Biggest Wastes of Money: 6 Major Categories

I’m not an anti-spender.

In fact, I believe there are plenty of things you SHOULD spend your money on to live your best life.

Spend your money on the things that matter most to you, and that will be different for everyone.

If you enjoy it, do it as long as it’s not wrecking your finances.

That being said, there are things that are unequivocally a big waste of your money.

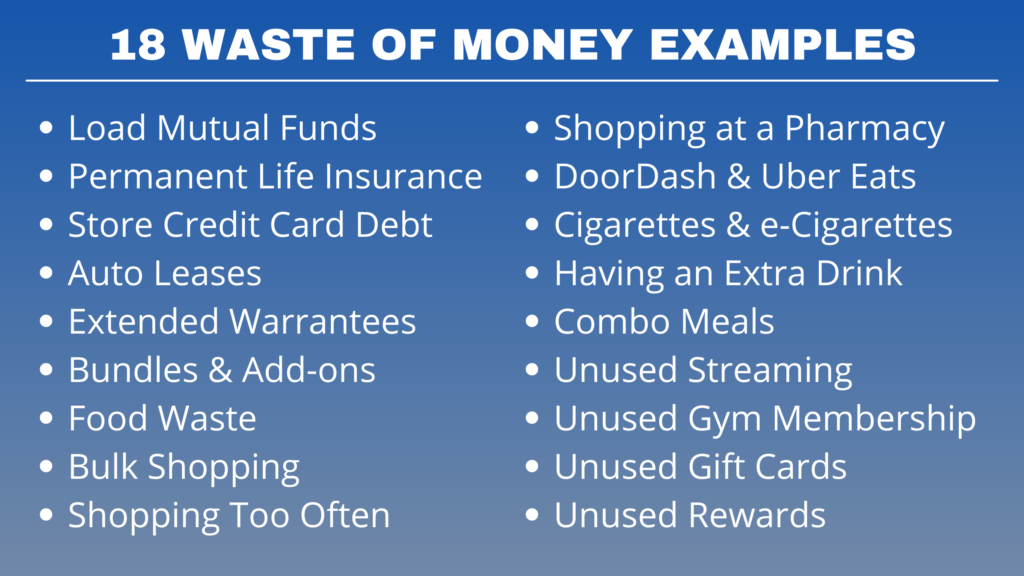

What is a waste of money? Here are the main categories:

- Excessive commissions and fees

- Buying too much

- Spending for convenience

- Things you buy that you don’t use

- Bad for your health & energy

I’ll share examples for each category in a moment, but first…

Table of Contents

Why you shouldn’t waste your money

“When I spend my money, I’m transferring my wealth to someone else.”

That’s what a client said to me when we were going through a spending review, and it is 100% true.

Any money you spend cannot be used to pay off debt, invest or save. It’s gone.

It’s for that reason that we need to make our spending count.

You see, I want you to live your best life and spend on the things that put you at your best.

AND, I want you to keep every dollar in your pocket that you can so it can go towards building wealth and reaching your financial goals. It’s the key thing to focus on in personal finance.

Biggest Wastes of Money

I’m not the judge and jury of where you should and shouldn’t spend your money.

You’ve probably heard family, friends and financial gurus try to take away your fun.

They give waste of money examples like going out to coffee, buying brand name products, bottled water, and new cars.

Yes, some of those things are overpriced, but it doesn’t mean it’s a waste of your money if that’s how you want to spend it.

BUT there are certain things that are definitely a waste of money because they either:

- Charge too much for something you can get a lot cheaper

- Cause you to buy more than you intended

- Trick you into getting something you don’t actually want or need

- Are not being used

- End up costing you more in the long run

Let’s start with the category that can lead you to spending thousands of dollars more than what you need to.

Excessive Commissions & Fees

This category includes many financial products that charge way more than the industry average.

Permanent Life Insurance / Whole Life Insurance

Any life insurance that has a cash value component is at the top of the list in terms of commissions and fees.

I could go into great detail here, but I’ll keep it simple by just focusing on the commissions paid.

For example, did you know that the commissions on a life insurance product are close to 100% of the first year’s premium and 50% of the second year’s premium?

That means if you buy a whole life policy for $1,000 per month, you pay about $12,000 in commission the first year and about $6,000 in the second year.

In other words, you pay $24,000 over two years and $18,000 goes to commission. Only $6,000 of your money is actually going to your insurance coverage and cash value.

Then, the investment piece itself within the cash value is charged a 1-2% management fee.

Anecdotally, I’ve done a bunch of whole life analyses. Most of the policies I have looked at have a cash value below the total premiums paid AFTER 10 YEARS!

Those clients would have been better off just buying term life insurance and putting the difference in a bank account earning 0%!

I don’t want to knock life insurance agents because there are plenty of great ones out there and life insurance is really important to have in place for most families.

However, there are better ways to get life insurance and grow your wealth for much cheaper. That’s why whole life policies are a waste of money for 99%+ of people out there.

Load Mutual Funds

This totally baffles me.

I’m shocked when I see people today who are working with a financial advisor who put them in mutual funds that charge a 5% “front-end load” or commission. Or a “B share” mutual fund where you have to pay a trailing fee if you were to sell it.

Sure 20+ years ago, this was one of the “better” ways to invest, but today, it makes no sense.

The advent of low-cost index funds and exchange traded funds (ETFs) make it downright silly to give up 5% of your money off the top, when you can get the same investment for 1% or less.

Investing $1,000 per month means you could end up paying $600 in fees per year year vs $25 for very similar investments

I’d rather you keep those fees in your pocket. That’s why load mutual funds are a waste of money today.

Store Credit Card Debt

Credit card debt is bad, but store credit card debt is one of the worst.

These cards come with the highest interest rates and some of the more aggressive sales tactics out there.

Why do you think they offer you 20% off your purchase to open up a card? Because if you don’t pay it off, you’ll be charged 25% in credit card interest.

Understand the store’s incentive to get you to open up the credit card is hoping you don’t pay on time, get charged a high interest rate, and end up spending more in credit card interest.

You’ll realize it’s not a bargain at all to open up a store credit card.

Car leases

This is a tricky one for people to understand, because it looks like leasing is cheaper on the surface since the monthly payments are lower than purchasing.

But it’s important to understand why car dealerships do this.

They make great money when someone pays full price for a new car, and they make even more profits on selling a quality used car.

When you lease a car, you give the dealership the best of both worlds.

Here’s how it works:

- You lease a car (which is essentially buying a new car at a peak price).

- You pay more to the dealership over the lease period than the car depreciates over that period of time. The dealership makes a profit on your lease.

- Then you return the car with low mileage and in good condition (per the lease requirements) after 36 months.

- The car dealership then has a premium used car to sell which has a higher profit margin for them than selling a new car would.

- You end up with no car and no lump sum from selling it since you never owned it in the first place.

Wouldn’t it be better if you bought a new car for a bargain price, took good care of it for 3 years, then sold it at a premium used car price on your own?

Of course!

Leasing a car can cost you around $10,000 more over the 3 year lease period vs just buying it outright.

That’s why leasing a car is a waste of money.

Being Upsold

The next category of biggest wastes of money is one a reader brought up to me.

We often are put into situations where we go in wanting to buy something and are then convinced to get more. Think package deals or add-ons.

Extended Warranties and Insurance

This is a giant waste of money, and companies are raking in the dough on your dime.

Cellphone insurance is one of the worst out there.

It’s only $15 per month, but then you have to pay a deductible on the latest phones of $200 to $250.

Meaning if your phone breaks after 2 years, you would have paid $360 in insurance premiums then have to spend another $200 for the new phone? It sounds like a bargain but it’s a big profit center for Asurion.

Amazon, Best Buy and other retailers do this too.

When buying a pricier item, spend time doing research on whether this is a quality product rather than spending money on extended warranties and insurance.

Don’t buy this kind of insurance or extended warranty on inexpensive items either. I’ve seen companies offer a $5 warranty on $20 items. You just end up paying 25% more for something that you probably don’t need in the first place.

Bundles & Add-ons

Have you ever been talked into adding channels to your streaming service in order to get a discount on the real service you want?

What ends up happening is you end up spending more money per month, and you don’t really watch the added bundle channels.

It’s a waste of money to upgrade or bundle when you weren’t going to get the item in the first place. You end up spending more than you intended.

It’s never a bargain, and you’re not getting a deal if you end up paying more money each month even if it is less money per item.

Buying too much

No one goes out in search of wasting money, but when we’re out there “in the wild”, we will usually end up with more than we intended, especially with food.

Food waste

The three telltale signs of wasting food are when you find food ends up in your:

- Pantry

- Freezer

- Trash can

The most expensive areas of wasted food are produce that goes bad and when we buy too much of a protein like fish or meat.

Parents, it can be a challenge if you have kiddos like we do, because it’s totally unpredictable how much they’ll eat.

It seems like when we buy too much, they only nibble on it and when we buy smaller portions, they go right through it.

At this point, we keep our protein portions below 1 lb for the whole family, and it seems to work for us. Even when they are famished after soccer practice and become vacuum cleaners at the dinner table, they’re fine.

Your kids won’t starve.

Take stock of your food items. What has been sitting in your pantry for a long time? What has been sitting in your freezer?

That’s money just sitting there. Rather than going to the grocery store, work your way through that first.

Take stock of the food that ends up in the trash can right after a meal.

Throwing food in the trash is like throwing money away.

Bulk shopping

Although buying in bulk can save you money per item, getting a bargain per item isn’t a bargain if you end up buying more than you need.

When the pantry or freezer gets filled up or you feel obligated to eat more because of how much you have, buying in bulk can be a waste of money.

What do you normally buy in bulk that you never go through? Take that off your Costco or Sam’s Club shopping list and just buy a smaller amount at the store next time you go.

Shopping too often

Have you noticed that every time you go to spend money, you end up leaving with things you didn’t intend?

It happens to everyone, because companies have gotten really good at making us set up bad spending habits and buy more than we planned.

People who spend more often end up wasting more money on things they don’t need than those who shop less often.

Think about it this way:

Imagine if you could only go onto Amazon for one hour per week vs going on there once a day.

If you had one hour, you’d probably keep a shopping list and be very focused on buying the things you really needed.

If you go on every day, you’d get distracted by the other deals, suggested items, and just browsing around. There would be many more items purchased over the week.

One of the main habit changes I work on with my clients is counting how many times they buy each day rather than how much they spend. If it’s 4 or more, they are typically wasting money on things they don’t need.

Shopping for Convenience

I’m all about keeping things simple and saving time, but we end up spending more than we need to if we rely too much on that.

Shopping at a pharmacy chain

Look, I get it. We need a birthday card or to pick up a prescription so we might as well pick up a bag of chips, soda, or personal care items while we’re there.

It’s ok to do once in a while, but the prices are so much more expensive there that if we end up doing it all the time, it can be costly.

If you find yourself wanting to buy something there ask yourself if you actually need it today or if you can put it on the Target, Walmart or grocery list to buy at a better price later.

DoorDash & Uber Eats

Hey, if you need to have something delivered because of the hectic schedule of shuffling the kids around and work, I get it especially during the pandemic.

But can we admit that we might be doing too much of it?

The most expensive way to eat is going to a restaurant, picking up food is next, and the least expensive is cooking at home.

If you order in but pick it up, it’s still like dining out but you don’t pay the delivery fees and tip which makes it closer to making food at home.

But when you use a food delivery app, it makes it just as expensive as if you went to the restaurant because of the extra fees.

Things that sabotage your health

Making healthy choices 100% of the time is virtually impossible unless it’s a big part of your career like Tom Brady, LeBron James, Simone Biles, other professional athletes, fitness trainers, dancers or entertainers.

But there are things that are expensive on their own and also make your health care more expensive too.

Please don’t take this as me getting on a soapbox and preaching here. My goal is to help you live your best life and have extra money that will help you live your best life.

To make that happen, I want to point out the financial cost.

Anything in moderation is usually ok

Cigarettes and E-Cigarettes

Quitting smoking is a great challenge, but it’s important to know that putting resources towards trying to quit will help you both in terms of your health and your savings account.

Along with a pack of cigarettes costing $5-$7 (and vaping cartridges being slightly less) smoking makes everything more expensive.

Health insurance premiums can be up to 50% more expensive and life insurance can be 2-4x more expensive than for non-smokers.

All in, smoking can cost you thousands per year aside from the direct cost of purchasing them.

Having an extra drink

Just to reiterate, I’m not suggesting you stop having a libation when you feel like it but going one or two too many can be costly.

But when we have too many, it impairs our judgement and makes us feel not so great. Along with that, drinks can be expensive.

It’s that balance between loosening up a little bit and getting out of control. We’ve all had one drink too many.

Sometimes it’s just having one or two less when you go out. Go ahead and have enough to loosen up, but that extra one that gets us into trouble should be avoided financially speaking too.

Combo Meals & Bigger Sizes

It doesn’t seem like much when you upgrade from a medium to a large.

“I get all that extra for only $1 more?!?”

It seems to make sense. Except that in the end you end up consuming more calories than you intended to or throwing much of it away. That is textbook wasted money.

As far as combo meals go, have you ever added up the individual prices of a burger, fries and soda and compared it to the combo meal price?

I did this a few times, and it’s virtually the same price!

In the end, you end up buying more food because you think you’re getting a bargain, but then you realize that there’s no savings with the bundle.

Plus, the extra calories add up over time. An extra 20 calories a day means 2 pounds gained a year. 10 years of this leads to putting on an extra 20 pounds. Other poor health outcomes can come about that as well.

Unused Items

This is one of the biggest wastes of money because you end up paying for something you are not even using at all.

These could be smaller amounts on a monthly basis which is why we become numb to them, but it adds up to a lot of money in the long run.

Streaming services and subscriptions

The reality is that we all have a gajillion different streaming services between Netflix, Prime Video, Apple TV, YouTube TV, Hulu, Disney+, HBO Max, Spotify, Amazon Music…

Cutting the cord ended up seeming like a cost saver, but it ends up costing us about the same or more as traditional cable.

Take inventory of all of the streaming services you have. The best way to do that is to review your spending over the last month and see how many you have.

A sign to cancel the service is if you forgot you were paying for it in the first place. That happened with Amazon Free Time which is something the kids used to use when they were younger.

Unused gym memberships

Let’s lump in health and exercise apps too like Peloton, Obé, Apple Fitness Plus, and others.

I’m all for using things that will keep you in good health, but if you’re not using them, you’re wasting your money when it would otherwise help your bank account grow.

By the way, you can cancel these and always rejoin. That’s what I did with Noom.

Gift Cards

How many unused gift cards do you have sitting in your drawer?

We have a bunch and I forgot to use one the other day when I took my daughter to dinner. I just wasted $20 that didn’t have to be spent.

If you want to save money dining out, I suggest going through your gift card stack and picking your next place to eat based upon what you have there.

Any Amazon or Target gift cards? Put them in your wallet or purse to remind you to use them.

Credit Card Rewards

When was the last time you logged onto the rewards tab of your credit card website?

You might have hundreds of dollars (or even thousands) sitting there doing nothing.

If you have credit card debt, the best thing to do would be to trade them in for a statement credit. The second use of points could be to get a gift card to a store that you shop at frequently.

Need help figuring out how to waste less money?

Let’s work on this together!

Not only can I help you identify where you’re wasting money on your terms, but I can help you figure out how to stop spending money on things you don’t care about so you can finally have the extra money to pay off debt, save and invest for the future.

If you feel like you’re making enough money but can seem to rub two nickels together at the end of the month, it’s easy to start the conversation.

Just schedule a free 30 minute consult with me to talk through this. Then we can figure out the kind of help you need, and how to work together going forward.

If you want help, but aren’t ready to talk, get my Free Guide: 5 Steps to Cut Spending