What is the first step in financial planning? Don’t skip it even if you’re doing it yourself.

I love that there’s more opportunity and access to financial planning resources than ever.

Some of that is due to a shift in the financial industry toward lower investment minimums, lower fees, and greater resources.

Along with that is the rise of incredible podcasters, YouTubers, and others like me who are trying to help people reach their best financially.

So many people are able to more confidently manage their finances on their own with the support of these resources, and I’m all for it.

But oftentimes, the first step in financial planning is skipped mainly because it isn’t emphasized out there.

When we think about getting a handle on our finances, we jump right into investing, getting out of debt, or trying to make a budget.

These are all worthwhile to focus on, but first things first. Start with this step.

Table of Contents

What is the first step in developing a financial plan?

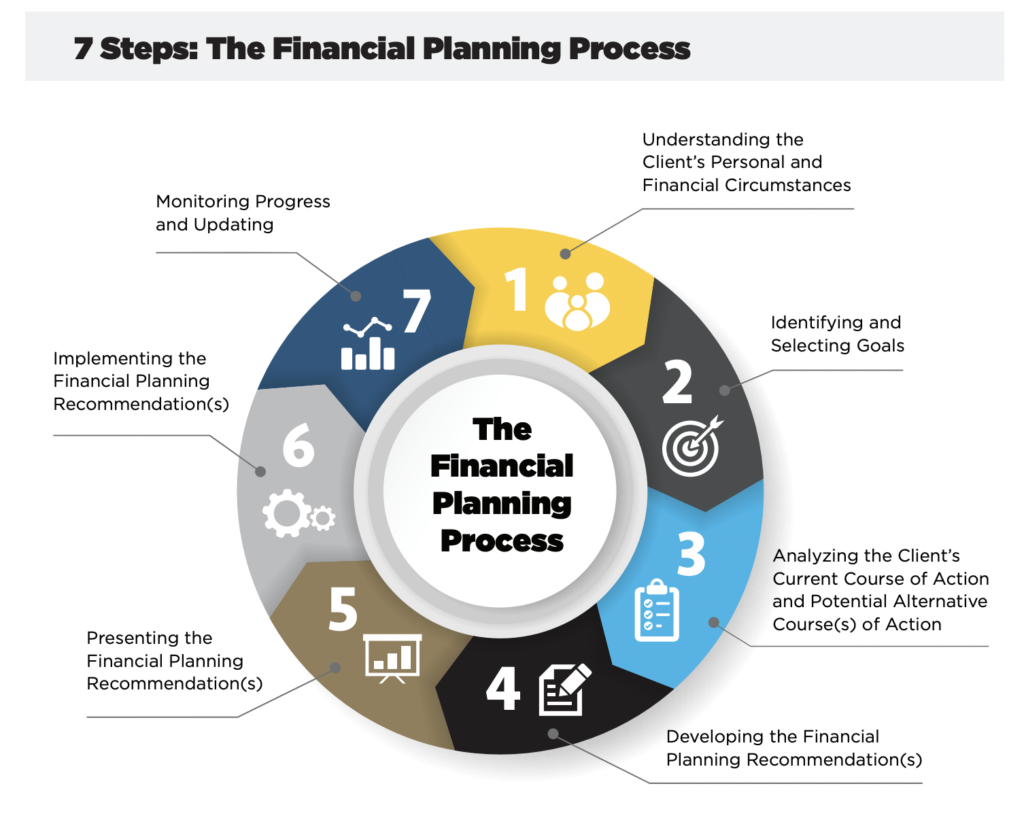

The first step in the financial planning process is to “Understand the client’s current personal and financial circumstances.”

When you’re doing it on your own, this means taking inventory of where you are right now before jumping in.

(In fact, implementing the plan doesn’t come until step 6 of the financial planning process.)

Why is it important to know your starting point before you can figure out how to get where you want to go?

The most common example I see is when people jump into budgeting before understanding how much they’re actually spending today.

If you want to spend $8,000 a month, there’s a big difference in getting there for someone who’s spending $8,500 vs $11,000.

In my experience, people wildly underestimate how much they’re spending which is a major reason why they can’t seem to stick to a budget.

It’s the same thing with getting out of debt.

Many people just start spreading out extra payments on their debt before looking at the overall picture. How do they know that the money they have left over is going to the right place?

I also see people end up in credit card debt because they’re focused on putting money away for retirement before understanding that it puts them in the red each month.

Those that know the full picture of where they stand today can more confidently move ahead with their goals.

So let’s talk about how to understand your current financial and personal circumstances.

How to start financial planning on your own

There are three main actions to take when you’re financial planning on your own. It all starts by managing your current financial health.

It doesn’t have to be that complicated. Thinking it will can make it feel overwhelming and can stop people from taking this crucial first step.

Here are the first steps to start financial planning on your own.

Put together your personal balance sheet

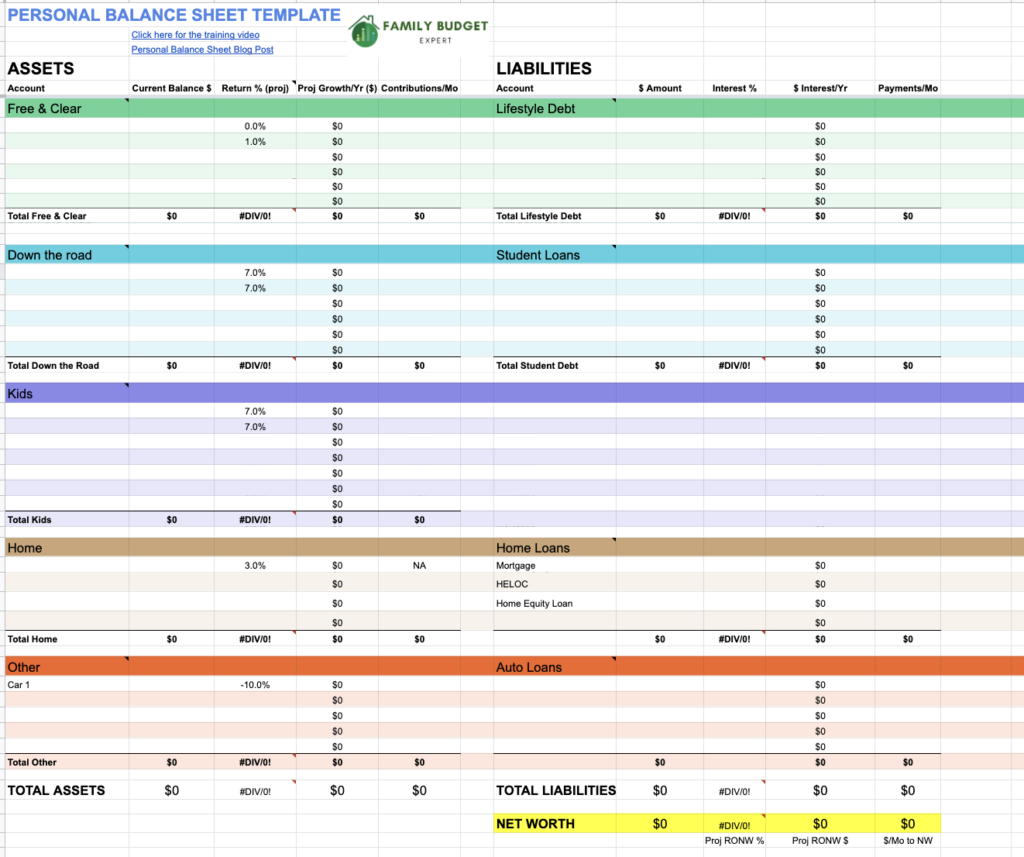

Your personal balance sheet is a snapshot of your current financial situation, a list of your assets and debt.

This will show you what buckets need to be filled and help you prioritize what to do with extra money.

If you’re not sure where to start or how to put this together, I have a free personal balance sheet template and instructions you can get instant access to for free.

Figure out where your money is going

Cash flow (how much money comes in and goes out) is the best thing you can do to reach financial security and a solid financial future.

This has never been easier to see where you’re spending your money.

Start by signing up for a budget app like Mint or YNAB. Find one that will automatically connect to your bank accounts and credit card accounts, because they’ll typically pull in the last 90 days of data.

Once you do that, look through the data for 10 minutes and make sure any major inflows and outflows are categorized correctly.

Then you can use their graphs, charts, and numbers to see your total cash flow in and total cash flow out.

Now you’re able to see how much you’re really spending each month without any guesswork.

Identify and select your goals

Now that you’ve completed step one of the financial planning process, you can now dive into where you want to end up.

Most of the time, people focus on the long-term stuff.

That’s all well and good, but it’s hard to think about reaching financial independence or to think about retirement planning when you have fires to put out like a lack of emergency funds or credit card debt.

You can read about my top 10 short-term financial goals to get some guidance here.

Put together a budget that sticks

Now that you know your financial status including:

- Where your money is and isn’t.

- How much you’re spending each month.

- Your short-term financial goals .

You can now create a budget that sticks.

The budget will be more realistic because you’re not pulling numbers out of a hat. You know where your money is going and how much you’re spending in the various budget categories.

In the end, you can create a budget that is very intentional and uses your hard earned money to spend on the things you care about, cut out the things that add no value to your life, and how much you can put toward your financial goals like:

- Getting out of credit card debt

- Building up a cash cushion

- Investing for the future

That’s the power of budgeting AFTER you do the first step in the financial planning process.

What are the next steps if I’m doing financial planning on my own?

After you get those steps done, now you can look at your overall financial planning needs including:

- Investing

- Debt management

- Retirement planning

- Estate planning

- Term life insurance

- Tax planning if your situation is complex

For most people, again this won’t be that complex.

Typically you’ll want to:

- Find a solid tax professional.

- Link up with a low-cost robo-advisor or investment firm.

- Get your term life policy someplace like PolicyGenius or Zander Insurance.

- Find an estate planning professional to help you.

When should you hire a professional financial planner?

Definitely seek financial advice from a professional if you have a more complex financial situation like:

- A windfall of money or inheritance.

- Have investable assets above $250,000

- A divorce or blended family

- Getting close to retirement

- Own a six-figure profit business

- Received significant stock options from the company you work for

You should also work with a financial advisor if you just don’t want to do it yourself or feel like you want a professional opinion to help you make your financial decisions.

But don’t work with a financial advisor only because they’re your friend or family member.

Also stay away from those trying to get you to buy a permanent or whole life policy unless you have pre-existing medical conditions.

Make sure you can answer these 6 questions before hiring them:

- Can you understand the financial advice and course of action they’re recommending and why they’re recommending it?

- Are they knowledgeable and competent in the advice they’re giving?

- Are their business interests aligned with your personal interests? Do they eat their own cooking? Are they honest about their conflicts of interest?

- What are the total fees and commissions you’ll have to pay directly?

- Can they clearly and specifically explain their compensation from the investment or insurance products they recommend?

- Do they involve your spouse/partner?

Some of this information will be in their required disclosures, but make sure they take the time to explain it to you, THEN read it on your own.

What if you just want help with your budget and prioritizing paying back debt, saving and investing?

I can help here.

This is a glaring gap in the financial planning industry around budgeting which is why I started Family Budget Expert.

My sole focus is on helping couples and families finally find the extra money they need at the end of the month to pay off debt, build their savings and invest for the future all while helping them get on the same page and strengthen their relationship.

Let’s start by having a conversation about your situation and seeing if working together to solve the problem is the kind of help you’re looking for.

Book a free 30 minute consult with me here: