Wondering why you can’t seem to save despite earning a decent income? Maybe you even find yourself with credit card debt and wonder, “How did we get here?”

What if you could find more money left over to put towards your goals so that you could feel on track instead of feeling behind?

You might be thinking, “We’ve tried budgeting, and it just hasn’t worked for us.” It might not be you. It might be the techniques you have been told to use.

Keep reading if you want to learn about a method that works while also bringing you closer together through the budgeting process instead of having it drive a wedge between you.

Before we can dive into creating a budget that works, we need to review what makes budgets fail in the first place.

Table of Contents

Why budgets fail

Popular budgeting advice may actually set you up for failure. What if the advice is the exact opposite of what it takes to be successful when creating a budget?

Here’s a list of the five most common budgeting mistakes I see out there that stem from the bad budget advice:

- Too rigid and drastic. There’s no wiggle room, and it doesn’t adjust when life throws curveballs your way.

- It takes too much time to keep up with because there are so many budget categories to monitor.

- Too restrictive. It doesn’t let you take advantage of positive experiences that come your way.

- It’s a one-sided approach that typically works for one person but not the other.

- Budgeting starts with cutting back on the things you enjoy most.

Most budgets are created to fail during the initial set up. It’s almost like they were designed in a numbers vacuum without understanding how people spend money in the real world.

Yes, it would be great if everything went according to plan and we could follow a budget perfectly. But you and I both know that’s just not how life works. Even if we’re using the best budgeting apps, spreadsheets, or AI, these techniques still pose challenges.

What would the ideal budget method look like?

The goal of budgeting is to help you have money left over so you can reach your financial goals, such as paying off debt, saving for an emergency fund, or building up your nest egg to reach financial independence.

Here is my criteria for the ideal budget method for families:

- Easy to maintain: It can’t take hours per month to keep up with. Even the busiest of families should be able to do it.

- Adjusts as things pop up: Whether you have something unfortunate like a medical bill or something fun like getting invited on a trip with friends, the budget should respond to make it work.

- Aligned with your values and priorities as individuals, as a couple, and as a family: The budget should help you keep what you enjoy most and put you at the best version of yourself. It should help you spend your time and money on what matters most to you, your family, and your friends.

- Creates small habits that generate gradual and lasting change: Drastic changes often don’t last long (think crash dieting). This should build and grow over time as you learn and experiment with what works.

- Brings you closer together instead of driving a wedge between you: It should open lines of communication and work for both the structured person and the spontaneous one.

| Criteria for the ideal budget method | Description |

| Easy to maintain | Minutes to keep up with it, not hours |

| Adjusts as things pop up | Flexibility to accommodate unexpected expenses or opportunities |

| Aligned with values and priorities | Keep spending on what you enjoy most as an individual, as a couple, and as a family |

| Creates small habits for gradual change | Sustainable, lasting changes perform better than drastic, short-lived ones |

| Brings you closer together | The system should have enough structure for the “saver” and flexibility for the “spender” |

My budgeting story

I was never great with budgeting. Yes, the Director of Family Budget Services at Focus Partners Wealth didn’t have it all together. Like many people, I had tried different methods, budgeting apps, and spreadsheets, but nothing seemed to stick. I didn’t like how budgeting made me feel guilty when I spent money on the things I really wanted to do. It was hard to keep up with. And even though my wife and I are pretty much on the same page in life, we just couldn’t get on the same page with budgeting. With three kiddos in the house, money was happening to us rather than us feeling in control of it.

So then I thought, let’s simplify this process and turn it on its head.

Rather than looking at a ton of information, let’s look at only the stats that matter.

Rather than starting with what we need to stop doing, let’s start by making room for the things we want to continue doing.

Rather than working separately, let’s start by working together.

The results?

Spending came down and we were getting along better than ever. We were as surprised as you might be!

Then I started working with friends and eventually clients, learning and evolving the process as I discovered more about what works and what didn’t for people.

Now, this is what I do every day, all day. It’s my job to help people budget effectively while bringing relationships closer together through the process.

Create a family budget using the Budget MAP Method

The MAP Method is a budgeting technique designed specifically for busy families. It is designed to help drive towards your financial results, maintain your quality of life, and get along better than ever around money.

MAP stands for:

- MAKE your budget.

- ADJUST when the unexpected happens throughout the year.

- PRIORITIZE what’s most important to live your best life AND reach your financial goals.

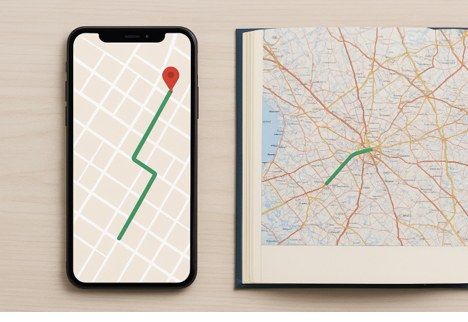

Just like using a map app, the Budget MAP will find the best way to get from your starting point to your destination, and reroute you if obstacles show up during your journey.

Let’s break this down further.

MAKE your budget

Creating a budget is a much simpler process using the Budget MAP Method. But it doesn’t start where you think.

Believe it or not, the first step is NOT making a budget.

The first step is to track your spending.

Step 1: Track your spending using a budgeting tool

If you start budgeting before knowing your starting point, it’s like using a map app to get directions when it can’t find your current location. The wheel on your phone will spin, and you won’t know where to start.

I’ve seen countless people fail at budgeting simply because they didn’t know how much they were spending in the first place.

Setting a food budget of $1,500 per month is very attainable if you’re spending $1,800. That’s only a handful of meals.

But what if you THINK you’re spending $1,800 but you’re actually spending $2,500?

You’d need to cut spending by $1,000 per month to reach your goal. That might mean significant changes to your dining out routine that you don’t even know you have to make, setting you up for failure.

So how do you establish your starting point?

Use a budgeting tool. It will make your life so much easier!

It doesn’t matter if you use Monarch Money, Simplifi, Rocket Money, Tiller, or a good old fashioned spreadsheet. Figure out your baseline spending first.

Step 2: Calculate your average monthly income

Your annual income will be the main constraint of your budget, so this number is critical to know.

Use your take home pay, not your gross income or salary. The money that hits your bank account is the only money you can use without going into debt.

Think about all of your income sources. If you have irregular income like bonuses, commission, overtime, RSU compensation, or volatile business income, estimate your family’s income for the full year instead of monthly income.

Get a good understanding of the income timing too. If it looks like a roller coaster, there are other systems you can put in place to smooth it out.

Step 3: Determine your savings goals and debt reduction goals

How much money do you want to save this year? How much debt do you want to pay off? Do you want to make regular contributions to your investment accounts?

Whether you pay down debt, build an emergency fund, or invest for your future financial goals, it all counts towards building your net worth.

Figure out how much progress you want to make this year. That progress will come from the money you have left over after your income comes in and your expenses go out.

Step 4: Create your annual spending target

Now that you know how much income will enter your bank account and how much you’d like to save, you now know how much is left over to spend.

Simply start with your take home pay, and subtract how much you want to save from step three.

This leftover number is your annual spending target which already has enough money earmarked for your goals.

This is the main number to focus on, and these next steps will break that number down even further.

Step 5: Add up your regular monthly bills

When creating a budget, it’s best to start by filling in the things that are hardest to change, such as your fixed expenses.

What is the criteria of a fixed expense?

- Same amount each month (or close enough)

- The bill comes on the same date each month

- Could be a necessity or discretionary

- Bills are above $50 (don’t count smaller streaming services)

Here are examples of fixed expenses:

- Housing payment (mortgage, rent)

- Auto payments (lease payment or loan payment)

- Other debt payments (student loans, credit card debt, personal loans, appliance and furniture financing, etc.)

- Monthly insurance premiums

- House cleaning

- Phone and internet bills

- Streaming services

- Utilities

- Baseline grocery spending

- Gym memberships

- Child support or alimony

- Any other monthly payments

Add all of these up and see how much they take up of your total annual budget.

Step 6: Think through the things that will spike your spending throughout the year

I often hear, “We do fine with our budget but then something always seems to come up!”

Conventional budget systems take the annual spending goal, divide it equally by 12, and expect every month to have the same.

That’s just not how life works, and it makes people who budget feel like failures.

A solid budgeting system will help you plan in advance for certain expenses (expected and unexpected) that pop up throughout the year, especially the big ones.

Here’s a list of non-monthly (aka irregular) expenses to plan for in your budget:

- Holidays

- Birthdays

- Travel and vacations

- Home maintenance

- Home improvement

- Auto maintenance

- Medical bills

- Charitable donations

- Kids activities/summer camp

- Taxes

- Pets/veterinarian visits

- Entertainment (sports, concert tickets, and live events)

- Financial fees and annual insurance premiums

- Other financial obligations throughout the year

- Earmarks for the unexpected

Here’s how to calendarize your irregular expenses:

- Open up a spreadsheet

- Put the months across the columns (January, February, March, etc.).

- List the irregular expense categories down the rows (travel, holidays, taxes, etc.).

- Earmark for the unexpected (auto and home maintenance, medical expenses, and veterinary bills).

- Add it all up to see the total expected costs for the year.

- Look across the months to figure out which will be the more expensive ones.

Remember: These are not monthly expenses. They are things that pop up throughout the year and cause your spending to be higher in one month versus another.

People are often surprised when they see how much this adds up to and are relieved when they know it’s coming up rather than it popping up out of nowhere.

Step 7: Calculate how much remains for your flexible spending

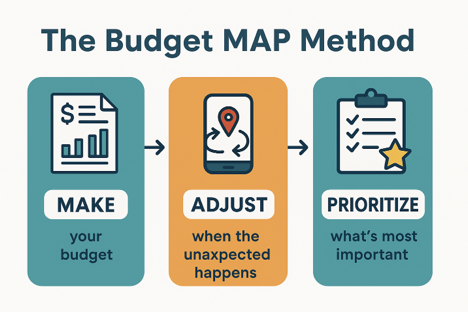

So far you have planned how much money will go towards your:

- Financial goals

- Fixed expenses

- Irregular expenses that will pop up throughout the year

What’s left over will go towards your variable expenses. This is the spending you do every month but to varying degrees, you have some discretion over, and can more easily dial back or turn off altogether.

Flexible expenses include:

- Food/dining out

- Clothing

- Shopping

- Household goods and services

- Kids discretionary spending

- Hobbies

- Entertainment

- Streaming services and smaller monthly subscriptions

- Impulse purchases

- Other discretionary purchases at Amazon, Target, Walmart, Costco, Sam’s Club, TikTok shop, Instagram, and Facebook Marketplace

- In-app purchases

A big budgeting mistake I see is getting super detailed with budget categories. However, the more granular we get, the less likely we are to keep up with the system.

I see this all the time. A couple goes over on their food budget, so they borrow from their clothing budget. But now they overspent there and need to take from another category.

This is a pointless exercise that costs people time and energy and causes them to fall behind in the process altogether.

Does it really matter if I went out to eat for $30 or made a $30 online purchase? The money has left my account either way.

I personally like to lump these purchases into one category. This makes it much easier to track and keep up with.

Reduce stress by lumping all flexible monthly expenses into one category.

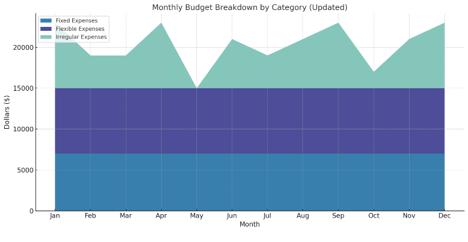

Step 8: Create your monthly spending targets

We can’t just take the annual budget and divide by 12 months.

Your spending level will be different every month thanks mostly to those irregular or non-monthly expenses, so we need to set different spending targets each month.

Each monthly spending target will include:

- Your consistent monthly expense run rate (fixed and flexible expenses)

- Your highly-variable irregular expenses. This could be zero some months and thousands in others.

Here’s how to create your monthly budget:

- Add up your regular monthly expenses including housing payment, auto payments, debt payments, phone and internet, childcare costs, and any other fixed bills that come up.

- Next, add up your irregular expenses. These are the things that will spike your spending in any given month. Think about the holidays, birthdays, travel expenses, annual or quarterly payments, home maintenance.

- Now take your flexible expenses and add them all together.

- Do this for every month of the year (January through December).

Here’s a sample monthly budget:

- Fixed expenses: $7,500

- Mortgage: $3,000

- Car payments: $1,500

- Other debt repayment: $1,000

- Insurance: $700

- Phone, internet, and streaming: $500

- Gas, electric, and water bills: $800

- Flexible expenses: $5,000

- Irregular expenses: $4,500

- Vacation booking: $2,000

- Concert tickets: $500

- Quarterly insurance premium: $1,000

- Summer camp registration: $1,000

- Total monthly expenses budgeted: $17,000

This example shows a more expensive month for this family due to the $4,500 in irregular expenses.

It also shows that their run rate or baseline will be $12,500 per month (fixed and flexible). That amount will be the same every month.

The budgeting process doesn’t stop there

Congratulations! You just completed the MAKE YOUR BUDGET section in eight easy steps!

You know your starting point and destination and are ready to start your trip!

This is where most budgeting systems stop, but not the Budget MAP Method.

Things will come up that are expected as well as things you didn’t anticipate, and you may have to reroute depending on new obstacles or things clearing up.

That’s where the second part of the process comes in.

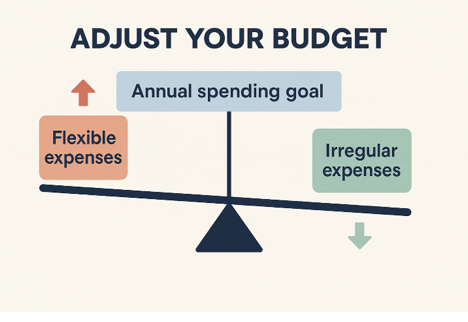

ADJUST your budget

The destination of the MAP is your annual spending goal.

That needs to remain intact no matter what if you want to reach your short and long-term goals.

Reality check: Life will happen, good and bad. There’s a chance you might go over your budget in any given month.

Fear not through, this system will adjust for it.

Let’s break this down:

- You have an annual spending target.

- That target is broken down into three components of your expenses—fixed, flexible, and irregular.

- Chances are that the overspending came from either the flexible side (higher day-to-day expenses) or your irregular category (something popped up that you didn’t anticipate).

- In order to stick to your annual number, you’ll have to adjust one or both downward.

- Side note: You can lower your fixed expenses to some extent by negotiating lower bills and payments, but other major actions are usually more disruptive (selling house, car, changing childcare arrangements). That’s why we stick to the other categories.

This works in the other direction as well.

If you underspend, you’ll have more money for savings, retirement, and reducing debt.

Your budget is a living and breathing document. It’s not set in stone. You can move things around and make the necessary adjustments as life happens so you can hit your annual spending target.

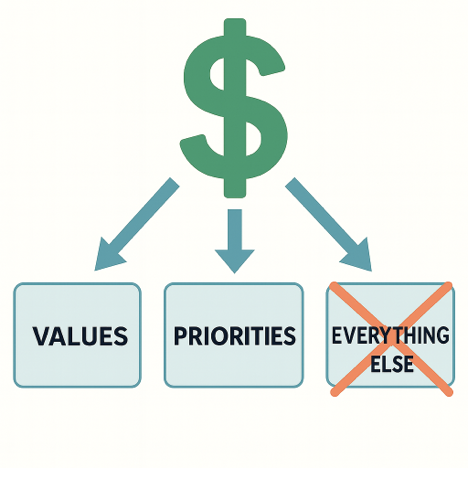

PRIORITIZE Your Values

Every single dollar spent should be in alignment with your values and priorities as an individual, as a couple, and as a family for those that apply to you. You get to decide where your money is going.

That’s the filter you use when you need to adjust your budget.

Your values and priorities are your north star.

If things get tighter because of unexpected expenses and you have to pare back, start by understanding what you want to KEEP spending money instead of going to the things you feel like you should cut.

For example, if you value health, don’t skimp out on that area if it means sacrificing that value.

Once you identify what’s important, the stuff you don’t care about will show itself, and you’ll know to cut back or eliminate that spending altogether.

Keep investing in yourself and the things that put you at the best version of yourself.

Reach your budgeting goals using the Budget MAP Method

The beauty of the Budget MAP is that it puts your goals, values, and priorities at the forefront while making it easy to adjust as things pop up.

I didn’t even mention that it only requires five minutes per week to keep up with. Anyone can find the time to make it happen, even the busiest of families.

How is that possible?

Think of the Budget MAP Method like using a map app instead of a physical atlas.

The app only gives you the info you need. A physical road atlas can come in handy, but it has way more information than you need.

In the end, a budget helps you balance saving for tomorrow while living for today.

The Budget MAP Method can help you get there while prioritizing the people and values you care most about. It can bring you closer together through the process because it has enough structure for some but also allows for the spontaneous.

Get started today by scheduling a complimentary call to talk through your biggest challenges, get some quick solutions, and see what next steps you can take to make it happen.

FAQs – MAP Method budgeting

What is the MAP Method for budgeting?

The MAP Method is a simple three-step budgeting system designed for busy families: Make your budget, Adjust when life changes, and Prioritize what matters most. It helps couples manage money without giving up their lifestyle, and without taking up a lot of valuable time.

How is the MAP Method different from traditional budgeting?

Traditional budgets often fail because they’re too rigid, time-consuming, or restrictive. The MAP Method is flexible, aligned with your values and priorities, and only takes about five minutes a week to review. It works for even the busiest households.

Can the MAP Method work if my spouse/partner and I have different spending habits?

Yes. The MAP Method is designed to work for both “savers” and “spenders” (or as I like to call it “structured” and “spontaneous”. It focuses on aligning your budget with your values and priorities as individuals, as a couple, and as a family which reduces arguments and improves communication.

How do I start using the MAP Method?

Start by tracking your spending using a budgeting app. Think of this as finding your “starting destination”. Then set your annual spending target by subtracting your savings goals from your take-home pay. Finally, group expenses into three buckets — fixed, flexible, and irregular — and review them weekly.

What are the three expense buckets in the MAP Method?

- Fixed expenses: Bills are very much the same each month (mortgage, insurance, and utilities).

- Flexible expenses: Monthly spending you have some discretion over (dining out and shopping).

- Irregular expenses: Things that happen during the year but not every month. These are the ones that spike your spending for that particular month (vacations, car repairs, holidays, birthdays, etc.).

How much time does the MAP Method take?

Once your budget is set, it only takes about five minutes a week to review and make adjustments. The goal is to get the habit set rather than diving too much into the details. One of you should set a timer and end the meeting when it goes off.

Will the MAP Method help me save money without cutting out fun?

Yes. You should be able to spend less without feeling like you’re making major sacrifices. The MAP Method prioritizes the things that are important to you so you can keep spending on what matters most while finding savings in areas that matter less. In the end, you can enjoy life now and still reach your long-term financial goals.

What if unexpected expenses come up?

The MAP Method will ADJUST when this happens. You can build the predictable and unpredictable into the budget when you set it up. If the unexpected are more than you thought, you can adjust other flexible or irregular expenses while still being able to stick with your overall annual spending target.