What to do with extra money – Step by Step Guide

The ONE Thing is one of my favorite books. I love how simple and effective the main concept is.

“What’s the ONE thing I can do, such that by doing it makes everything else easier or unnecessary?”

In personal finance, I wholeheartedly believe that the “ONE thing” is figuring out how to have more money left over at the end of the month after what you earn and what you spend.

Think about it: It’s hard to save, invest or pay back debt without extra money left over. A high savings rate makes everything easier.

So if you’re reading this and wondering what to do with extra money each month, congratulations! You have completed the most important step in personal finance.

Now, what should you do with that extra cash?

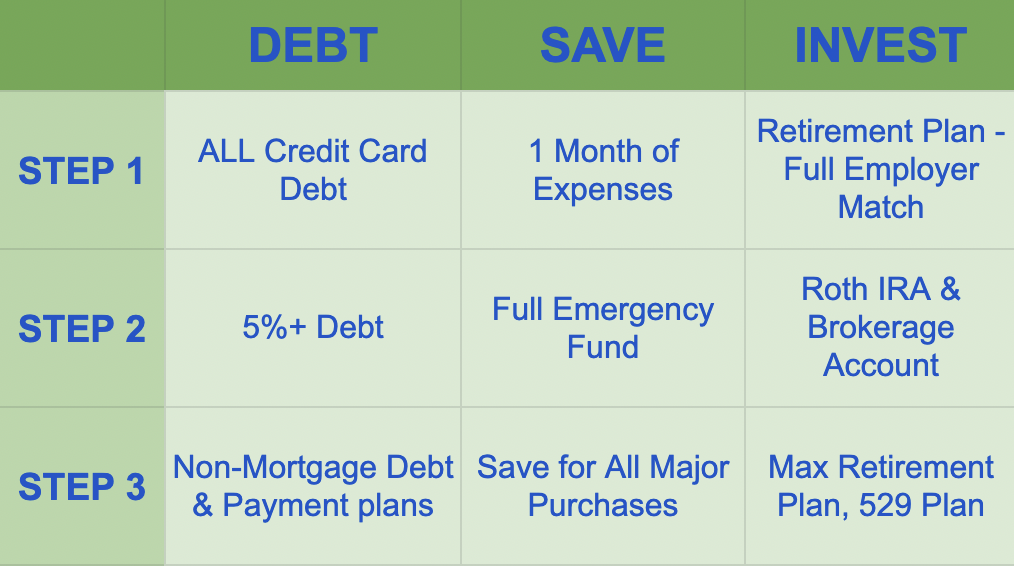

Here’s my 3 step system to help you prioritize and build wealth. Each step includes a short term financial goal for savings, paying back debt, and investing for long term growth.

Table of Contents

Step 1: Achieve Financial Stability

The first step to build long-term wealth is to eliminate the obstacles in your way and put out all of the fires.

Stop everything until you meet all 3 of these milestones.

Pay off ALL credit card debt

“Hey Rob (aka Captain Obvious), I know paying off credit cards is important because it’s the highest interest rate debt.”

That is certainly true, but there’s a very important psychological piece at play.

Credit card debt is the gateway drug of personal finance. It’s the “toe over the line” that leads to all sorts of financial problems, because it makes you ok with carrying debt.

Pay off credit card debt…ALL of it. The 0% ones along with the high interest credit cards.

Then ALWAYS pay off the full credit card balance each month.

Start an emergency fund

Now you might be thinking, “I don’t want money just sitting in your bank account doing nothing, especially with the low interest rates today.”

Yes, the interest rate is low compared to other options. But no, that money isn’t doing nothing.

The point of emergency savings is to be prepared in case of something unexpected. It’s your protection against getting into a bad financial situation that would put you into credit card debt or cause you to miss out on a last minute opportunity.

Calculate your emergency fund starting with your monthly expenses (not income). Most experts recommend having an emergency fund that will cover three to six month of expenses.

If that seems like a tall order, just start with one month.

Eventually, you may need a bigger emergency fund depending on your situation, but one month is a good start. Checking accounts or savings accounts are a good place to hold this money.

Employer retirement plan – Get the max match

Contributing to your 401(k) or 403(b) is a great way to invest over the long term because it grows tax free.

If your employer offers a matching program (meaning they’ll contribute money to your account if you do), this is a no-brainer first place to start investing.

Think of the employer match as an immediate return on investment. Most will put 50% to 100% of the contribution you put in up to a certain percentage of your salary. That investment return is hard to beat!

Learn about your employer matching program and contribute to your retirement account up to the maximum employer match.

Step 1 Summary: Set your financial foundation

To summarize: Pay off all credit card debt, build up your emergency fund and get the max match from your employer retirement plan. The debt and savings goals will increase your liquid net worth, money available to you today.

Step 2: Grow Your Wealth

Once you are credit card debt free, have a 3 month emergency fund, and are getting the maximum match from your employer plan…

Wait…Just take a moment and picture how amazing that would feel…

Ok…moving on…

Here are the milestones for Step 2.

Pay off other high interest debt

Now that the credit cards are behind you, let’s prioritize the rest.

Think on this: The interest rate on your debt is the investment return the lender is making off of you.

So, you earn that investment return back with every extra dollar you use to pay down the principal balance.

I consider high interest debt as anything with a 5% interest rate or higher.

Why? Because getting that kind of investment return after-tax requires taking a good amount of risk.

In other words, your money is much better utilized by paying down the principal rather than trying to take on risk in the stock market, real estate, cryptocurrency or other investment vehicles.

Along with that, those payments go away once a debt is paid off. That frees up extra cash flow at the end of the month so you can put it to the asset side of your balance sheet.

High interest debt usually includes HELOCs, home equity loans, personal loans, private student loans, federal student loans, and high interest rate car loans, but often excludes a home mortgage and most auto loans.

*If you’re not sure about everything you owe, put together your personal balance sheet to get organized.

What’s the best way to organize it? Smallest debt first (debt snowball)? Highest interest rate (debt avalanche)?

The right method is whichever one you will actually commit to. Forget optimization. Focus on completion.

Invest in a Roth IRA & Brokerage Account

You won’t be able to touch the money in your employer retirement plan until 59 ½ without a penalty, so it’s good to have investment accounts with greater flexibility.

The Roth IRA contribution is made with after tax dollars. You won’t pay taxes on it while it’s in the account and when you make a qualified withdrawal.

Plus, the Roth IRA withdrawal rules are more flexible than the Traditional IRA.

*If you aren’t eligible to make contributions to your Roth IRA, talk to a tax advisor or CPA about the Backdoor Roth Contribution.

After the Roth IRA, invest using a brokerage account.

You can invest it like you would an IRA, but there are no deposit or withdrawal limitations or penalties. The tradeoff for that flexibility is that capital gains, dividends, and income are subject to taxes along the way.

By investing in a brokerage account, you will have money that can grow for your medium term goals (10-20) years and can act as a bridge if you want to retire early.

Fully funded emergency fund

There’s a chance you might need 6 or even 12 months of expenses.

The size of your fully funded emergency fund depends on how complex or unpredictable your income or expenses are.

A single person with no kids and a steady job might only need 3 months. But a family of 5 with a decent sized house and a couple cars should probably get closer to 6 months.

It’s important to have a bigger cash cushion if you have irregular income. Single income households and people paid on commission should have closer to 6 months too. If you’re an entrepreneur or small business owner, it’s a good idea to have between 6-12 months of expenses.

Go one size larger than what you think you need. After the pandemic, I think a fully funded emergency fund is 6 months minimum.

Step 2 Summary – Tuning things up

This step is all about tuning up your balance sheet, protecting yourself from the unpredictable and putting every extra dollar to the best use possible after completing Step 1.

Step 3: Fund your long term financial goals

Step 3 is all about working on the long term.

No matter where you are today, I believe anyone can get here (especially if you use my 50/50 Rule as your income grows).

Pay off all non-mortgage debt

It’s time to pay off all debt except for your mortgage, freeing up all cash flow from all other debt payments.

That includes any 0% loan or payment plan like furniture and appliances, money you owe to a family member (even if they say you don’t need to pay it back), auto loans, etc.

The debt side of the balance sheet should be totally clean after completing this step.

*Bonus tip: After you clean up your debt, increase your mortgage payment by 25-50% so that you’re on track to pay off your mortgage early.

Save for major expenses

Now that you’re getting rid of all debt payments, never go into debt again.

Start saving for major expenses, because it will not only keep your cash flow lean, but your money mindset will start to change too.

For example, when you buy a car with cash instead of looking at the monthly payment, the decision has more weight to it and people naturally spend less money on a car which is much better than getting an optimal interest rate.

There’s a powerful feeling when you have the cash to pay for a major expense. You have more satisfaction, you’ll negotiate better, and you won’t have any more ongoing payments.

Invest for other family goals

As far as investing goes, this is where you save for kids’ college in a 529 plan and max out your retirement savings. Go back to the brokerage account if you still have money left over.

Step 3 Summary

Pay off all non-mortgage debt, save for major purchases, start working on your college savings and retirement accounts.

What to do with extra cash right now

If you’re sitting on cash, and you’re wondering what to do with extra money in the bank right now, follow these steps in order.

Pay off all credit card debt, give yourself a cash cushion, and get the max match from your employer.

If you have extra cash after that, pay off all other high interest debt, fully fund your emergency fund, and so on.

What to do with extra money

Remember, extra money at the end of the month is “the ONE thing” to reach your financial goals faster and with more certainty.

Now you have clear steps for every extra dollar. Here’s the recap:

If you want to figure out what to do with extra money for your specific situation, set up your free 30 minute session with me to see how I can help you get there.