How to Simplify Your Finances

You have the best of intentions.

I mean, who doesn’t want to get their finances in order right?

The way I manage my finances starting out wasn’t working so well even though it was super complex. But it evolved over the years to become a simple and easy to implement framework that has worked for me as well as my clients.

First, I started off seeking the perfect system, and it was pretty complicated.

Signing up for credit cards with great points and rewards programs, opening up bank accounts to get the deposit bonus, being ok with low interest rate debt to maximize my investment returns. I was reviewing all sorts of metrics to help me figure out what was happening.

But that only worked as long as I could keep up…and then things got really disorganized.

Bank accounts all over the place, money moving between accounts, having umpteen credit cards to pay. It was hard to look through my stats and really understand what was going on.

Aside from the complexity, there was a financial cost. Annual membership fees and bank fees started wracking up. Free trials went uncancelled, and sometimes I even had late fees because I missed a payment.

Money was moving all over the place that it was hard to even know if I was overspending or saving each month. This, from a so-called financial professional.

There was so much going on that I lost track and I had to check out my credit report to see what all the accounts I had opened.

Then I grew up a little bit. I got married and had kids.

It was then that I realized that the complex way I was managing my personal finances was actually distracting me from other places I wanted to put my time, energy & money. Plus, the system wasn’t working.

So I simplified my financial life, and it had so many tangible and intangible benefits.

I didn’t go full minimalist, but this quote by Joshua Becker of Becoming Minimalist rings true.

He said, “Minimalism is the intentional promotion of the things we most value and the removal of everything that distracts us from it.”

Simplifying worked! My stress level went way down, and I stopped the bleeding with the fees, lost money and time.

Now that I’ve worked with a bunch of clients on their family budgets and finances, simplification has a dramatic effect on their financial situation and their relationships as well.

Here are the tips I’ve learned that will help you simplify your finances and spend your time, energy, and money on more worthwhile things.

*Pro tip: Don’t feel like you have to do it all. Highlight the ones that interest you most, review it, and simplify that list too 🙂

Table of Contents

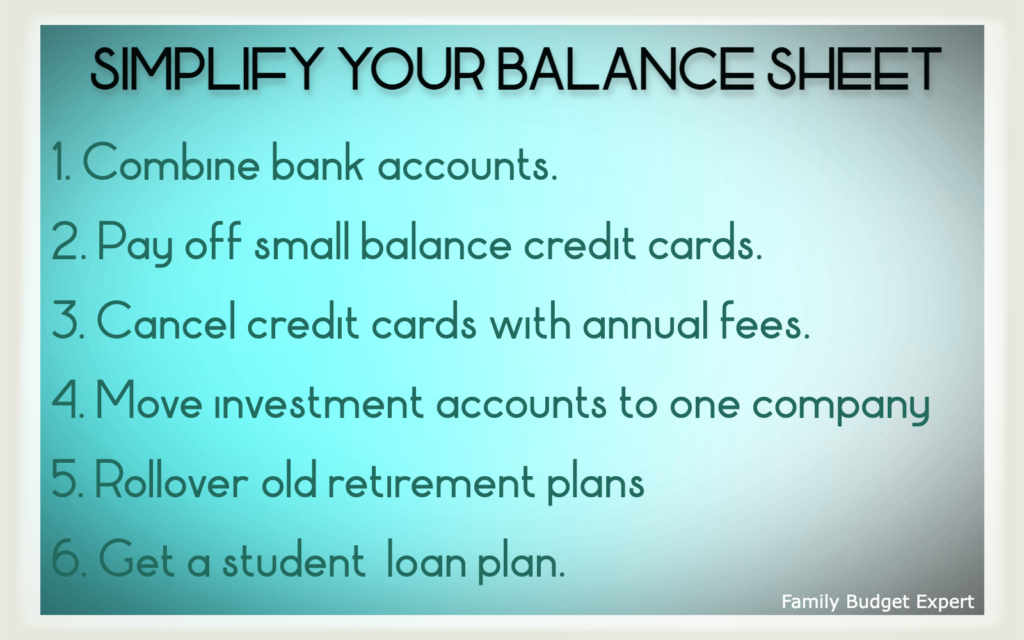

Simplify your balance sheet

The first step in simplifying your balance sheet is to know where things stand.

Take inventory of all of your accounts and debts. Make a list of the following items:

- Checking accounts

- Savings accounts

- Money sitting in apps like Venmo, CashApp, PayPal

- Retirement plans

- Non-retirement brokerage accounts

- IRAs (Roth, Traditional & Rollover)

- 529 plans for kids

- Custodial accounts for kids

- Credit cards & store credit cards

- Payment plans outstanding – Buy Now Pay Later, appliance & furniture

- Personal loans & lines of credit

- Student loans – Federal & private

- Auto loans, car leases

- Mortgage, Home Equity Loan, HELOC

Got your list? How many items do you have? Probably too many.

Here’s what to do with it.

Combine bank accounts

How many bank accounts do you have?

Many couples I work with have more than one savings account and checking account whether they have merged their finances or not.

But you really only need one checking account or two max.

The argument for having more than one is if you have a primary local bank or credit union you’re working with but also want a bank with a more national or global presence for when you travel.

Same thing with savings accounts. Normally people have one at a traditional bank and another at an online bank to get a higher interest rate.

If you have more than two savings accounts and more than two checking accounts, merge them together.

Pay off credit cards especially those with small balances

The typical client I work with has 3 or more different credit cards with balances on them that they don’t pay off in full each month which is very common out there.

Not only is this costing them interest, it’s also stressful to have that many different credit cards to pay.

For whatever you think of Dave Ramsey, the Debt Snowball is actually a really good concept for credit card debt.

Use cash from your bank accounts to pay off the small balances and eliminate one more monthly bill.

Making progress, building momentum and freeing up that cash flow will make you feel great.

Cancel credit cards with annual fees that are unused

Take an inventory of all of the credit cards you have outstanding. If you need to pull out your credit report, go for it. That’s what I needed to do.

Are there any credit cards that have fees that you aren’t using and don’t have significant unused benefits?

Go ahead and cancel those as well as any others you are comfortable closing. (Changes to your credit score are overemphazed in my opinion. Simplicity will lead to greater results than credit scores.)

A side benefit is that you’ll be eligible for the promotional reward again when you’re a couple years out from closing it.

If you’ve always wanted to get rid of credit cards altogether, then switch to one card, your debit card.

Move your investment accounts to one or two companies

I see this a lot too.

People have multiple small investment accounts spread out at Acorns, RobinHood, a couple crypto places, and other brokerage firms like Vanguard, Fidelity, Betterment, Schwab, ETrade, etc.

Think about which place is your favorite and move all or most of your accounts there. Keep any specialty ones you want to keep.

There’s no need to have more than 2-3. It just ends up watering down your system.

Rollover old retirement plans

Many of us have had more than one job and have accumulated more than one retirement account.

Rather than leaving them at your prior company, open up a Rollover IRA (for traditional 401ks or 403bs) or a Roth IRA (for a Roth 401k), and move those accounts over.

You can take 2-3 old retirement plan accounts and roll them into one IRA. Plus you’ll have the flexibility to invest it how you want as opposed to the restrictions inside an employer retirement plan.

The prior rule applies here. Open these accounts up at an investment company that you like and has a good reputation.

Get a plan for your student loans

If you owe more than you earn or are eligible for loan forgiveness like PSLF, it’s really important to make sure you’re taking the optimal path forward.

The student loan repayment rules are very complex so I suggest checking out Student Loan Planner if you have six-figures of student debt.

If you have a bunch of private student loans or owe less than you make and loan forgiveness isn’t an option, they have some of the best cash back bonuses out there if you’re looking to refinance your student loans.

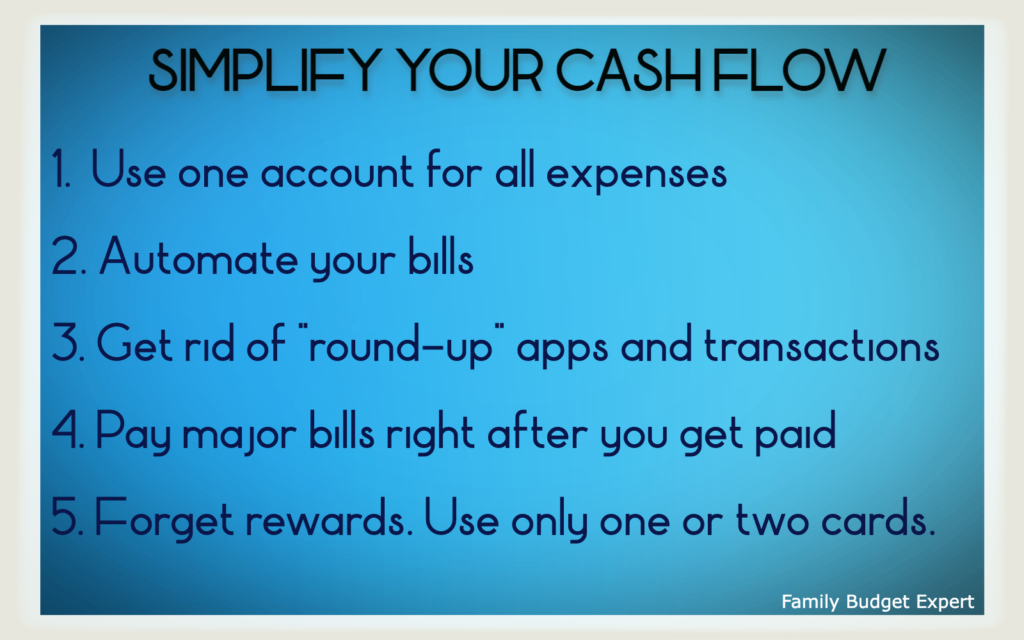

Simplify your cash flow

It can be a major challenge to figure out where you are financially if you have money moving around all over the place all the time.

When you simplify your cash flow, you can more easily identify and track your spending trends.

Here’s how to do it:

Use one account for all of your outflows

We know how popular the envelope system used to be, and I’ve seen people apply this concept but have separate bank accounts for each budget. Though the intention is good, I’d consider that overkill.

Sometimes people just do something like have a separate account that will pull out their mortgage payment.

But the most common thing I see is when couples haven’t yet combined their finances and one spouse pays certain bills and the other spouse pays the rest.

What would be better is if there was one joint account for married couples where all transactions, credit card payments, housing payments, bills & utility payments are paid out of it.

When all expenses come out of one account, you can easily examine how you’re doing for the month.

Automate your bills

Late fees are simply wasting money, and so are interest charges from missed payments.

That’s especially true if it is just being disorganized like I’ve been in the past.

Now I totally understand if you’re used to skimming by with a small bank account balance and you want to make sure you have money in the bank to pay the bill.

But, the downside of not paying at all is too great.

Make sure that all of your important bills (at the very least) are on automatic payments, and make sure that any debt is on autopilot for the minimum at least.

Get rid of round-up apps for savings

Your intentions are good here. Save a little here and there, wherever you can.

But, it can backfire.

The downsides of round-up transfers are the following:

- It motivates you to spend because you feel like you’re saving.

- You feel like you are checking the box of savings even though it’s not nearly enough money to write home about.

- All of the extra transactions clutter your budgeting apps and bank account statements which makes it hard to see where your money is actually going.

So if you’re using Acorns, Chime, Qapital or Digit, sit down and review how much money you have actually saved over the last (up to) 12 months.

Figure out what that breaks down to on a monthly average basis, and just set up an automatic transfer in that dollar amount rather than saving a dollar here a dollar there.

That way, you won’t be able to say, “Well I’m actually saving money by spending.”

Plus, you’ll see how it’s much better to have one monthly transfer to savings rather than 100 that clog up your bank statements.

Doing this one thing will go a long way to simplify your finances.

Pay your major bills right after you get paid

Money can burn a hole in your pocket. Some of my clients can spend $10,000 in a month but live off of $200 for a week if their bank account balance is running low.

If you can match up your housing payment, your auto payment, and any other major bills for the day or two after you get paid, it does a couple things.

One is that you know the money is there to pay these major bills. Two is that you can see how much you have to spend on discretionary items for the rest of the month.

Not only that, but only sitting down once or twice a month will save you time.

Forget the different cards for different benefits. Just use one or two.

It can be a major distraction to use one card for gas, one card for groceries, another for restaurants and another for each store.

This can get out of hand in a hurry because of all the options, the Target credit card, Amazon credit card, Apple credit card, department store credit cards, home improvement cards, etc.

Next thing you know, you have 6-8 credit cards with 6-8 different credit card bills all to save an extra few hundred dollars a year.

That is real money, but if it gets in the way of running your finances efficiently or if you miss a payment or carry a credit card balance for any period of time, the math quickly sways toward NOT using these cards.

Plus, if you’re carrying a balance on any of your cards, it’s hard to know if you’re making progress or getting more in debt as you make payments.

Stop using cards that you are focused on paying off to see your progress more clearly.

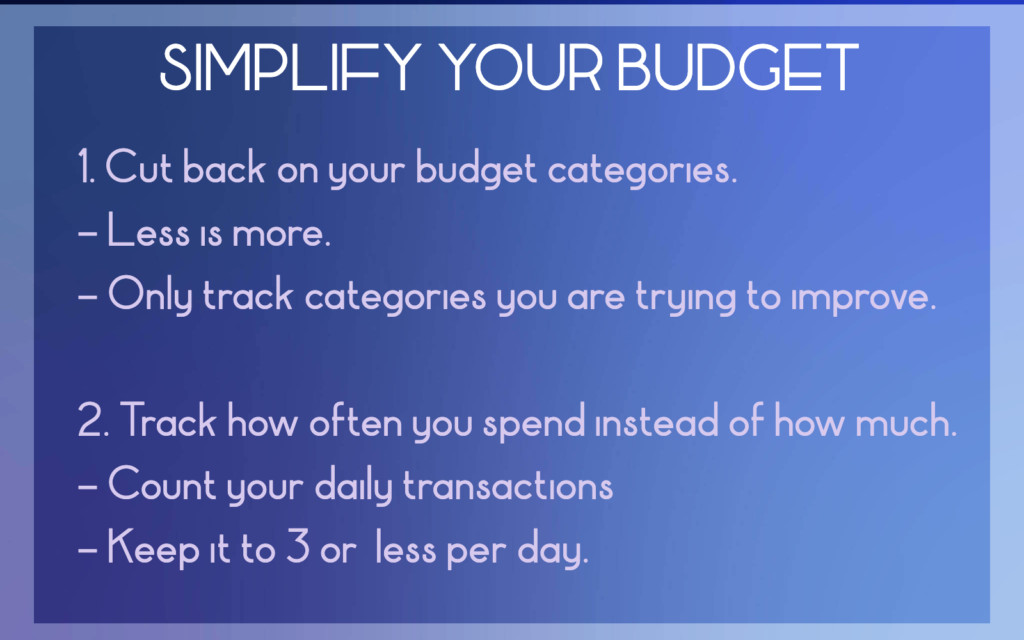

Simplify your budget

This is what got me into trouble the most.

I thought I needed a complex budget with 30 different categories so I could track the trends.

But in the end, what I really needed was to only focus on the things I wanted to change and look at the key metrics.

Budgeting is important but too much complexity can sabotage even the most detailed person (let alone us meer mortals).

Here’s how to simplify your budget:

Cut back on your budget categories

If you’re going on vacation, do you really need to break down how much you spent on dinners or drinks? Or could you just look at how much you spent on travel overall?

Do you really need a separate budget for your mortgage or rent? It’s the same every month, so there’s no need to clutter your mind.

When you’re starting out trying to change your budget, simpler is better.

Sometimes you don’t even need categories, just tracking your total inflow and outflow is a great place to start.

Do you have money left over at the end of the month or not? That’s the most important thing to know.

Take a look at your budget categories and narrow it down.

Track how often you spend rather than how much you spend

This is a great budget hack that will help you simplify money.

If we just reduce how often we spend, we’ll spend less money.

Why is that the case?

Because every time we go to a store or shop online, we usually end up with more stuff that we intended. The more times we spend, the more slippage we have with our spending.

Think about it. Do you ever leave the grocery store with ONLY the things on your list? Of course not.

Simply count on your fingers how many times you spend each day. If you’re in the 5+ range, you’re most likely overspending. Work on getting it down by 1-2 transactions a day from your starting point.

If you’re spending 2-3 times, you’re probably doing ok. Just track it to make sure.

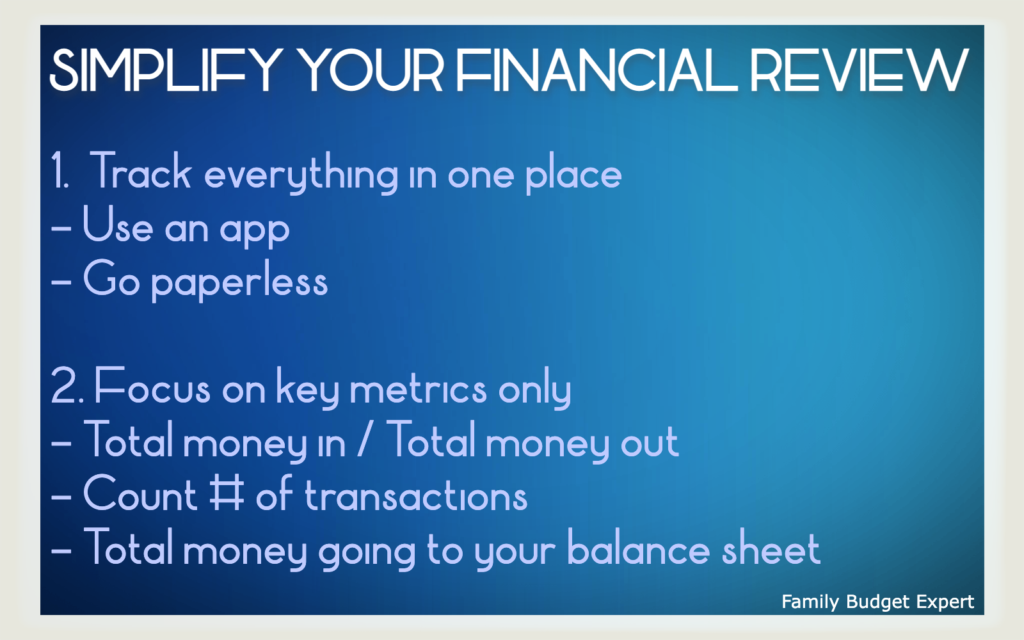

Simplify your financial review process

It’s really important to review your financial situation. When you focus on something and measure it, you will make improvements.

But we can all fall prey to the opposite, making things complicated.

It’s really hard to simplify your finances if you’re trying to track things that won’t move the needle.

Here are some tips to simplify your financial review:

Track everything in one place

The greater the effort it takes to get it done, the less likely you are to do it.

Make it easy on yourself by putting all of your info in one place rather than having to log into each bank account and each credit card to find the right information.

Fortunately, it’s never been easier with all the apps and websites out there.

Many people like Personal Capital, others YNAB, some like EveryDollar, and Mint.

I would use no more than two of these. One to track your wealth, and another to track your cash flow / spending / budget. If you find one you like that can do both, you’re good to go.

(By the way, if you’re still getting paper statements, go paperless. It’s much easier to find things by searching on your computer.)

Focus on the key metrics during your financial review

Don’t inundate yourself with data and spend hours looking at this, or else you’ll never do it and your spouse will have trouble getting on board.

Now if you’re a detail-oriented person that’s fine, but chances are your spouse is not.

You need to look at these things TOGETHER. Do the detailed work behind the scenes but keep the review as a couple super simple.

The biggest predictor of future financial success is how much surplus or deficit you have with your spending at the end of the month.

Next is how are you applying that to your balance sheet and your net worth?

Here are the key metrics to focus on:

- How much money is coming in and how much is going out? Look at the total spent and the total take home pay.

- How often are you spending? Count how many transactions you have.

- How much money is going to your balance sheet each month? Do you feel like it’s going to the right places?

- Credit card payments

- Student loan payments

- Other debt payments

- Automated savings

- Retirement plan contributions

- Investment contributions

If you only focus on those items, your family financial situation will continue to improve.

Let’s keep it simple!

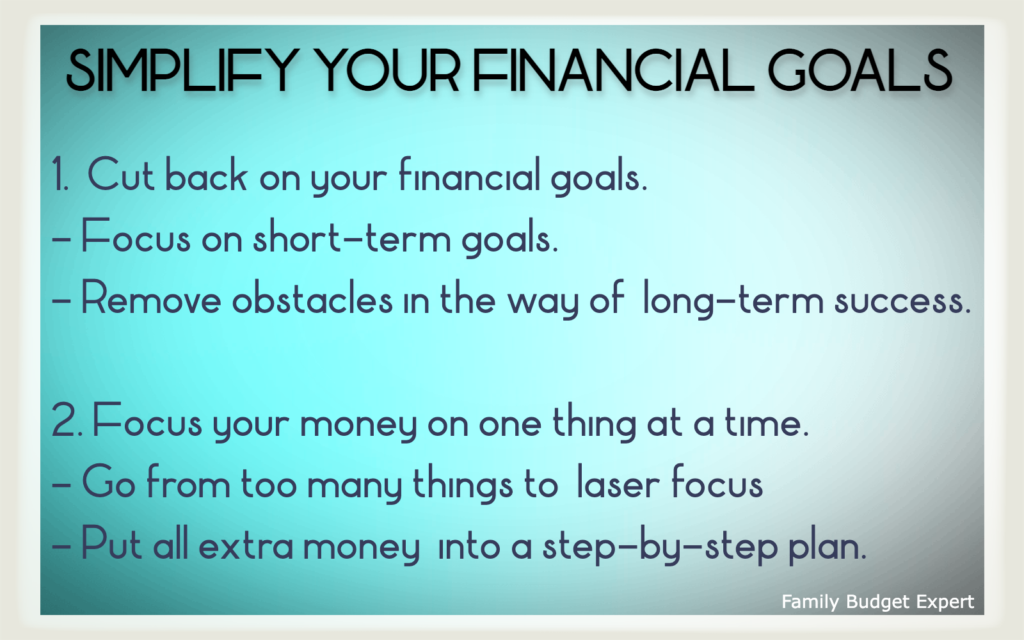

Simplify your financial goals

We want to do so much!

We want to be debt-free, save for our kids’ college, save for retirement, buy a house or upgrade it, and we want to save up for the fun stuff like a family vacation.

Having goals is great but too many ends up being a distraction.

James Clear talks about not only how to set goals, but how to achieve goals.

Focus is the key.

Here’s how to get there.

Cut down on your short-term goals

I used to be a serial goal setter but not a serial goal achiever.

It’s because I tried to do too many things.

Goli Kalkhoran says that we overestimate what we can do in the short term and underestimate what we can do in the long run. This is so true!

Sometimes we want to do so many things in the future that we try to do too much today.

In reality, simplicity and focus today will get us to our long term goals faster.

I heard Jamilla Souffrant from the Journey to Launch Podcast speak, and she said, “I don’t know how to get from A to Z, but I can get from A to B.”

That is so true!

For example, you can’t reach financial independence and retire early if you have credit card debt today.

Figure out the closest obstacle that will move the needle the most and have that be your priority to accomplish in the short run.

Continue to think big! Don’t sacrifice your long term potential!

But you must determine the short term financial goals you need to set that will help you take the next step.

Focus your money on one thing at a time

Families often take the shotgun approach to reaching their financial goals.

They try to fill up all the buckets at once but as a client told me, “None of them end up getting full.”

This is so true.

Take a look at how many different places your money is going.

How many different cards are you paying on? How many different bank and investment accounts are you making automatic transfers to?

Instead of the shotgun, use a laser. Focus what you’re doing with extra money on one thing at a time so you can eliminate it, check it off as completed, and move on.

Not only will you get there faster, but you’ll gain momentum because you’ll be able to see your progress.

Plus this is a great way to simplify your finances, because you won’t have money being spread out to so many different places and have to track where it’s all going.

Need help simplifying your financial life?

Don’t try to do it all! (That would be in direct opposition to what this post is all about!)

Go back and circle at least one but no more than three steps that most resonate with you to simplify your finances.

This is critical stuff that will make or break where you end up 10 years from now and beyond.

But I know from personal and client experiences that it can be a real challenge to get on the same page and get going.

If this is something you’re not sure you can do alone, please reach out to me.

I’ll give you the tools, framework, and accountability to right the ship, work together, simplify your finances, and reach your goals.

Schedule your free 30 minute consult to learn more here.

Want help but you’re not ready to chat? Get my free guide: