How to budget for irregular expenses

(Hint: They’re not as irregular as you think!)

Have you ever started a big project that you were intimidated by? Then you finally start by creating a plan to get it done? It feels amazing, doesn’t it?

Just having a plan in place can feel so freeing. You know exactly where you’re headed, what to do to make it happen and what to expect going forward.

But what happens when you’re trying to implement the plan and something comes up that derails you?

It’s kind of like committing to giving up sugar then having a tiny, tiny bite of cake at your kid’s birthday party. (I’m speaking from experience, but I can’t be the only one, right?).

All of a sudden I’m thinking, “Well, I’ve already broken the streak, so…MORE CAKE!!”

What happened there is that I had a plan to give up sugar for a period of time, but I forgot that maybe…just maybe…I might want a piece of cake at my daughter’s birthday.

Rather than planning for it, I let it sabotage me. For the next 3 months, I let it all go and put on double digit pounds.

This happens when people try to budget too.

We set a budget and have the best of intentions. Things are going along smoothly, but all of a sudden, something comes out of nowhere and breaks our budget.

These irregular expenses can wreck your family budget and your commitment to it. But with just a tiny bit of planning, you can learn how to budget for irregular expenses.

Check out our family budgeting tools.

Table of Contents

What are irregular expenses?

Irregular expenses are those things that don’t happen every month and that seem to sneak up on us. They can be bills or events that cause us to spend more money during the month than we originally anticipated. We often forget about them.

Each irregular expense can come up somewhere between 1-6 times per year. These include events, special occasions, and non-monthly bills.

Pretty much every client I work with can rattle off their regular monthly bills, their fixed expenses. Your mortgage or rent happens every month. It’s something predictable you can expect to be the same amount and due on the same date.

Irregular expenses are different.

They’re predictable bills, but since they’re not front of mind each month, we tend to forget they exist until we get the bill or see the event coming up on our calendar.

When we forget about them, they become unplanned expenses which can really sabotage our mindset while we’re trying to stick to a budget, because often lead to spending more during the month than we expected.

Plus, it seems like there’s always some irregular expense that seems to come up each month. Even if we use the “reset the clock” mindset when the months change, inevitably, something new will derail us.

There’s good news here though. All we have to do is put a tiny bit of planning, and we’ll be able to finally stick to a budget. More on that later.

Irregular Expenses Examples

Here’s a long list of irregular expenses. No wonder budgets fall apart! There’s something all the time!

Holidays

- Valentine’s Day

- Easter / Passover / Ramadan

- Mother’s Day

- Father’s Day

- Halloween

- Thanksgiving

- Christmas / Hanukkah / Kwanzaa

Family Occasions & Kids Activities

- Birthdays (for each family member)

- Anniversary

- Activity fees (sports leagues, gymnastics, dance, martial arts, music lessons, etc)

- Summer camp dues

- Private school tuition

- Back to school supplies & clothing

- Spring break plans

- Winter break plans

- Dentist / Orthodontist

Home & Auto

- Property tax

- Home insurance premium

- Home maintenance (lawn care, pest control, etc)

- Car insurance premium

- Car maintenance (oil change, etc)

Medical Expenses

- Annual medical visits

- Eye doctor visits

- Vet bills

- Prescriptions (non-monthly)

Other Irregular Expenses

- Quarterly estimated taxes

- Credit card annual fees

- Amazon Prime Membership

- Annual membership dues

- Travel / Vacations

- Charity / Annual Giving

How irregular expenses mess up your budget

Remember the birthday cake example? One little slip up can cause us to scrap everything and wait for a good time to reset. In the meantime, we end up blowing out our budget rather than just being slightly over.

Because, hey, over budget is over budget so might as well go big.

Here’s how irregular expenses sabotage your budget.

Clients often want to work on their food budget. Food spending is something that we all feel like we have control over and can make changes to it.

When I’m helping clients make a budget, we take up a monthly spending goal, then break it down into weekly spending. For example, if someone wants to spend $1,000 on food, that’s $250 per week that they should aim for.

Well, what happens if you’re two weeks into the month and have spent $500 on food. You’re right on track!

But you remember that your kid’s birthday is coming up next week, and you’re planning on ordering in from her favorite place, getting a cookie cake, and inviting the grandparents over. That could be $100-$200 on just one meal!

So after week 3 you’re at $1,001 on your food spending and feel totally defeated. You have just have to wait until next month to get back on track right? So you figure, “Well, it’s already blown, so let’s DoorDash a few extra times.”

The toe-over-the-line is all it takes. From that point, how much you go over feels like it doesn’t make a difference.

Remember the birthday cake example above? We’ve all been there, right?

How to plan for irregular expenses

Planning for irregular expenses can feel like a major challenge, but it’s actually pretty straightforward. Here’s are the detailed steps to get on top of them:

- Open up your favorite place to keep lists and notes.

- Make a space for each month of the year. (January, February, March…)

- Go month-by-month and list your irregular expenses that happen each month.

- Pencil in how much you plan to spend for each of them.

- Optional: If you want to get even more detailed, review how much you spent the prior year.

Now that we have the list of irregular expenses in front of us, let’s talk about how to save for them.

How to save for irregular expenses

The list is made. The cost has been estimated. Now all you need to do is make room for it in your budget.

It will either look one of two ways:

- Consistent: Surprisingly, the cost of irregular expenses is pretty even month to month.

- Clusters / Clumpy: Some months have minimal cost while others are massive.

If you have “consistent” irregular expenses each month and it works out to be about the same dollar amount of spending, then you can just stick to your regular monthly spending.

But if you have “clusters”, then we have to work on smoothing it out. That could include setting aside a consistent amount of money into a savings account each month.

It’s kind of like frosting a cake (Rob, seriously with the cake stuff!).

First, you take a dollop of frosting and put it on the cake. If you just left it like that, some bites would just be plain old cake and a small portion of it would be almost too much frosting (if there is such a thing). But if you use a frosting knife, you can smooth it out so that the cake is evenly coated.

In essence, saving up each month is like you’re smoothing out your expenses.

For example, if you know you’ll be spending $3,000 for kids’ summer camp, then saving $250 per month for 12 months would smooth it out.

How to start budgeting for irregular expenses

If you’re fairly certain you can map this out on your own, then let’s take a look at what this might look like if you were to lay it all out on a spreadsheet.

I’ll share how to start a budget for this if you aren’t sure what you might spend on these things.

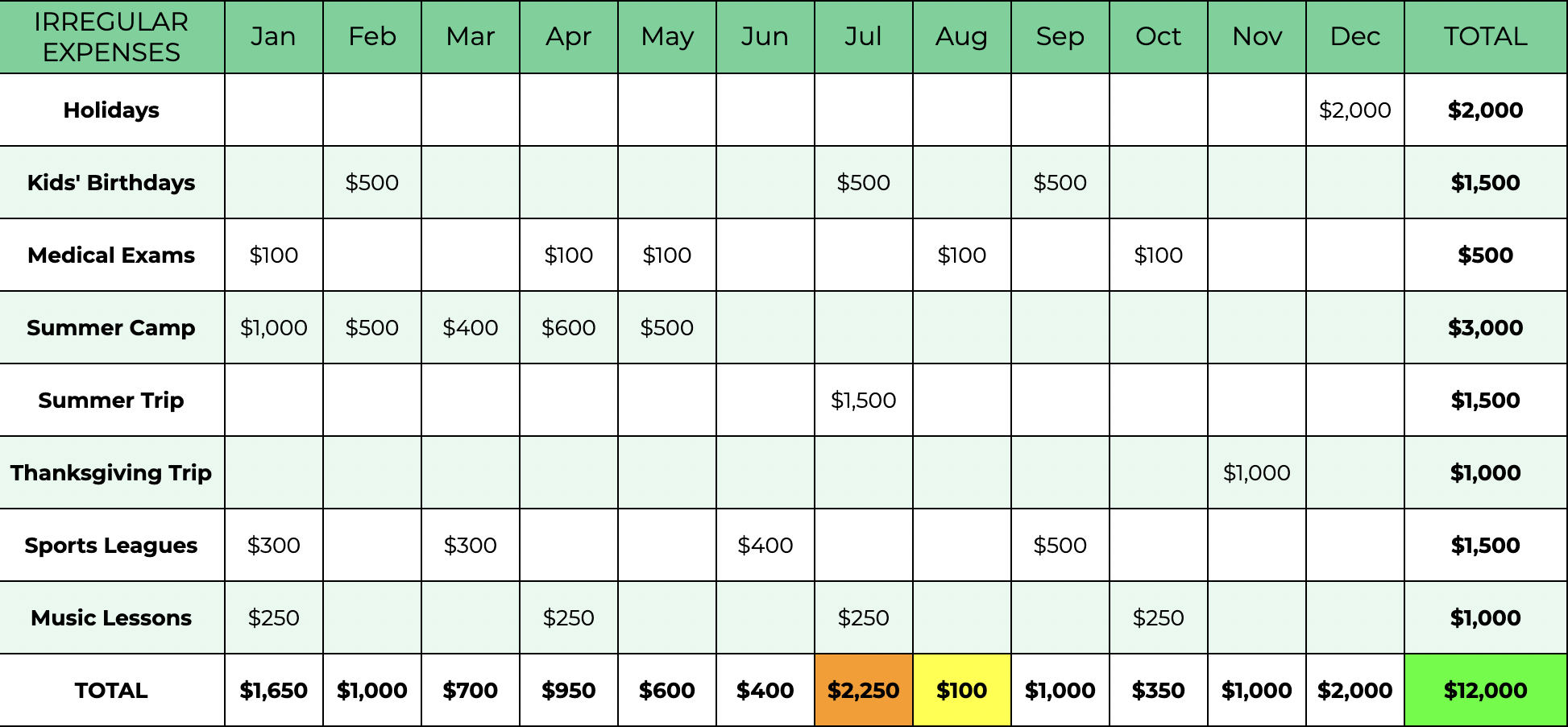

Here’s a budget for irregular expenses example:

A few things to highlight here:

- The lowest month has $100 of irregular expenses.

- The highest month has $2,250.

- The total irregular expenses are $12,000 and every month has at least one of them.

Let’s say that this family is spending about $9,000 per month outside of these expenses. The lowest monthly expenses would be $9,100 and the highest would be $11,250. That higher amount could drain their checking account unless it’s smoothed out.

Fund an irregular expense account

This family should budget $10,000 per month. $9,000 goes to regular expenses and $1,000 per month goes into the irregular spending account. Think of it like an emergency fund, but this account can be used to pay for these non-recurring expenses.

Now, this family has a smoothed out spending budget they can stick to.

What happens if you’re not sure what you spend on irregular expenses because you’ve never tracked them before? Here’s what you can do:

- Start tracking your irregular expenses going forward.

- Fill in this spreadsheet over the course of the year as these situations come up.

- Figure out your total irregular spending for the year and divide that number by 12.

- Set up an irregular expenses bank account and start putting that amount of money in there to smooth it out.

There, you made your list and created a budget for irregular expenses.

Next time you have a kid’s birthday coming up, you can account for it in your monthly spending so it won’t derail you…but the cake might 🙂

Need help with your family budget?

If you’re struggling to stay on a budget, you’re not alone.

If you feel like you can’t keep up with your irregular expenses, you’re not alone.

I can help you go from feeling behind to finding the money to finally to build savings, get out of debt without a restrictive budget.

If you need more help:

or, if you’re ready to take action but don’t want to talk quite yet: