Liquid Net Worth: Your key to staying out of debt

Which part of the title stuck out to you?

Was it, “What the heck is this liquid net worth thing and why does it matter? How is it different than regular net worth?”

Or was it, “I want to get out and stay out of debt!”

The term “liquid net worth” may be new to you, but it’s something that you should take a serious look at if you want to avoid getting in debt.

I’ll show you why it’s important to your financial health and how to calculate it the traditional way.

Then, I’ll show you the more impactful yet simpler calculation I use with my clients to help them get out of debt and stay out.

Table of Contents

Net worth vs liquid net worth

Total net worth is something you might be familiar with. It’s how much you have left over if you subtract the value of everything you own (total assets) from everything you owe (liabilities aka debt).

That’s net worth.

The best way to calculate it is to create your personal balance sheet, a list of all of your assets and liabilities. Once you have that together, calculating your net worth is easy:

Net Worth = Assets – Liabilities

Net worth is a great measure of your financial situation.

But what net worth doesn’t tell you is what would happen if you had to come up with money quickly.

That’s where liquid net worth comes into play.

Liquid net worth is all about your ability to navigate any short term bumps in the road without damaging your long term financial future.

What happens if your car breaks down or you need a new HVAC system for your house? What happens if you have unforeseen medical expenses?

Would you take money out of retirement as a loan or pay an early withdrawal penalty and taxes? Would you have to downgrade your car? Maybe in an extreme circumstance, you might have to downsize your house.

The money you would get from taking any one of those actions would be much less than what it shows on your balance sheet right now.

For example, taking $10,000 from retirement may end only putting $6,000 in your pocket net of taxes, fees, and penalties.

That $10,000 in net worth is actually $6,000 in liquid net worth, a $4,000 haircut.

Liquid assets, like cash on the other hand, don’t need to be discounted. You can just use it.

So liquid net worth discounts your assets to what would actually make it into your pocket if you were to tap into it.

Liquid Net Worth = Discounted Assets – Liabilities

What is liquid net worth and how do you calculate it?

When you calculate liquid net worth, all of the debt stays the same.

Credit card debt, mortgage, car loans, student loans, and any other debt keep the same value. No discounts there unfortunately.

The main change from net worth to liquid net worth is what would happen if our assets are turned into cash quickly, converting any hard-to-sell or illiquid assets to liquid assets.

Let’s go through some of the major assets and how they would be discounted to get to liquid net worth.

Real estate – Liquid Net Worth Calculation

You can try to figure out the value of your house by checking Zillow or looking at the other real estate comps in your neighborhood to see the recent transactions.

But these sales are most likely under normal conditions. Plus, they don’t take into account the real estate agent fees of 5-6%.

So if you had to sell your house quickly (in a “normal” housing market), the list price would probably have to be the real value discounted by about 20% for a fast sale. Then you’d have to pay your realtor 5-6% of the sale price.

What’s the likelihood of having to do this? It’s more likely than you think.

If a family already bought another house but their old one hasn’t sold yet, they can only carry two mortgages for so long. At some point, discounting the listing price significantly becomes a very serious option.

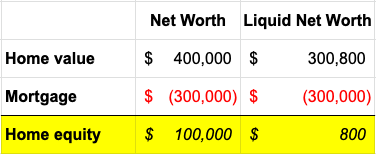

If your house is worth $400,000 according to Zillow, then here’s what you could end up with if your house is priced to sell quickly:

That’s nearly a 25% haircut from its current value! If there’s a $300,000 mortgage on this property, the home equity on your personal balance sheet just went from $100,000 to $800.

How do I list our home value on our balance sheet when calculating our regular net worth?

I don’t go as far as 25%, but I do discount it by 10% for realtor fees and any other work that might need to get done to get it ready to sell.

In my mind, that paints a much more accurate picture of my home equity (and our real net worth.)

Let’s continue with another major category, retirement assets:

Retirement Accounts – Liquid Net Worth Calculation

Many people consider tapping into their retirement savings when they are in a pinch, so this is very important to take a look at what would happen if you took money out early.

The current balance on your traditional (pre-tax) retirement plans (401(k), 403(b), 457, or traditional or rollover IRA) isn’t actually what you would get out.

Let’s say you have $200,000 spread between all of your pre-tax retirement accounts and you’re in your 30s or 40s.

Well, not only are these distributions subject to your marginal income tax rate (both federal and state), but there’s a 10% early withdrawal penalty.

Pretend you’re in the 24% marginal federal tax rate and your state taxes are 6%. That $200,000 on your balance sheet is actually worth a heck of a lot less if you wanted to use it today:

People actually do this! They take early distributions from their pre-tax retirement accounts, taking a 40% haircut to do it. That hurts!

My goal is to help you avoid this which is why I’ll share my version of liquid net worth and why it’s so important further down.

Roth IRA early distributions work a little differently because the contributions are made post-tax. Any money contributed can be taken out without taxes, and there’s the five-year rule for taking out the earnings portion.

Vehicles – Liquid Net Worth Calculation

This is a relatively simple calculation.

Look up the Kelly Blue Book value. Decrease the condition of your car to the next level down, then subtract 20% from that value.

So if KBB says the car is worth $20,000, take $4,000 off the value to convert it.

Yes, discount that much. Dealerships won’t offer you that, neither will TrueCar or Carvana.

Liquid assets that don’t need to be discounted

Some assets are the same value right now as they would be if you needed them in a pinch.

These liquid assets include:

- Checking accounts and savings accounts

- Cash and cash equivalents held elsewhere (like a brokerage account)

- Money market account

Some think that holding cash means missing out on higher investment returns. But in actuality, these are the keys to making sure you don’t go into credit card debt or have to sell illiquid assets in a fire sale.

Liquid Net Worth vs Net Worth Example

Let’s look at how the liquid net worth calculation vs the normal net worth calculations differ continuing on with the above example.

This hypothetical couple has:

- $200,000 in pre-tax retirement accounts

- $400,000 home with a $300,000 mortgage

- A minivan and an SUV currently worth $20,000 each. $20,000 in combined auto loans.

- $30,000 in student debt

- $15,000 in credit card debt

- $20,000 in checking/savings

Let’s see how the calculations are different:

Take a look at the asset values side-by-side.

The liquid net worth calculation reduces their assets by $187,200.

The debt side of liquid net worth doesn’t change (aka no discounts):

Liquid net worth will be lower than net worth only because of the discounted asset values:

Now you know how to calculate liquid net worth.

Exciting right? Ok, maybe that’s a stretch.

I’ll admit it’s not the most fun thing to look at, because you may already feel behind financially. Discounting assets makes it look even worse.

But this is a worthwhile exercise for sure, because it will make you think twice (and hopefully stop you) before tapping into very costly ways to get your hands on more cash.

Now, let’s talk about how this exercise can help you get out of debt and avoid getting into debt in the first place.

The Problem with Liquid Net Worth

At this point, you’re probably thinking, “This is great to know but I’ll never need to sell everything like that.”

The odds are in your favor there.

I think the concept is a great one, but liquid net worth doesn’t really help you in your day-to-day life.

It’s also a little complicated to put together and can be depressing to look at. It’s a calculation for the most dire of life circumstances.

BUT it does help you understand that your net worth isn’t the be all end all.

I want you to avoid extreme measures like selling your house, your car, taking money out of your retirement assets, or taking out toxic forms of debt.

So let’s talk about something more tangible that will help you stay out of debt and weather the unexpected storms that may come your way.

Here’s how to do it.

Family Budget Expert’s Liquid Net Worth Calculation

I’ve worked with many families that have a decent amount of home equity and retirement funds, yet they still live paycheck-to-paycheck with minimal cash while at the same time carrying credit card debt.

You’ve probably heard the term “house poor”. It’s when someone has too much money tied up in their house so they struggle to make ends meet day-to-day.

Well, there’s also the concept I call “retirement plan poor” where money is trapped in something you can touch without a major cost until you’re 60.

So when I think of a client’s current financial situation, I think, “What money could they use today without any major costs or uprooting their life?”

The answer lies in what I call “free & clear” funds. Check out more on Family budgeting help here.

Free & Clear Funds

This is money you can access quickly at any time and for any purpose, my version of liquid net worth.

It may sound a little like an emergency fund, but it goes one step further.

Take cash (or assets you can quickly convert to cash) netted against credit card debt or bills due in the near future.

It’s a little closer to the corporate finance equation for working capital but much simpler.

Free & Clear Funds = Checking/Savings + Brokerage Investment – Credit Card Debt – Personal Loans

Remember from the prior example, that they had a net worth of $295,000 and a liquid net worth of $107,800?

How much do they actually have free & clear though?

With a total net worth of $295,000, they only have $5,000 (1.7% of their net worth) in free & clear funds.

Even though they’re doing ok financially, the lack of free & clear funds causes day-to-day financial stress of juggling bills.

Plus, when an unexpected expense comes up, they go into costly credit card debt.

Lose a job? Have an unexpected home repair? Car breaks down? They are in a serious predicament, because the rest of their net worth is tied up.

The only choices available? Take out more debt or sell assets at fire sale prices. Neither is a good option and can be prevented.

Why net out the credit card debt?

I’ve seen many people think they have a solid amount in cash, but they have a mound of credit card debt next to it. This leads to:

- Anxiety every time the credit card bill comes

- Needlessly spending thousands on credit card interest

- The illusion of financial security

I totally understand it can be hard to part with cash and may feel easier in the moment to carry a credit card balance. Cash equals security for many of us, and credit cards are “funny money”.

That’s why it’s so important to look at your cash net of credit card debt.

It shines a light on why you might be feeling the day-to-day financial stress. It’s also a measure of your ability to weather an adverse financial event.

What’s step 1 on your journey to eliminating financial stress and reaching financial freedom? Focus on your free & clear funds first.

How to Grow Your Free & Clear Funds

The fastest way to get anywhere is to take a focused approach and commit to making progress no matter how small.

Remember the example from earlier where this family had $20,000 in savings and $15,000 in credit card debt?

Most people wouldn’t be comfortable with paying off all credit card debt and bringing their bank account down that far.

Sure, that would be the optimal move to make, but progress beats perfection and optimization any day of the week.

This person could get a jump start by taking $5,000 from their savings account to pay down some of the credit card debt at 20%.

Boom, they just saved about $1,000 in interest. It might even clean up a couple credit cards which frees up a couple hundred bucks in monthly payments.

*Notice that this doesn’t change the free & clear amount or result in increasing your liquid net worth, but it does jump start the process without feeling like it’s a huge sacrifice.

To actually increase free & clear funds, it means throwing any extra money at the end of the month at the credit card debt ONLY.

Got a second job, a raise, bonus, or tax refund? Throw that amount of money at it.

Are you able to cut your spending a little bit? Put it all towards the credit card debt.

Are you making retirement plan contributions above the employer match? Reduce it and put the extra take home pay on the credit card debt.

If you want to spend some of the extra money that comes in, that’s fine too. Just use my 50/50 Rule so you don’t go overboard.

Make this your primary focus and take the smallest sustainable step to make progress and keep the wheels on.

Then CELEBRATE your progress.

Need some help getting there?

How great will it be when you have $0 credit card debt and a solid amount of cash?

The fastest way to get there is to focus on the one thing in personal finance that will make the most difference, your spending.

Before you get nervous, my guess is that there are things you can cut back on without drastically changing your lifestyle.

How do I know? This is my sole focus and clients have gotten these results.

I’m here to help you get there.

Not ready to talk but want some help?