because of a sale, it leads to overspending.

Think of it this way, any amount of money you spend on things that aren’t on your list can be wasteful spending.

Even if you buy something that was normally $100 and is now 20% off, you still end up spending $80 on stuff you don’t need.

I’d rather you keep that in your pocket and put it to some of your short term financial goals instead.

Use credit card rewards and points

Many of us have been accumulating credit card points and rewards.

Put them to use by getting cash back, a statement credit to go toward your budget, or redeem them for store gift cards at stores where you plan to shop for gifts.

That will reduce the money out of pocket during the holidays, and you have already amassed those points. Just use them!

Revisit your gift card stockpile

You know you have them. We all do.

Gift cards are strewn about your house. They are lurking in your inbox.

This is literally cash just sitting around waiting to be used. So use your gift cards.

See if you can adjust any of your gift purchases to be from stores where you can use them.

Buying less is more

Remember what happened the last time your kid had a birthday party and a bunch of gifts from friends and family?

They tore through all the wrapping paper and boxes in a whirlwind. But how many toys were they still playing with a week later? Not many.

The rest are just sitting around the house and taking up space. Translation: It would have been better getting much less.

Sometimes buying less is actually better than buying too many things. The kids will place a higher value the fewer things they get…and it will save you money.

Avoid impulse spending and add-ons

Have you ever gone to buy something only to leave with more than you went in for? Who hasn’t!

Online shopping and brick and mortar stores are really good at showing you add-ons when you’re at the checkout.

Don’t fall for it!

You probably don’t need that clothing accessory to go with the outfit or the extended warranty on your electronics.

Ditch the add-ons and save money.

Agree to gifts for kids only

Do your siblings or adult friends really need a gift from you? Do you really want gifts from them too?

A while back, both my family and my wife’s family agreed to stop buying gifts for us grown-ups and only buy for nieces and nephews. It was great all around!

We just ended up buying things for each other and spending less money during the holidays.

Most parents feel the urge to do right by their kids and make it fun for them. You’ll have more in the holiday budget to do that if you only get gifts for kids.

After you buy everything, pick one thing to return

Just because you bought everything, doesn’t mean you have to keep it. You return things all the time anyway.

Take a look through all the gifts you purchased for everyone and review that spreadsheet too.

See if you can pick just one thing that you can return and get that money back in your pocket.

Remember, less is more.

How can I spend less during the holidays?

When it comes to the holiday season, we know that this time of year is when we spend the most, but that doesn’t mean we can’t end the year on strong financial footing.

Here’s a recap of the 10 holiday shopping tips to not overspend during the holidays:

- Start with a holiday shopping budget

- Go in with others on big ticket items

- Bargain shop / Buy used

- Avoid great deals unless it’s for something on your list

- Use credit card rewards and points

- Revisit your gift card stockpile

- Buying less is more

- Avoid impulse spending and add-ons.

- Agree to gifts for kids only

- After you buy everything, pick one thing to return.

Don’t let the holiday season put you in a worse financial situation.

I’m here to help if you need it.

Or if you just want help with your holiday budget: