How to budget for the holidays

It’s that time of year again! Time to start thinking about the holiday season.

Although we have all had challenges this year, I hope you can look back and find at least some positive things that happened whether you’re at your weakest or strongest point right now.

Let’s finish the year strong!

Financially speaking, this is a good opportunity to work on your budget for the holidays so you can stick to it and start the upcoming year on stronger financial footing even if you’re yet to start saving for the holidays. – Family Budget Help

Table of Contents

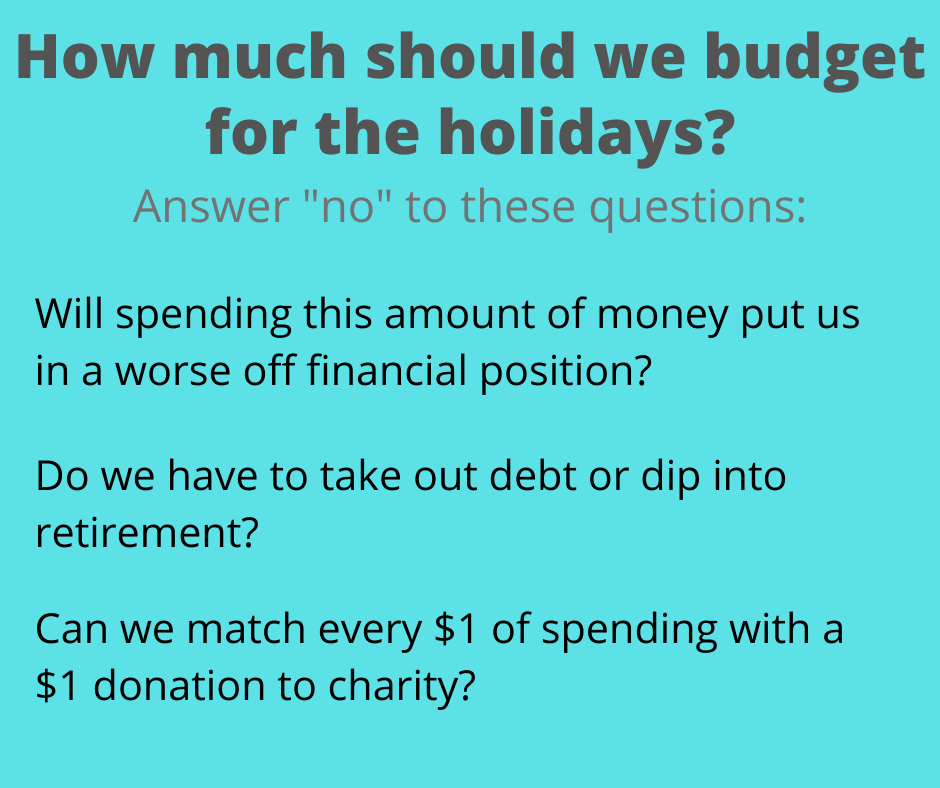

How much should I budget for the holidays

Conventional thinking is that you should spend no more than 1% of income.

But benchmarking holiday spending to income is flawed in my opinion, because it doesn’t accommodate for the rest of the financial circumstances.

High-income earners might have debt while middle-income earners have a bunch of money saved up. How much someone earns doesn’t tell the whole story.

If you have to take on credit card debt or drain your savings to do your holiday shopping, you won’t be able to fully enjoy this time of year.

You could end up feeling guilty about spending money on the holidays and zap the celebration and excitement that this season brings.

Look, it’s important to be able to celebrate the holidays and treat yourself, your family and some friends if you’re so inclined. But the holidays shouldn’t put you into a worse financial situation.

When it comes to taking on any major expense, it’s always good to provide some sort of sanity check to make sure you can afford it.

Here’s are three great questions to ask yourself that matches the sentiment of the holiday season and the coming new year:

- “For every dollar that I spend on gifts, do I have an equal amount that I could donate to charity?”

- “Can we spend this amount of money without being in a worse off financial position starting out next year?”

- “If I had to pay for everything in full instead of using payment plans or debt, would I still spend this money?”

If the answer is no to any of these questions, then you’re probably spending too much on your holiday budget. If the answer is yes to all three, then you should be good to go.

Along with asking the three questions above, think about it like an experiment. It shouldn’t be so complicated that you need a financial planner to help you with it.

Throw out some numbers, $200, $500, $1,000, $5,000. When you make that face like you know it’s too much, pull back a little bit.

Sometimes, you just have to start your online shopping research to fit your way into it too.

The bottom line is that there is no hard and fast rule when it comes to setting a holiday budget. It’s dependent upon your overall financial situation.

So now it’s time to ask, “How do I make a holiday budget?”

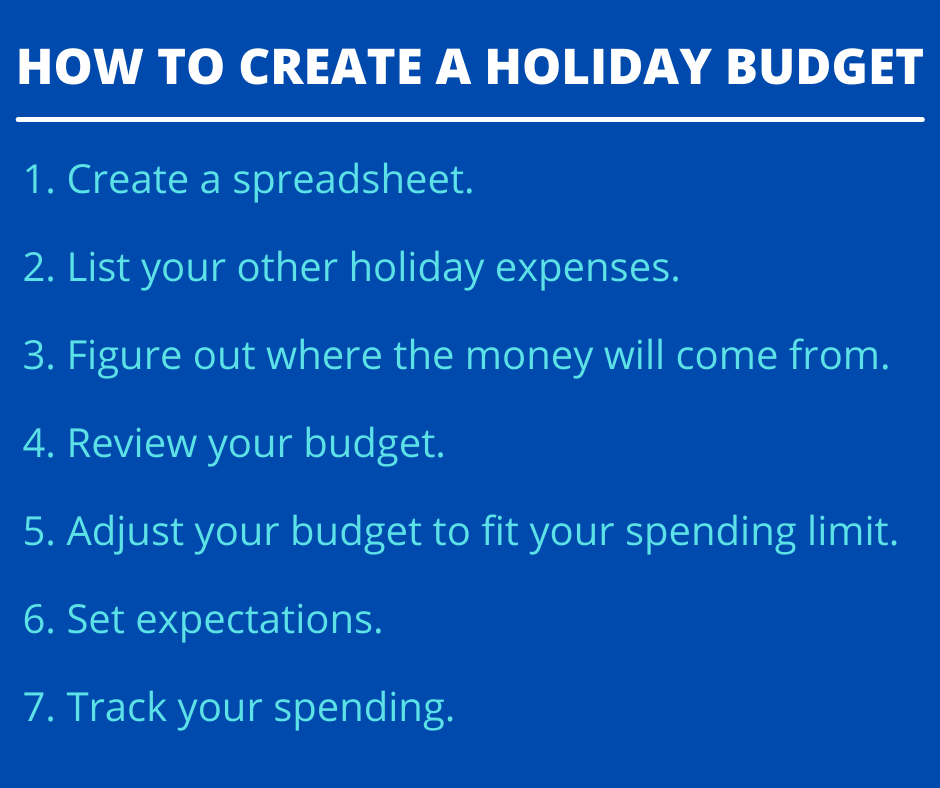

How to create a holiday budget

When it comes to creating a budget for the holidays, a little bit of planning goes a long way to ensure that your holiday expenses don’t sabotage your wealth.

Create a spreadsheet for your holiday shopping

When I say the word “spreadsheet”, you either jump for joy or are totally terrified. But I promise you, this will be easy enough to put together.

Think of it like a gift list which you probably put together anyway, just in spreadsheet form.

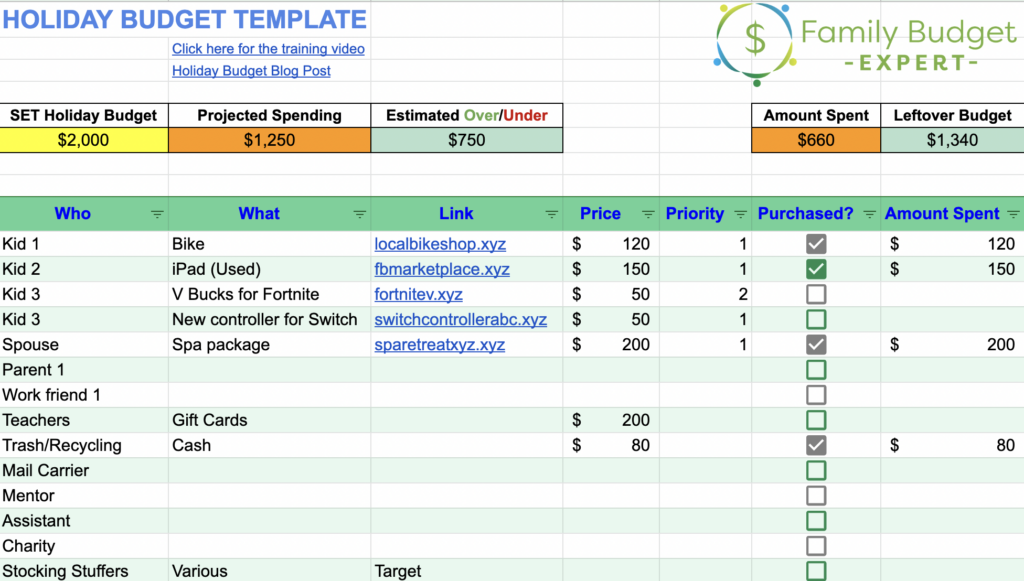

The spreadsheet will look like this:

The first column is “who” do you plan to buy holiday gifts for?

This list needs to be comprehensive, because the easiest way to go over budget is to mistakenly leave people off this list.

Family members are who comes to mind first, but think through all the areas of life to make a complete list. Here’s some help to jog your memory:

- Spouse / Partner / Significant other

- Kids

- Parents

- Siblings

- Aunts, Uncles, Cousins, Nieces, Nephews

- Work friends

- Teachers / Caregivers

- Mentors / Mentees

- Mail carrier, trash collector, housekeeper, other service providers

- Assistants, employees, staff

- Charity / Donation

Now put about another minute of thought in here to see if anyone else comes to mind. Good to go?

The next column is what do you plan to buy for them. Our kids have wishlists, and we ask our siblings what our nieces and nephews are interested in these days.

Next, start doing a little bit of online research but don’t buy yet!

When you find something you might want to get, copy and paste the link right into the spreadsheet as well as the price. (Don’t forget about sales tax).

If you have people that you plan on getting more than one gift for, make another column so you can rank it by priority.

Keep a running total of how much this will cost you.

Don’t worry about setting the budget yet, just see where you land.

List your other holiday expenses

Along with gifts, don’t forget you’ll have other expenses this time of year related to the holidays.

Some holiday expenses include:

- Holiday cards

- Decorations

- Clothing for parties and events

- Wrapping paper

- Party hosting

- Holiday parties you’ll brings something to

- Holiday travel

- Charitable giving

- Gift exchanges

We normally just do this kind of stuff without budgeting for it, but it’s all holiday-related spending and it needs to be included in the budget.

Figure out where the money will come from to buy gifts

Have you been super organized and saved a little each month? If that’s you, congratulations! You have the green light.

Now if you’re like the other 95% of people, you’re probably going to come up with the funds from your cash flow.

Perhaps you’re getting an end of year bonus that will cover it, or maybe you’ve been spending less money over the last few months to build up a little bit in your bank account.

Maybe your plan is to draw from your savings account to make it happen.

Whatever you plan to spend, as long as you’re not going into debt or draining retirement savings, it’s probably an acceptable plan.

Next, we want to add in the overall expenses for this holiday season.

Review your holiday budget

The good news is that you haven’t bought anything yet…right?

So before spending any money, review what you’ve come up with so far. The spreadsheet will show you what the total cost is projected to be and if this will be ok.

Now that you have a list of everyone you’ll be buying gifts for and all the other expenses, take a look at the number and ask yourself:

- “Will I be ok spending this amount of money?”

- “Do I know where this money will come from aside from going into debt?”

If not, it’s time to tweak your budget.

Adjust your budget to fit your spending limit

Remember, you don’t want to cause any long term financial harm to yourself. That will leave you feeling worse than before, and you won’t be able to properly enjoy this time of year and your gift giving.

If you feel like you’ll be spending too much, then it’s time to adjust your spending plan.

Prioritize by ranking each item as a 1, 2, or 3.

1 is a “must get”, 2 is a “nice to get”, and 3 is not all that important.

If it still doesn’t work, think about anything you can do to come up with extra money like selling stuff you don’t use or need, getting a seasonal part-time job, or giving up spending in a certain area to make room.

Set expectations

The National Retail Federation is projecting that this will be the highest retail sales on record.

BUT, this is the perfect year to adjust your spending downward here if you feel like you need to.

Pretty much everyone will understand if holiday gifts won’t be on par with where they were pre-pandemic. Even your kids will get it. They’ve seen plenty of changes in their lives as we all have.

Remember, just because others are overspending on the holidays, doesn’t mean you should. Do what’s best for YOU. Don’t get into a competition, because that will be a race to financial ruin.

On the positive side, look at this as an opportunity to come up with creative ways to swap gifts with free experiences and holiday traditions that your kids will actually remember.

No matter what you plan to do, make sure to have conversations and set expectations. You could even underpromise, then overdeliver!

Track your holiday spending

Now that you have your list, it’s prioritized, and your spending limit is set, it’s time to go out and spend some money!

Shopping online will be much easier since you’ve prepared everything in advance. Use the links in your spreadsheet to simply click, add to cart, and purchase.

After you make the purchase, put the actual dollars spent right into that line item on the spreadsheet and keep a running total of what you’ve spent so far.

Stick to your list and stick to your budget as best you can, but if you just can’t help yourself and end up adding one-off items to the cart before buying, be sure to add those lines to your spreadsheet.

Get a free resources to help with your holiday budget

This time of year is filled with fun, but it can also put you in a bad financial position without proper planning.

Think about how much time you spend trying to save $5 when you’re shopping online. Don’t you think you should spend more than that preparing for the holidays especially if you’ll be spending hundreds or thousands of dollars this time of year.

Go through these steps and get instant access to my holiday budget template.

Or if you want to talk through it with me and see how you can finally get your budget in order, schedule a complimentary 30 minute call with me.